As global climate finance falling woefully short, India may need to start charting its own course to sustainability—leveraging domestic resources, financial innovation, and strategic investments to bridge the funding gap.

Read more

India has to start looking inwards to fund its climate battle

Looking inward: Can India pave its own path to self-reliant climate finance?

As global climate finance falling woefully short, India may need to start charting its own course to sustainability—leveraging domestic resources, financial innovation, and strategic investments to bridge the funding gap

The year 2024, the warmest year on record, marked a turning point in the global climate crisis.

The world officially breached the 1.5°C temperature threshold. Climate systems are now closer than ever to irreversible tipping points. At a time when the world needed to show renewed urgency, the year ended with a double setback. Negotiations at COP29 in Baku, Azerbaijan, resulted in a paltry $300 billion commitment from the rich countries, which came laden with caveats. On the other side of the world, former US president and climate denier Donald Trump was reelected to power.

For India, an emerging economy that is already facing the worst impact of climate change, these developments confirm what it had already known for a while now—it has to start looking inwards to fund its climate battle. India’s annual Economic Survey presented earlier this year in Parliament clearly says that the shortfall in climate finance “may lead to a reworking of the climate targets.” Beyond phasing out fossil fuels, climate finance is critical for India to build resilient infrastructure, accelerate clean energy adoption, and safeguard vulnerable communities.

With international climate finance falling short, what are some of the alternate strategies that India can adopt to generate climate finance? Experts suggest tapping into multilateral development banks (MDBs), sovereign wealth funds, pension funds, and private equity investments, while simultaneously mobilising domestic resources through commercial banks, non-banking financial corporations (NBFCs), and institutional investors. According to them, addressing high capital costs and improving credit access is essential, as is reforming MDB mechanisms to provide affordable concessional funding instead of high-interest loans.

India’s response to this funding crisis will not only help set its own climate trajectory, it will also establish its role in global climate leadership. Experts believe India has a chance to turn its financial constraints into an opportunity for innovation and resilience, thereby securing its climate future.

Climate crisis at its peak

The planet is heating up at an alarming rate and Earth is fast approaching a tipping point. The past decade has seen record-breaking temperatures, with 2024 being the warmest on record. Despite being a La Niña year, India recorded its warmest January this year. The Himalayan glaciers are melting at twice the previous rate and ocean temperatures are rising four times faster than in the 1980s. These shifts have led to increased floods, landslides, droughts, and cyclones, causing economic devastation and loss of life.

According to a report by the World Meteorological Organisation (WMO), “Economic losses from drought, floods and landslides have rocketed in Asia.” The report says that in 2021 alone, weather- and water-related hazards caused total damage of $35.6 billion, affecting nearly 50 million people. There were more than 100 natural hazards events in Asia that year which caused almost 4,000 deaths.

A report by CEEW predicts that production losses in rice, wheat, and maize alone could go up to $208 billion and $366 billion in 2050 and 2100, respectively. An ADB report says 300 million Indians could face coastal inundation, leading to a 24.7% GDP loss by 2070.

The developing world and a country like India needs urgent climate finance to fight the impacts of global warming. But there are various estimates about how much climate finance India will need to deal with the challenges of rising temperature.

India’s climate finance needs: A growing gap

The Indian government estimates $2.5 trillion will be needed by 2030 or $170 billion annually to achieve its Nationally Determined Contribution (NDC) under the Paris Agreement in 2015. India has since updated its NDC, therefore even this figure may fall short.

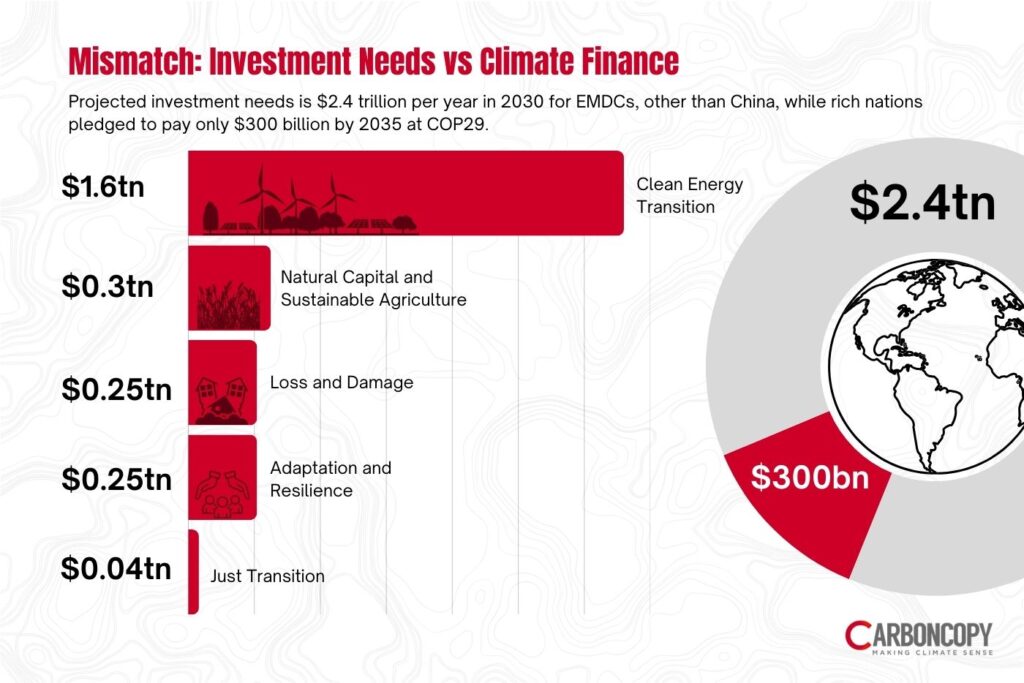

A report of an independent high level expert group on climate finance released at COP29 last year said emerging markets and developing countries (EMDC) other than China need $2.3-2.5 trillion per year of investment in climate action by 2030.

