In May 2025, the Ministry of Finance released a document that could reshape India’s financial landscape. The draft Climate Finance Taxonomy framework covering power, mobility, buildings, agriculture, food security, water security, and hard-to-abate sectors, represents more than policy guidance. For Indian financial institutions, this framework isn’t just another regulatory document but a strategic roadmap that helps banks thrive in the next decade as global capital increasingly flows toward climate aligned investments.

The global context: how taxonomies are reshaping finance

Climate taxonomy, once a concept confined to environmental circles, has become the universal reference point for aligning finance with measurable climate and sustainability goals. At its core, climate taxonomy provides science-based classifications of which activities and investments genuinely advance environmental objectives, helping financial actors determine what can legitimately be labelled “green” or “climate-aligned.”

The European Union’s taxonomy is one of the global standards, helping direct trillions toward sustainable investments by providing unambiguous criteria for green investments. It has enhanced regulatory clarity and investor confidence, mobilizing €191 billion in 2023 and €249 billion within the first five months of 2024. China’s approach shows how taxonomy can accelerate national priorities by aligning it with the national industrial policies and accelerating low-carbon transformation. The ASEAN region’s common taxonomy reflects the ambition of emerging economies to pursue economic growth while embedding sustainability at the core of development.

Multilateral Development Banks (MDBs) and private investors alike now demand green alignment as a precondition for concessional finance, ESG fund allocation, and cross-border green capital mobilisation. The message is clear: countries with credible taxonomy frameworks are capturing a significant share of the global green capital.

India’s climate taxonomy: building a strong foundation

India’s draft taxonomy framework didn’t emerge in a vacuum. It builds on years of regulatory groundwork, policies and frameworks. For example:

- SEBI introduced green debt disclosure norms (2017; expanded in 2021), and mandated BRSR for the top 1,000 listed firms. In its consultation paper, it flagged the lack of a taxonomy as a barrier, citing risks of greenwashing and hesitation among lenders and issuers.

- The RBI, through its 2022 discussion paper and the 2023 Green Deposits Framework, emphasised climate-aligned governance and green fund tracking.

- IFSCA issued guidance for sustainable lending in 2022 and recommended developing a globally aligned taxonomy.

India’s Green Steel Taxonomy, released in December 2024, provided a sectoral blueprint that the broader framework now extends across the economy. The May 2025 draft framework represents the culmination of this regulatory evolution, providing Indian financial institutions tools to tap into global climate finance pools and markets.

From Policy to Practice: FI Readiness for India’s Taxonomy

Despite regulatory progress, Indian FIs display varying levels of preparedness for climate taxonomy adoption. A public sector bank might have developed a dedicated green finance vertical with internal classification standards, while a private bank adopts international frameworks or creates bespoke internal systems. Some institutions in the country have recently developed institution -specific frameworks, adding another layer of complexity.

This fragmentation results in threats of ‘greenwashing’, reputational damage, and missed opportunities to tap concessional climate finance from global pools like the Green Climate Fund (GCF) or international green bond markets.

To tackle this, Indian FIs need to transition from fragmented experiments to a dedicated institution wide taxonomy, aligning with national guidelines and global requirements. More than compliance, it is a strategic imperative to unlock new revenue streams, lower the cost of capital, strengthen resilience to climate risks, and position them competitively in a rapidly evolving sustainable finance market.

Building blocks of green transformation for Indian FIs

For FIs to successfully transition to a Climate Taxonomy aligned financing, systematic transformation across five critical areas is key.

- Governance and oversight: embed taxonomy within institutional governance which requires strong oversight at the board and credit committee levels. This entails institutionalising green finance policies, integrating taxonomy-based criteria into enterprise risk and credit frameworks, and aligning compliance, audit, and disclosure systems to reflect taxonomy-linked obligations and reporting standards.

- Strategy and product innovation: include sustainability considerations into business models by developing taxonomy aligned products, such as green credit lines, sustainability linked loans, and transition finance instruments, aligning business growth plans and sectoral priorities with India’s national climate and development objectives.

- Data systems and digital readiness: upgrade core banking and risk management systems to embed taxonomy-based classification, environmental risk scoring, and dynamic green portfolio tracking. This requires integrating the existing data architecture with mechanisms to capture credible emissions baselines, granular climate risk assessments, and consistent environmental performance metrics. This includes both client provided information and external data sources on environmental performance metrics.

- Process integration and operationalisation: operationalise taxonomy criteria across the full credit lifecycle, integrated into origination templates, due diligence protocols, approval processes, and post-disbursement monitoring. Internal classification guides aligned with the national taxonomy will be critical for frontline staff.

- People and capacity building: targeted training for staff across functions, the creation of internal knowledge resources, and fostering a culture that mainstreams sustainability into core financial decision making. This includes both technical training on specific taxonomy requirements and broader education on climate change impacts and transition pathways.

