China’s 14th five-year plan lacks the foresightedness needed to help the country achieve its target of carbon neutrality by 2060

Chinese President Xi Jinping caught the world by surprise last September when he laid out China’s plans to achieve net-zero emissions by 2060. While the announcement was welcomed by observers around the world, most agreed that any celebration would be premature without additional details on China’s strategy. The wait for specifics ended last week as the country unveiled the first steps of its long-term decarbonisation plans.

The 14th Five Year Plan (FYP), the guiding document for China’s economic development for the next five years, has laid out decarbonisation targets the country will pursue till 2025. While the plan, adopted officially by the National People’s Congress on Thursday, reflects a marginal increment over targets included in the 13th FYP (2016-2020), experts have pointed out that it falls substantially short of the emission reductions required in the short term.

Failure to meet climate expectations

The FYP mechanism to set out national economic and development objectives dates back to 1953. Climate change has figured in the plans since the 10th FYP, which guided China’s development from 2001 to 2005. Concrete targets regarding energy intensity of the economy, carbon intensity and the share of non-fossil fuels in China’s energy mix assumed significance in the 12th and 13th FYPs. The 13th FYP aimed to lower the energy intensity and carbon intensity by 15% and 18% respectively in 2016-2020, and bring the share of non-fossil fuels in the energy mix to 15% by 2020. China managed to achieve both these targets ahead of schedule.

While that might be construed as an indicator of China’s readiness to raise ambition, the 14th FYP barely stays the course, despite the introduction of a target on forest cover expansion. The draft includes some key targets for climate action during the 2021-26 timeframe:

- Energy Intensity: China will aim to lower the energy consumption per unit GDP by 13.5%, less ambitious relative to the 13th FYP target.

- Carbon Intensity: It will maintain the course set in the 13th FYP with planned reductions in carbon emissions per unit GDP at 18%.

- Non-fossil Energy Share: There are plans to increase non-fossil share in consumption energy mix to 20% from the current 15.8%.

- Forest Cover: The goal of a marginal increase in forest cover from 23.01% in 2020 to 24.1% in 2025 has been set.

- Air Pollution: A target to eliminate heavy air pollution within the five-year period has also been set.

Analysts believe the marginal increment reflects a misalignment between China’s short-term goals and long-term ambitions for low carbon growth. “As the first five-year plan after China committed to reach carbon neutrality by 2060, the 14th FYP was expected to demonstrate strong climate ambition. However, the draft plan presented does not seem to meet the expectations. Overall, the plan doesn’t contain enough details on how China plans to accelerate the economy’s decarbonisation, nor does it offer much strategic guidance on how to peak carbon before 2030 and reach carbon neutrality by 2060,” says Zhang Shuwei, chief economist at Draworld Environment Research Center.

Net-zero by 2060 still a long shot

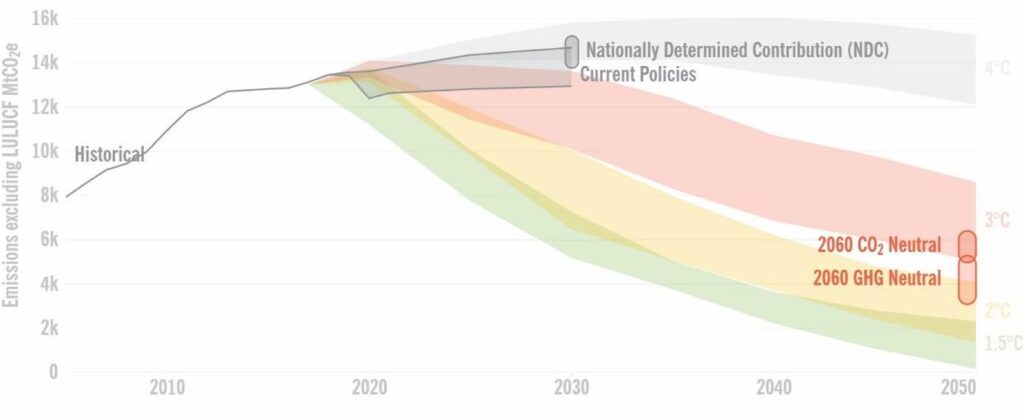

China’s emissions, which were significantly dented by the pandemic, saw a sharp rebound in the latter half of 2020. Fuelled by stimulus spending in heavy industries, manufacturing and construction, China’s emissions actually registered a growth of 1.5%. The 14th FYP will likely culminate in a slowdown in emissions compared to levels in recent months. Analysts, however, believe this is still short of China’s NDC towards the Paris Agreement, and nowhere near the action required to achieve the country’s 2060 net-zero ambitions. “There remains much to be done beyond these five-year targets. There’s still no end in sight for China’s coal plant construction boom. Runaway momentum in the steel, cement, and aluminium sectors suggests China needs to do much better to green its COVID recovery,” says Li Shou, policy advisor to Greenpeace East Asia.

Analysts have long believed that decarbonisation efforts will hinge on when China plans to peak its emissions, and at what levels. While China has committed to reaching peak emissions before 2030, a recent study published by the Asia Society Policy Institute and Climate Analytics suggests that the peak will have to be attained much sooner, and no later than 2025, in order for China to meet its NDCs.