“[T]he projected investment needs of around $2.4 trillion per year in 2030 for EMDCs other than China, around $1.6 trillion is for the clean energy transition, $0.25 trillion for adaptation and resilience, $0.25 trillion for loss and damage, $0.3 trillion for natural capital and sustainable agriculture, and $0.04 trillion for fostering a just transition,” the report said.

While the Global South demanded $1.3 trillion at COP29, they got just $300 billion, which will be given by 2035. This massive shortfall was strongly criticized by the Indian government and climate observers.

Climate finance roadmap for India: Challenges and solutions

As an emerging economy with a population of over 1.4 billion people, India needs vast funds for basic education, employment and poverty alleviation. According to a UN report published in 2019, India needed to spend 10% of its GDP to meet the sustainable development goals (SDGs) by 2030. That is an estimated $2 per person per day. Considering only half of the Indian population needs support from the government, India will still require $1.4 billion per day (considering the population 1.4 billion) which comes to more than $500 billion per year.

Experts say India’s climate goals will be impacted as the government will mostly rely on domestic funding for climate change, as indicated in the Economic Survey. “The funding shortfall may lead to a reworking of the climate targets. Considering that domestic resources will be the key to action, resources for meeting development challenges may be affected, undermining progress toward sustainable development objectives and compromising the integrity of international climate partnerships,” the survey stated.

RR Rashmi, a climate change expert and distinguished fellow at New-Delhi-based The Energy and Resources Institute (TERI) says the “decision taken in Baku is quite clearly a disappointment.” Speaking to CarbonCopy, Rashmi said that before the Baku conference, many countries were expecting that international finance will drive ambition towards the climate goals, but now it is clear that it won’t happen.

“We have already overshot the temperature barrier and quite clearly we will miss the global targets. This is due to many factors including the inadequacy of climate finance. The other major reason is the inadequacy of efforts on the part of developed countries. That inadequacy is getting reflected in their financing commitments,” Rashmi said.

Leveraging alternative financial mechanisms

Union minister for environment, forest and climate change Bhupendra Yadav told the Parliament earlier this month that India has received $1.16 billion as climate finance so far. This amounts to less than one percent of India’s annual requirement ($170 billion) for climate action. Yadav told Parliament that most of India’s climate action is financed by domestic resources.

A report published by Climate Policy Initiative (CPI) last year stated that “despite the challenges, India has made commendable progress in attracting green finance.”

As per CPI estimates in 2019-20, a total of $44 billion was raised, marking an increase of 150% on 2017-18. These strides are laudable but inadequate. Current investment represents approximately 25% of the total required across sectors just to meet the country’s NDCs. While climate-related foreign direct investment (FDI) has increased substantially, to reach $1.2 billion in FY 2020, this only accounts for ~3% of total FDI during that year.

At COP29, a new climate funding regime, the New Collective Quantified Goal (NCQG), was adopted. The NCQG replaces the annual $100 billion assistance provision from developed countries to developing nations, which was agreed upon at the Paris COP in 2015. While the climate finance target has supposedly tripled under the NCQG ($300 billion), it is considered highly insufficient given the needs of developing countries, which are running into trillions annually.

It is also anticipated that India, being a large economy, will not receive any grants under the NCQG, and the needs of Least Developed Countries and Small Island states will be prioritised. A major portion of India’s climate finance will likely be generated through domestic sources, or loans from Multilateral Development Banks (MDBs) and agencies, and bilateral mechanisms.

Avinash D. Persaud, who is the Special Advisor on Climate Change to the President of the Inter-American Development Bank, Washington DC, told CarbonCopy, “India is already financing its green transformation domestically. But that will mean the pace is not fast enough, because the size and pace of the investment required to protect the planet outstrips available domestic savings in all developing countries except China.”

The high cost of capital is a challenge for developing countries. To meet the vast demand of climate finance, India will require soft loans of long duration, equity investment and technology transfer at a faster pace.

The CPI report says: To bridge the climate finance gap, India needs to exploit the rapidly growing pool of global green capital from sovereign wealth funds, global pensions, private equity, and infrastructure funds. Ways to do so include addressing barriers to investment in transition projects, fostering a sustainable finance ecosystem, and diversifying funding sources.

Persaud says, “The domestic investment will need to be augmented by foreign investment, perhaps to buy — at high prices — those investments that have already been made and the start-up risks taken by local investors who would then have the cash from selling those investments to foreign investors, to go and invest more locally.”

