As of June 2021, the world has avoided a 56% expansion of its coal fleet, which would have been equivalent to adding a second China to the global coal capacity, says study

COP26 president-designate Alok Sharma’s declaration that the upcoming summit will be the “COP that consigns coal to history” may just come true, if a new report is to be believed. The study, by climate change think-tank E3G, revealed the global pipeline of proposed coal power plants has fallen by a staggering 76% since the Paris Agreement was first signed in 2015.

Since that time, the report found 44 countries (including 27 in the OECD and EU, and 17 non-OECD) have committed to no new coal. Forty more countries (eight in the OECD and EU, and 32 non-OECD) don’t have any coal projects in the pre-construction pipeline, the report stated. This makes the path for these countries to committing to ‘no new coal’ easier.

The global scenario

The report stated this drastic drop can be attributed to accelerating market trends that have combined with new government policies and public opposition to coal. Across the world, 1,175GW of planned coal-powered plants have been cancelled since the Paris Agreement. As of June 2021, 56% expansion of the global coal fleet has been avoided, according to the report. This would have otherwise created a global coal capacity equivalent to China’s (1,047GW).

The countries with the largest pre-construction pipelines are China, India, Vietnam, Indonesia, Turkey and Bangladesh, the study stated. These countries account for a massive four-fifths of the world’s remaining pipelines, it found. If these six countries were to take action towards achieving no new coal, 82% of the pre-construction pipeline would be removed, according to the report. The remaining pre-construction pipeline is spread across 31 other countries, of which 16 have only one coal project each in hand.

China, the coal behemoth

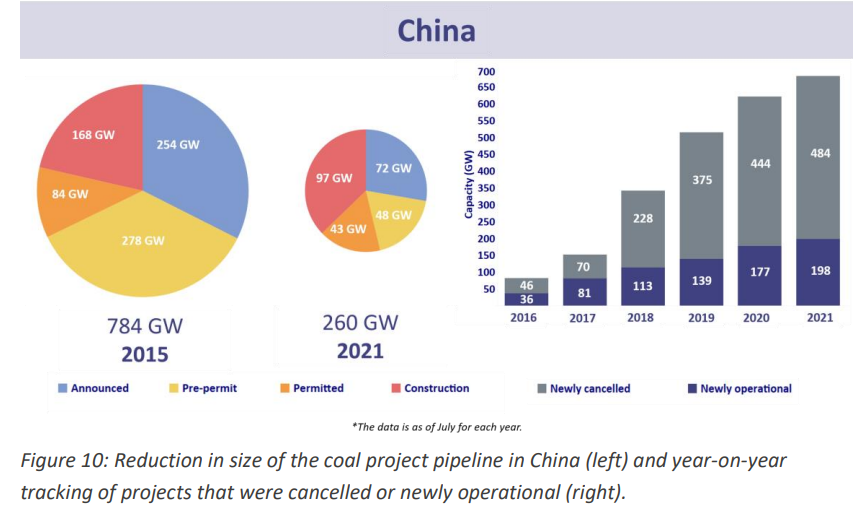

The report revealed China is currently home to 53% of the coal capacity under-construction and 55% of the pre-construction pipeline. If it were to end overseas coal finance, like its neighbours South Korea and Japan have, this would lead to the cancellation of more than 40GW of pipeline projects across 20 countries, the study found. The good news, however, is that since 2015, the country has seen a 74% reduction in scale of its project pipeline (484GW of cancellations) since 2015.

Where India stands

The pre-construction pipeline in South Asia amounts to 37.4GW, with India (at 21GW) accounting for a majority (56%) of this. Across South Asia, this pipeline has shrunk by 87% since Paris, with three of the four countries in the region– Sri Lanka, Pakistan and Bangladesh–leading the way on no coal policies and cancelling projects, the study stated.

The study found that in India, while some states are showing keenness to commit to a no coal future, at the national level, officials are still hesitant to debate on this issue. The country’s 21 GW of pre-construction pipeline is the second-largest in the world. It is also in the midst of constructing 34GW of new coal capacity to add to its existing operating fleet of 233GW. But like China, India seems to be inching slowly, but surely, towards committing towards no new coal as, the study found, it has seen more than 326GW of projects cancelled since Paris, which is a massive 92% decrease in the pipeline. This study broke it down further to reveal that for every 1GW of capacity that has gone into operation, 7GW has been scrapped.

According to the study, conditions are more than favourable now for India to scrap its pre-construction pipeline. This is because the country, despite its large coal reserves, is struggling to justify coal-fired power’s economic viability. The study pointed to how the coal plant load factors have fallen from 61% in 2018 to 53% in 2021, which has made the running of existing plants an expensive affair. This, coupled with the falling tariffs of renewables (reached a record low of Rs1.99/kWh (US$ 0.026/kWh) in December 2020), and the dire financial health of the country’s power distribution companies have triggered doubts about the need for building new coal plants.

“The economics of coal have become increasingly uncompetitive in comparison to renewable energy, while the risk of stranded assets has increased. Governments can now act with confidence to commit to ‘no new coal’,” said Chris Littlecott, associate director at E3G and the report’s author.

About The Author

You may also like

Coal Addition Beyond the National Electricity Plan 2032 Uneconomical: Report

Methane from Australian Coking Coal Mines May Increase Steel’s Short-Term Climate Impact: Report

From extraction to regeneration: How India’s coal mines are being reimagined

India’s coal heartland is powering down, with no safety net

UK downs shutters on its last coal plant