The Playbook that will make the climate taxonomy work

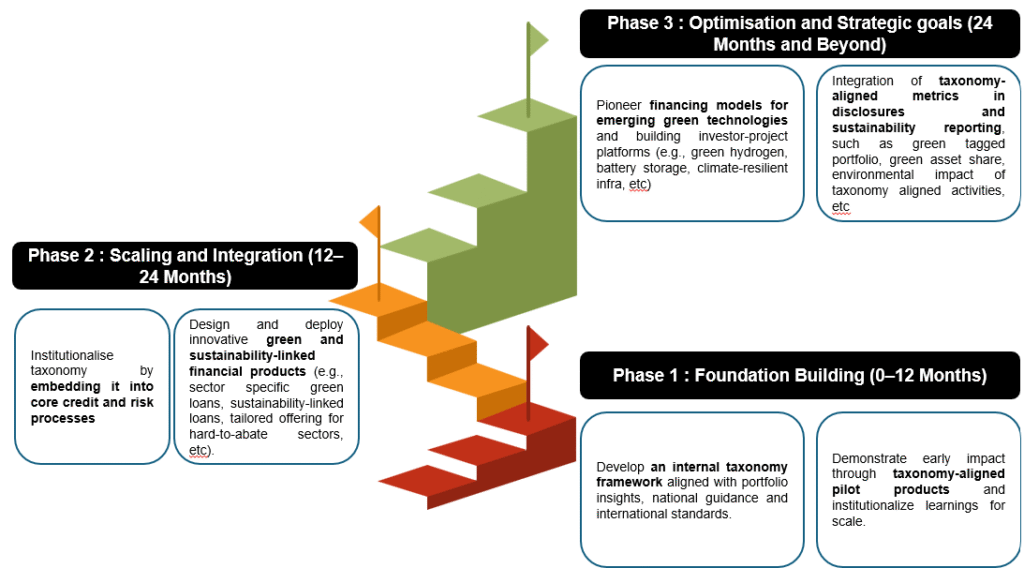

To inculcate the building blocks, financial institutions must take proactive, phased steps. An effective roadmap will outline the strategic journey in three phases.

Phase 1: Foundation building (0–12 months)

This phase focuses on building institutional readiness by developing an internal taxonomy framework aligned with the existing portfolio, national directives, global benchmarks. The framework should be structured by sectors, sub-sectors, eligible activities, use of proceeds, and clear reporting indicators. This begins with a comprehensive portfolio analysis to map adaptation and mitigation exposures, identify growth opportunities, align with targeted funding sources’ monitoring requirements, and assessment of the technical capacity of both the institution and clients to report data. Decisions should be made on whether to restrict the framework to a use-of-proceeds classification or integrate technical screening criteria for more robust monitoring. Other key actions include securing board level commitment, piloting taxonomy-linked lending in 2–3 priority sectors, delivering organization-wide training to ensure full buy-in, standardising impact assessment methodologies for all the clients and planning for third-party verification where needed.

Phase 2: Scaling and integration (12–24 months)

This phase should focus on institutionalising taxonomy use across all business lines through structured stakeholder consultation with each department to define process flows, realistic targets, and integration into core systems and processes. It also includes setting measurable green portfolio targets. Technology systems should be enhanced (backed by vendor buy-in) to integrate AI/ML tools for automated taxonomy alignment, climate risk profiling, and portfolio optimisation. A comprehensive system design document should outline green tagging, monitoring, and dashboard visualisation flow with the existing core banking system to ensure seamless integration. Institutions can expand their product suite with taxonomy-aligned products such as green loans, sustainability-linked instruments, and sector-specific solutions. Partnerships with data providers and verifiers, combined with borrower engagement through education, advisory, and technical assistance, will further strengthen both green project structuring and reporting.

Phase 3: Optimisation and strategic goals (24 months and beyond)

This phase should focus on embedding taxonomy-aligned metrics into disclosures and sustainability reports to demonstrate transparency and impact, capturing indicators such as green asset share, green-tagged portfolio, and environmental performance outcomes. This will enable the development of innovative financing models for emerging green technologies like green hydrogen, battery storage, climate-resilient infrastructure, etc. while also connecting high-impact projects with investors. Based on initial implementation experience (or pilots), the taxonomy framework should be periodically updated to close gaps, improve usability, and align with evolving market and policy developments. Policy leadership can be strengthened by sharing lessons from implementation, actively engaging in industry dialogues, and contributing structured feedback to strengthen the national taxonomy framework.

Beyond compliance: building India’s sustainable finance future

The adoption of Climate Taxonomy is not a regulatory checkbox; it’s a strategic lever for Indian FIs to stay competitive in an increasingly climate-conscious global economy. Proactive institutions will gain preferential access to green capital, establish reputational leadership, and secure a competitive advantage in developing innovative and market ready green financial products.

The May 2025 framework provides the roadmap—success depends on execution. Regulators like RBI and SEBI, apex bodies like NABARD and SIDBI, and industry associations have a pivotal role in guiding this transition. But the real ownership must come from India’s financial institutions.

Ankit Gupta is Partner and Puja Paramhansa is Manager at Intellecap. Views expressed are personal.

About The Author

You may also like

Companies in BASIC nations are turning carbon rules into an advantage: Report

Can green trade barriers save the environment?

Brazil Set 60-Day Deadline for Fossil Fuel Phase Out Plan

Litigation increases legalisation of protection against climate threats: Report

What COP30 reveals about the next phase of multilateralism