Labanya Prakash Jena, a sustainable finance expert, says India has largely mobilised capital from the domestic market, although foreign investment in climate mitigation keeps rising in India.

“Commercial banks and NBFCs will continue to allocate capital to renewable energy and clean transportation. It is important India needs to look at other sources such as pension funds, insurance companies, and mutual funds to mobilise capital. These sources of capital are largely untapped,” Jena said.

The role of MDBs

The role of multilateral development banks (MDBs) is important in providing climate finance, particularly to low- and middle-income group countries. They can help these vulnerable countries to achieve their climate goals. At COP29, MDBs issued a joint statement saying that “by 2030, their annual collective climate financing for low- and middle-income countries will reach $120 billion.”

“MDBs significantly exceeded their ambitious 2025 climate finance projections set in 2019, with a 25% increase in direct climate finance and mobilization for climate efforts doubling over the past year,” the joint statement said.

The NCQG makes MDB finance legally part of agreed climate finance. Paragraph 8C of the document recognises “all climate-related outflows from and climate-related finance mobilized by multilateral development banks towards achievement of the goal”.

According to Rashmi, it is now the duty of the developed world to ensure a “concessional flow” of funds so that countries like India do not suffer high cost of capital while availing the long term longs for climate action.

“Since the requirement of climate finance is that it should be concessional by nature, it becomes an obligation on the developed countries to create mechanisms through the MDBs to allow the concessional funds to flow and rate of capital to go down. It can be through a sovereign guarantee mechanism, partial credit guarantee mechanism or by creating let’s say a hedge fund for meeting the currency cost or the fluctuation in the currencies,” Rashmi said.

There are more than 40 multilateral financial institutions and bilateral development corporations and agencies listed in the UN website, including the Asian Development Bank, European Investment Bank and World Bank. Bilateral agencies are mostly located in the US, Europe and Australia.

Jana said, “The MDBs can provide risky capital (e.g. credit enhancement), which can improve the credit profile of climate businesses. This will attract these low risk-seeking institutional investors. It is important that this risky capital must be at an affordable rate (e.g. less credit guarantee fees for partial guarantee), which will be attractive for the users of capital.”

But there are some problems as well. As highlighted by the authors in this piece of World Resources Institute (WRI), the “MDBs need to improve the quality of their climate finance and ensure sufficient concessionality to match needs.” Authors also underline the “continued financing of fossil fuels”, which is detrimental to climate actions. Also the share of climate finance going to the most vulnerable countries is decreasing.

Adaptation versus mitigation: The issue of unequal funding

India has ambitious mitigation plans with a target to achieve net-zero emissions by the year 2070. But being among the most vulnerable countries to the impacts of climate change, India needs to work on adaptation so that it can deal with loss and damage and build a climate resilient infrastructure. Extreme heat, prolonged droughts, water scarcity, sudden floods, and frequent cyclones can damage infrastructure, hamper crop yields and impact the economy.

In such a situation, a natural question also arises whether climate finance is equally available for both adaptation and mitigation projects? Although the “thumb rule”, according to experts, is that finance should be divided equally between mitigation and adaptation, the former gets financed relatively easily, while it is hard to get finance for the latter.

Jena says, “Climate adaptation is considered to be a public good, which is struggling to attract private capital. It means they will continue to rely on public capital. So, it is more problematic for developing countries than developed countries, including India where fiscal muscles of governments are limited.”

The Economic Survey declares “It [India] has to focus a lot more than it has so far on adaptation than on emission mitigation”. It clearly says that “vulnerable developing countries such as India need to undertake climate adaptation on an urgent footing as this has a direct impact on lives, livelihoods and the economy.”

However, the intentions shown in the Economic Survey to give priority to adaptation do not match the records and reality so far. The National Adaptation Fund for Climate Change (NAFCC) was established to support adaptation activities in the country. This fund, however, was transformed from scheme to non-scheme in 2022. According to an analysis by Down to Earth, NAFCC has not received any budget since 2022-23. The budget of the National Coastal Mission has been reduced, while no budget has been allocated to the programme O-SMART (Ocean services, Modelling, Application, Resources and Technology) in the past two years.

However, the government has increased the budget of the National Mission for a Green India (NMGI) from ₹160 crore in 2024-25 to ₹220 crore in 2025-26. The government has also launched some ambitious projects like ‘Mission Mausam’ (to make the country ‘Weather-ready and Climate-smart’ ) in 2024, with a budget outlay of ₹2,000 crore for two years.

Since developing countries and Least Developed Nations (LDCs) are more vulnerable to climate-induced extreme weather events, they also need finance for loss and damage, which is even more difficult.

Jana says, “Loss and damage fund is a post-event fund where capital [aid] will come after the event has occurred. Only public finance will be able to fund these, unless assets are ensured.”

Persaud says with public support, private savers can finance much of mitigation and public savers can finance much of the climate adaptation that generates future savings, such as investments in climate resilience, health and infrastructure. He says financing loss and damage generates few savings and no revenues and this must be financed by grants.

“Grants are scarce at the best of times and so new sources will have to be found, like taxes on emissions in shipping and transport more generally and a reduction in subsidies for polluting industries,” He said.