With mounting pressure to bring some clarity to these points, expectations were that 14th FYP would include a “carbon cap” that sets absolute limits on additional carbon emitted. The latest FYP, however, has persisted with the goal of reduction in emission intensity, effectively dodging the all-important question regarding the timeline for China’s peak emissions.

“To tackle the climate crisis, China needs to bring its emission growth to a much slower level, and to flatten the emission curve early in the upcoming five-year period. Peaking emissions earlier than 2025 is not only possible, but necessary,” adds Li.

Interestingly, the 14th FYP has deviated from the norm of setting five-year targets for the country’s GDP. Instead, this time around, China will evaluate its targets based on inputs from provincial and regional governments on a yearly basis, with the 14th FYP including only a target for 2021, which has been set at 6%. According to analysis conducted by the Center for Research on Energy and Clean Air (CREA), pursuing 6% growth at the prescribed 18% reduction in energy intensity would still raise emissions by about 1.9% in the current year.

At a 6% growth rate, emission intensity would have to be reduced by over 25% in order to bring emission growth rates close to zero, the analysis suggests. Even with an average GDP growth rate of 5.5% from 2020, CO2 emissions are poised to grow at 1.1% from 2020 to 2025 under the current target for reduction in emission intensity.

“The 14th FYP targets on energy intensity and carbon intensity are rather moderate. The plan doesn’t include an explicit five-year target on GDP growth. However, our calculations show if the actual annual GDP growth is above 3.9% in the 14th FYP period, China’s absolute emissions will continue to increase,” explains Zhang.

China’s CO2 emissions increased by approximately 1.7% per year from 2015 to 2020, and kept growing at 1.5% even in 2020, despite the pandemic. Assuming that GDP growth over the period averages 5.5%, CO2 emissions could grow at 1.1% from 2020 to 2025, and still meet all the targets announced. This would be a slight deceleration compared with past years. However, if there is a strong rebound in growth this year and the rest of the period averages 6%, CO2 emission growth could even accelerate under these targets, compared with the past five years. “This would be a slight deceleration compared with past years. However, if there is a strong rebound in growth this year and the rest of the period averages 6%, CO2 emission growth could even accelerate under these targets, compared with the past five years,” warns Lauri Myllyvirta, lead analyst at CREA.

The 14th FYP also seeks to increase non-fossil share in China’s energy consumption from the current 15.9% to 20% over the next five years. While this increase signals modest growth in renewables, analysis of pathways to attain the 2060 net-zero target suggests that a linear path would require at least 25% of China’s energy mix to comprise non-fossil energy sources by 2025.

A major issue though, according to Myllyvirta, is the absence of any limits on energy consumption. “Without the energy consumption control target, there’s even less in this five-year plan to constrain emissions growth than in the previous ones. As a result, there’s no guarantee that emissions growth will slow down, let alone stop, by 2025. So it’s leaving the decisions about how fast to start limiting emissions growth to the energy sector five-year plan and other plans expected at the end of the year,” he notes.

The road ahead

China has not released any official roadmap for its 2060 carbon neutrality deadline. The short-term plan reflected in the 14th FYP, though, is in line with the decarbonisation approach forwarded by researchers at the Tsinghua University, which proposes smaller reductions until 2035, after which larger reductions in emissions will be easier to achieve given a wealthier population and technological breakthroughs in green energy.

In the nearer term, however, the five-year plans for energy and electricity, expected to be released later this year, are likely to add further detail to China’s decarbonisation efforts. Additionally, China will also release its first ever five-year plan on climate, led by the environment ministry, which in recent years has seen a surge in official clout.

While demand for oil and gas is expected to continue to grow through the decade, a big concern among observers is how China intends to manage its growing appetite for coal with nearly three-fourths of all new coal power capacity being built by China alone. There is little indication of how China intends to handle the coal question. The 14th FYP draft document promises a “major push” for clean energy, but almost in the same breath, also advocates for the use of clean coal.

“In terms of the climate, initial indications from China’s 14th Five Year Plan are underwhelming and shows little sign of a concerted switch away from a future coal lock-in. We hope to see a coal cap in the more detailed energy sector and climate five year plans later this year, which will help shed light for the international community on the future of China’s emissions growth and its climate commitments,” says Swithin Lui, Climate Action Tracker’s China lead at the New Climate Institute.

Although a clearer formulation is expected in the five-year plan for energy later this year, the China Coal Association recently stated that coal consumption in 2025 would be capped at 4.2 billion tonnes, which is close to the current consumption levels and indicates peak coal consumption sometime in the next five years.

Further, the change in guard in the US with Joe Biden assuming presidency could provoke some change in China’s strategy for the Paris Agreement era that extends up to 2030. With the White House preparing a new, more ambitious target for 2030, international pressure on China to step up their own ambition will likely grow in the run up to the UN COP26 climate negotiations in November. While there is no doubt there is a will on China’s part to work on climate issues, the question of the way still remains to be answered.

About The Author

You may also like

India’s EV revolution: Are e-rickshaws leading the charge or stalling it?

Is pine the real ‘villain’ in the Uttarakhand forest fire saga?

NCQG’s new challenge: Show us the money

India’s energy sector: Ten years of progress, but in fits and starts

9 years after launch, India’s solar skill training scheme yet to find its place in the sun