Hiding behind Trump

The return of a climate-skeptic US administration raises concerns that global climate finance commitments will weaken further. Nakul Sharma, programme coordinator of Climate Action Network South Asia warns that Trump’s policies could shift India’s climate strategy inward, prioritising agriculture, energy diversification, and urban resilience over ambitious renewable energy goals. “In the absence of fair and funded means of implementation (MoI), India in particular, which had historically committed to international climate ambition beyond its fair share, will now recalibrate its strategy from relying heavily on implementation in sectors such as renewable to an inward-looking approach where sectors such as agriculture, new and innovative energy sources and building climate resilience of its urban agglomeration will be priorities,” Sharma said.

This is India’s opportunity to drive meaningful reforms in climate finance and set a precedent for developing nations. The challenge is immense, but with adequate planning and policy innovation, India can create a model for sustainable development, experts say.

India among worst-hit by extreme weather, accounts for 10% of global deaths

India ranked sixth in the Climate Risk Index 2025 by Germanwatch, facing over 400 extreme weather events from 1993-2022, resulting in 80,000 deaths and $180 billion in losses. The country accounted for 10% of global fatalities from such events and 4.3% of total economic damage. The report highlights inadequate climate finance, with COP29 failing to deliver a strong New Collective Quantified Goal (NCQG). The report’s findings are derived from extreme weather event data provided by the International Disaster Database (Em-DAT) and socio-economic data from the International Monetary Fund (IMF). Four other countries in the top 10 most affected list are Greece, Spain, Vanuatu, and the Philippines, Hindustan Times reported.

Flood isolates North Queensland towns, more heavy rain expected

Heavy rainfall hit the north Queensland coast cutting off towns near the Gulf of Carpentaria. Flood-hit communities may be isolated for more than a week in northern Australia after more rain was forecast, the Guardian reported. Shops have run out of basic supplies like bread and milk. Rainfall has spread west but continues to hit the north Queensland coast, which has been lashed for more than a week, claiming two lives and forcing hundreds of residents to evacuate. Rainfall has spread west but continues to hit the north Queensland coast which has been lashed for more than a week, claiming two lives and forcing hundreds of residents to evacuate.

Lightning kills 5 as storm Elvis hits Madagascar

Madagascar was hit by storm, Elvis, that reportedly killed at least five people, Mongabay reported adding that those killed were caught in “lightning events” in Vohibato district in eastern Madagascar, according to a European Civil Protection and Humanitarian Aid Operations (ECHO) report. The outlet reported that Elvis formed over the Mozambique Channel, between Madagascar and the African mainland, on Jan. 28 and struck the southwestern coast of Madagascar a day later. It caused heavy rainfall and strong winds in the southern part of the country, with maximum sustained winds of 84 kilometers per hour (52 miles per hour). The cities of Toliara and Taolagnaro recorded rainfall levels of 196 and 178 millimeters (7.7 and 7 inches) respectively over the course of five days, The Guardian reported.

Study: Natural world heritage sites threatened by climate extremes

“Natural” world heritage sites, such as the Galápagos Islands, Serengeti national park and Great Barrier Reef, will be impacted by extreme heat, rain and drought by the end of the century, researchers warn, reported Carbon Brief citing the study, published in Communications Earth & Environment. The study assesses the impacts of extreme weather on 250 natural world heritage sites, under different emissions scenarios. Natural world heritage sites are areas recognised by the UN Educational, Scientific and Cultural Organization (Unesco) for their “natural beauty or outstanding biodiversity, ecosystem and geological values”, the report said.

According to the findings, under a low-emissions scenario, 33 of the 250 heritage sites will face at least one “climate pressure” by 2100 while under a moderate scenario, 188 sites will be impacted. Under the highest emissions scenarios, the authors find that nearly all sites will experience extreme heat exposure, with many also facing the compounding impacts of drought or extreme rainfall, the report said.

Temperatures cross 20°C above average, beyond ice melting point, at North Pole

Temperatures at the north pole crossed 20°C above average on February 2, 2025, over the threshold of ice’s melting point of 0°C, reported the Guardian, citing models from weather agencies in Europe and the US.

“This was a very extreme winter warming event,” the newspaper quoted Mika Rantanen, a scientist at the Finnish Meteorological Institute. Burning fossil fuels has warmed the planet by about 1.3°C since preindustrial times, but the poles are warming much faster as reflective sea ice melts, the news outlet said, adding that the increase in average temperatures has driven an increase in fiercely hot summers and unsettlingly mild winters. The Arctic has warmed nearly four times faster than the global average since 1979, and extreme heat has become hotter and more common, the report said.

Dataset created for global future of coral bleaching risk in the 21st century

Researchers created a new dataset of past, present and projected future coral bleaching from 1985 to 2100. The dataset includes sea surface temperatures, heat stress anomalies and information on severe coral bleaching conditions from the past, and future projections – up to 2100 – under three Shared Socioeconomic Pathways. The data and a map can be viewed on an online portal, the researchers noted, adding that future projections will help conservation managers and policymakers to “quantify 21st century coral loss across the world’s coral reef regions”.

Research: Planted forests in China have higher drought risk than natural forests

New research found that planted forests in China are less able to cope with drought than natural forests. The study used satellite observations over 2001-2020 to understand forest drought risk. Researchers found that planted forests exhibit lower drought resilience and resistance than natural forests, particularly subtropical broad-leaved evergreen and warm temperate deciduous broad-leaved forests. Lower forest canopy height and poorer soil nutrients are among the factors responsible for planted forests’ higher drought risk, according to the researchers. They emphasise the need for “enhanced [forest] management strategies” as droughts become more frequent and severe.

India urges developed countries to fulfil climate finance pledges

India’s environment, forest and climate change minister Bhupendra Yadav expressed deep concerns over the failure of developed countries to meet financial commitments for a just transition, climate adaptation, and additional funding for biodiversity conservation, Business Standard reported. Speaking at the World Governments Summit in Dubai, Yadav said: “Climate change and biodiversity loss remain critical challenges, and these cannot be addressed without a transformative change in how the world approaches development”. The newspaper report said the statement “comes a day after almost all” countries – including India – missed the February 10 deadline to submit their third round of UN climate pledges. According to the paper, Yadav “urged developed countries to fulfil financial promises made and work together to close this gap as the world approaches the final stretch towards 2030”, adding that “without adequate financing, many nations face a debt burden that threatens their ability to pursue sustainable development.”

PM Modi’s US, France visit: SMRs, review of surcharges on luxury cars, solar cells on agenda?

India plans to review import tariffs on over 30 items, including luxury cars, solar cells and chemicals, Reuters reported, citing senior finance ministry official. This may lead to increased imports from the United States as global trade tensions grow.

The move, aimed at reducing average tariffs, comes ahead of Prime Minister Narendra Modi’s visit to the US and France. Also high on agenda during the twin visit is securing public-private partnerships for small modular reactors (SMR), reported Down to Earth.

In a bid to avoid President Donald Trump’s growing tariff actions, India has already reduced average import tariff rates to 11% from 13% on several items in the latest budget, the newswire report said.

Nuclear energy expected to form key part of energy mix: Nirmala Sitharaman

India’s Union Budget 2025-2026 renewed focus on nuclear energy announcing a ₹20,000 crore Nuclear Energy Mission aimed at developing Small Modular Reactors (SMRs). This initiative signals a strategic shift towards nuclear power as a potential substitute for coal, reported CarbonCopy.

The introduction of the Nuclear Energy Mission aims to fast-track the deployment of at least five indigenously developed SMRs by 2033. These next-generation nuclear reactors are expected to play a crucial role in cutting emissions, providing a stable power supply, and reducing the country’s reliance on fossil fuels.

Historically, coal has dominated India’s energy landscape, accounting for nearly 70% of electricity generation. While renewable energy sources such as solar and wind have gained traction, they remain intermittent and dependent on weather conditions.

India’s sugar production to drop 12%: Impacts of climate change and ethanol production

Sugar production in India may drop massively in the 2025 season, with forecasts predicting a fall to below 27 million metric tonnes (MMT), down from 31.8 MMT in the previous year, reported ANI. This marks a 12% decrease in output, primarily due to increased diversion of sugarcane for ethanol production and a reduction in cane availability across key producing states, reported the Outlook. The Centre increased ethanol prices for the Chandigarh route by 3%, the anticipated hikes for the Bihar and Direct routes were not implemented, leading to some disappointment within the sector, the report said.

This season between October 2024 and September 2025, Maharashtra was projected to produce about 102 lakh tonnes (lt) of sugar, down from 110.20 lt in the 2023-24 season. According to ChiniMandi, farmers have blamed climate change for early flowering, which shortened the crop’s life cycle. This early flowering ended the vegetative growth period prematurely, limiting accumulation of sucrose (sugar) in the stalks, impacting the overall yield, report said.

Lack of finance hamper India’s climate goals: Economic survey

The “failure of developed countries to commit adequate amounts of climate finance” at COP29 in Baku “might force India to temper the ambition of its climate targets for 2035”, said India’s national economic survey tabled in Parliament, the Indian Express reported. According to the newspaper, the survey described the $300 billion climate-finance target as “out of sync with the needs of the critical decade when action is required to keep the temperature goals of the Paris Agreement within reach”. The report added that resources to meet development targets and “international climate partnerships” might be “compromised” by the funding shortfall and “lead to a reworking of climate targets”, which will increasingly rely on domestic resources. The government survey also “flagged China’s dominance in clean-energy gear as a potential risk to its low-carbon transition.”

The survey also stated that coal and other fossil fuels will be the mainstay for energy needs in the medium term because of their reliability. “Lessons learned from the experiences of developed economies underscore the risks of prematurely shutting down thermal energy sources without viable technological alternatives that ensure a stable energy supply,” the survey said.

China threatens countermeasures to combat Trump tariffs, restricts Tungsten exports

China said it will defend its rights and interests while hitting out at new 10% tariffs imposed by the US on Chinese exports. The country said it will “take necessary countermeasures, FT reported. The newspaper cited analysts saying the tariffs instituted “would most affect home appliances, home furnishings, lithium batteries and [electric vehicles (EVs) made] in China”. It says that “many expect[] Trump to add more tariffs once his officials complete a review of trade policy in April”.

Meanwhile, China has put export controls on tungsten and other niche metals used in the electronics, automotive and solar industries as it “retaliated in a targeted way to US tariffs”, Bloomberg reported, adding that the move came immediately after President Trump imposed a blanket 10% tariff on Chinese imports. China produces around 80% of the world’s tungsten and bismuth, and is also the No. 1 supplier of the other metals.” While there are “alternative sources of tungsten being developed outside of China – including in Australia, Spain and South Korea,” the report said.

Paris Agreement no longer relevant for Indonesia, says envoy

Following Trump’s quitting of the Paris accord for the second time, Indonesia’s climate envoy Hashim Djojohadikusum said he considers the Paris Agreement “no longer relevant for Indonesia following the US withdrawal from the deal”, Antara News reported. The Indonesian news agency quoted him saying: “If the US does not want to comply with the international agreement, why should a country like Indonesia comply with it?” It says the nation “remains committed to developing new and renewable energy”, citing energy minister Bahlil Lahadalia, but says he “highlighted the high costs required.”

Most countries miss Feb 10 deadline to update plans to fight climate change

Only a dozen countries of the 195 nations that signed the 2015 Paris climate met the February 10 deadline to submit their updated “nationally determined contributions” (NDCs) under the Paris Agreement. CarbonCopy wrote that with major contributors to global warming resisting to upgrade their NDCs in 2025, experts in India and Global South have said that EU’s Carbon Border Adjustment Mechanism (CBAM) contradicts the spirit of the Paris Agreement that mandates rich countries account for their historical emissions and instead plans use the extra tax exclusively for the domestic industry to invest to reduce emissions and not share with countries from where EU imports.

The Associated Press reported that the nearly 200 signatories to the Paris deal were all due to have submitted their emissions-cutting plans for 2035 by the deadline, adding that the countries who submitted their plans on time account for 16% of the world’s carbon dioxide emissions, but “almost all of that is from the United States, where President Trump has already discarded the plan submitted by President Biden’s administration”.

Air pollution is a silent killer across the globe. Photo: Maverick Photo Agency/Flickr

Air pollution: Lung cancer patients who have never smoked tobacco rise globally

People who have never had a cigarette are being diagnosed with lung cancer and their proportion is increasing with air pollution an “important factor”, the World Health Organization’s cancer agency said, the Guardian reported. Such cases are now estimated to be the fifth-highest cause of cancer deaths worldwide, according to the International Agency for Research on Cancer (IARC).

Lung cancer in never-smokers is also occurring almost exclusively as adenocarcinoma. About 200,000 cases of adenocarcinoma were associated with exposure to air pollution in 2022, according to the IARC study published in the Lancet Respiratory Medicine journal, the report stated. The most adenocarcinoma attributable to air pollution was found in east Asia, particularly China, the study found.

Scientists, lawyers raise objections over dilution of pollution norms for 39 industries

Ecologists, scientists and lawyers have raised objections against a recent government notification exempting 39 industries (including fly ash/block manufacturing) from environmental clearances underlining ‘ease of doing business’, Down to Earth reported. The outlet said scientists and lawyers have sent a letter objecting to the notification of November 12, 2024, exempting the requirements of compliance to air and water pollution prevention and control.

“The lifting of consent requirements for industries with environmental clearances is a direct contradiction to the foundational objectives of the Air Act and Water Act,” the letter said.

The report added that the state pollution control boards (SPCBs) play a crucial role in holding industries accountable for polluting the environment. Diluting the requirements of renewal of Consents to Operate and Consent to Establish removes the mandate to routinely assess industrial compliance. The members pointed out that it is misleading and hazardous to classify industries such as fly ash bricks/block manufacturing as ‘white industries’, allowing them exemptions from environmental accountability. Fly ash, a byproduct of coal combustion, contains toxic heavy metals such as arsenic, lead, and mercury.

Green court pulls up authorities for failing to cleat Yamuna flood plains

The Centre’s Delhi Development Authority (DDA) and other authorities have failed to take necessary actions to remove encroachment along the Delhi stretch of the Yamuna, despite orders served to them over the years, the National Green Tribunal (NGT) stated on February 6, 2025, DTE reported.

On October 17, 2019, NGT ruled that the floodplains of a river should remain free of encroachments as that could pollute and harm the river’s ecology and ordered River Yamuna to be kept free from encroachment. The court also instructed DDA, Delhi Pollution Control Committee (DPCC), and the forest department to take legal action.

Green court seeks fresh report on heavy metal pollutants in Delhi air

The National Green Tribunal (NGT) on February 6, 2025 sought a fresh reply from the Central Pollution Control Board on tackling pollution in Delhi’s air stating that its previous report does not clearly reflect upon the monitoring of the heavy metals mentioned in the news article in The Times of India on September 29, 2024. These are chromium, copper, zinc and molybdenum. The report also doesn’t provide reasons for not monitoring, DTE reported.

The same was the case with the reply filed by the Punjab Pollution Control Board, the tribunal noted. The Union Ministry of Environment, Forest and Climate Change sought four weeks to consider the issue and file a response. The case will next be heard on May 15, 2025.

The original application was filed based on a news report referencing a study by the Indian Institute of Technology Delhi, which found dangerous levels of heavy metals like lead, cadmium and nickel in the air. The study also revealed that in East Delhi district, the primary heavy metals present in PM2.5 were chromium, copper, zinc, molybdenum and lead.

US schemes for electric trucks reduce premature air-pollution linked deaths among the poor

Policies to electrify trucks in the US have reduced air pollution-related premature mortality in “disadvantaged communities”, according to a new study which investigates the combined effects of Inflation Reduction Act investments in heavy-duty vehicle decarbonisation, reported Nature. However, while mortality rates have fallen in disadvantaged communities in the wake of federal investments, the findings suggest that a “disproportionate share of benefits” have accrued to “non-disadvantaged communities”. The researchers note that 40% of benefits of IRA investments are intended to flow towards disadvantaged communities.

As of January 2025, India’s total solar capacity installed stands at 100.33 GW. Photo: Pixabay

India hits 100 GW of installed solar power capacity

India surpassed 100 GW of installed solar power capacity, PV Magazine reported. As of January 31, 2025, India’s total solar capacity installed stands at 100.33 GW, with 84.10 GW under implementation and an additional 47.49 GW under tendering. The country’s hybrid and round-the-clock (RTC) renewable energy projects are also advancing rapidly, with 64.67 GW under implementation and tendered, bringing the grand total of solar and hybrid projects to 296.59 GW, the outlet explained.

India budget raises green hydrogen mission allocation 100% at ₹600 cr

The Union Budget for 2025-26 has provided ₹600 crore for the National Green Hydrogen Mission— a 100% increase over the previous ₹300 crore—to make India “the global hub for production, usage and export of green hydrogen and its derivatives” ET reported.

The mission was launched in 2023 with an initial outlay of ₹19,744 crore, including an outlay of ₹17,490 crore for strategic interventions for green hydrogen transition (SIGHT) schemes to incentivise electrolyser manufacturing and green hydrogen production. Till date, tenders for 412,000 metric tonnes of green hydrogen production capacity and 1.5 GW electrolyser manufacturing capacity have been awarded under the SIGHT scheme, according to Ember.

In 2020, India’s hydrogen demand stood at 6 million tonnes (MT) per year, it’s estimated that by 2030, the hydrogen costs will be down by 50 per cent. Some of the industrial players in the space are Reliance Industries, GAIL, NTPC, Indian Oil Corporation, and Larsen and Toubro. ET reported that the hydrogen sector will be dominated by big players, as high costs of “scaling” will push the smaller players out.

Costly Domestic Content Requirement solar modules slowing Centre’s schemes for farmers?

The increasing cost and limited supply of solar modules (restricted by curbs on imports from China to boost domestic manufacturing) are threatening the Centre’s programmes of subsidised power supply to homeowners and farmers (The PM Surya Ghar: Muft Bijli Yojana and the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan, PM-KUSUM), reported Mercom.

Domestic solar module prices have surged following the centre’s decision to impose provisional anti-dumping duties on solar glass imports from China and Vietnam. This move added approximately ₹450 (~$5.30) per 540 W–550 Wp module, resulting in a price increase of ₹0.80 (~$0.0094)/W–₹0.90 (~$0.011)/Wp. Some domestic manufacturers increased prices by ₹2 (~$0.024)/W–₹2.5 (~$0.029)/Wp, the outlet stated.

Developers told the outlet that the price increases are disproportionate to the actual cost impact. DCR (Domestic content requirement) cell prices are ₹13.75 (~$0.16)/Wp, compared to just ₹3.75 (~$0.043)/Wp for imported cells. Mercom cited developers stating that Yadav pointed out that the rates displayed on the PM Surya Ghar portal are approximately 20-30% lower than the prevailing market prices of DCR solar modules.

Adani withdraws from 2 wind projects in Sri Lanka

Adani Green decided to withdraw from two proposed wind power projects in Sri Lanka following the country’s review of its projects after US authorities in November accused its billionaire founder Gautam Adani and other executives of being part of a scheme to pay bribes to secure Indian power supply contracts.

Last month, the Lankan government asked Adani to lower the cost of power from the projects estimated to cost a total of $1 billion. The Adani Group is also involved in building a $700 million terminal project at Sri Lanka’s largest port in Colombo.

Trump’s policy uncertainty prods India firm to hold its plan to set up solar factory

President Donald Trump’s decision to pause Biden-era green policies has led Indian solar modules maker Premier Energies to put its own plan on hold to build a 1 gigawatt (GW) solar cell manufacturing facility, Reuters reported. Premier and North American solar module maker Heliene had announced a joint venture in July 2024 to build a US-based solar cell manufacturing facility to capitalise on the incentives and tax credits for domestic clean energy manufacturing under the Inflation Reduction Act (IRA), The newswire report stated.

Since he took over as president, Trump has halted spending related to climate and infrastructure laws from the previous administration, paused tax credits for clean industries, and suspended new offshore wind power leasing, while simultaneously unveiling a plan to maximise US oil and gas production and withdraw from the Paris climate agreement.

NCMM is enabling the exploration of critical minerals within the country and abroad. Photo: Wikimedia Commons

National Critical Mineral Mission a boon for India’s clean tech industry

India is fast-tracking the domestic green tech sector through the launch of the National Critical Mineral Mission (NCMM). An expenditure of ₹16,300 crore has been outlaid, and a further boost of ₹18,000 crore investment by Public Sector Undertakings (PSUs) is on the cards. With the ulterior motive of enabling the exploration of critical minerals within the country and abroad, the NCMM extends across the value chain, from mineral exploration, mining and beneficiation to processing and recycling.

Scientific research and technological innovation get strategic federal funding

Scientific research got a big boost in this year’s Union Budget, with Finance Minister Nirmala Sitharaman allocating ₹20,000 crore to the Research, Development and Innovation initiative. Her reasoning was that this is aimed towards “investing in people, the economy and innovation” in India. Also, she created a deep-tech fund to help domestic startups who are working on new generation technologies, and announced more funding for National Geospatial Mission, Vigyan Dhara and Bio-RIDE.

Indian govt turns its attention to developing AI

India has high hopes for artificial intelligence. While PM Narendra Modi chaired the AI Action Summit in Paris, France, Finance Minister Nirmala Sitharaman allocated ₹500 crore for establishing a new Centre of Excellence for Artificial Intelligence (AI) in education, while unveiling the Union Budget. It also allocates ₹2,000 crore to the IndiaAI mission, up from ₹173 crore committed in 2024. For the Department of Space, the budget allocation is ₹13,416.2 crore.

Tariffs, stagnating market slow down China’s growing push into Europe’s EV market

Chinese imports of electric vehicles (EVs, including battery EVs and hybrids) posted their “first annual drop since entering the [EU] market”, registering “3.5% fewer EVs” in Europe in 2024 as “trade barriers added to the challenge of building up sales in a stagnant market”, according to a report by Bloomberg. According to data from automotive researcher Dataforce, automakers like MG Motor registered 3.5% fewer EVs in the region for all of 2024.

Production of coal increased from 684.47 million tonnes (MT) to 726.31 MT between April and December 2024, making a big contribution to the growth of the overall sector. Photo: Max Phillips (Jeremy Buckingham MLC)/Flickr

Coal records highest growth at 5.3% among core industries

According to the Ministry of Commerce & Industry’s Index of Eight Core Industries (ICI), the coal sector grew by 5.3%, from 204.3 points in December 2023 to 215.1 points in December 2024, the Economic Times reported. Coal, cement, crude oil, electricity, fertilisers, natural gas, refinery products, and steel are all measured by the ICI. In comparison to the same period last year, the aggregate index of these industries grew by 4.0% in December 2024 and the combined index increased by 4.2% during the April–December 2024 period. Production of coal increased from 684.47 million tonnes (MT) to 726.31 MT between April and December 2024, making a big contribution to the growth of the overall sector.

India’s December LNG imports rise, natural gas production falls

The most recent data from the Petroleum Planning & Analysis Cell (PPAC) under the Ministry of Petroleum & Natural Gas showed that India’s natural gas production fell 2.1% in December 2024, with gross production of 3,066 million standard cubic meters (MMSCM), the Economic Times report. The 1,201 MMSCM of natural gas produced by the state-run ONGC was 5% less than the previous year. According to the report, during the same time period, the nation’s imports of liquefied natural gas (LNG) increased by 19.2% to reach 3,047 MMSCM. At 46.12 MMSCMD, Gujarat was the state with the largest natural gas consumption, followed by Uttar Pradesh and Maharashtra.

20 coal mines receive bids in coal ministry’s eleventh commercial auction

The 11th round of commercial coal mine auctions was opened by the Ministry of Coal, and offers were submitted for 20 of the 27 coal mines that were up for grabs, the Economic Times reported. Seventy online bids and seventy-two offline bids were recorded during the auction procedure. The bids were electronically decoded along with sealed envelopes holding offline bid paperwork which were also opened in front of the bidders. For transparency, the entire procedure was shown on a screen. In the eleventh round, 15 coal mines were put up for auction, and 65 bids were received. Five of the seven coal mines that were put up for auction in the second attempt of the tenth round each received one bid. 46 businesses in all placed bids throughout the auction procedure. For the first time, a Coal India subsidiary was among the more than 15 new businesses that took part in the commercial coal mine auction.

Trump’s trade war on Beijing could derail US LNG plans

According to experts, industry sources, and business filings, billions of dollars in planned US liquefied natural gas export projects—many of which depend on China as a major buyer—are at risk from President Donald Trump’s escalating trade battle with Beijing, the Reuters reported. According to the news outlet, Trump’s threat illustrates the dual character of Trump’s protectionist policies, which could unintentionally jeopardise his aspirations to significantly increase US energy output while simultaneously boosting American business and enforcing measures to combat illegal immigration and drug trafficking. As part of a larger attempt to improve the U.S. trade balance, Trump has imposed a 10% tax on Chinese imports. Beijing responded by imposing a 15% tariff on U.S. coal and LNG and a 10% tariff on U.S. oil. The report said that the United States is the world’s largest producer of LNG and China has been its significant consumer, purchasing around 6%, or 4.3 million metric tonnes of all U.S. LNG shipments last year. According to calculations by Reuters, Chinese state-owned enterprises have inked agreements to provide more than 20 million metric tonnes per annum (MTPA) of LNG from current and planned U.S. export facilities.