Coal power generation under pressure from increasing renewable energy.

At approximately 70% of generation, coal is the dominant fuel for electricity (or power) in India. Further, in India, most coal (again, approximately 70%) is used for power generation. Due to various reasons; including coal’s historic cost-competitiveness, energy security, incumbency and ability to provide baseload power; many believe that coal is likely to remain the dominant fuel for power generation in India in the future.

Many majority government owned entities – such as Coal India and Indian Railways – rely heavily on revenues from coal production and transportation. Coal power generation is directly proportional to coal consumption (i.e. coal sales for Coal India) and equivalently coal transportation (i.e. freight charges for Indian Railways); and, therefore, directly connected to the revenues, cash flows, and the financial health of these entities.

Coal power generation is, however, under pressure from increasing low cost, domestic renewable energy penetration in India’s power system. This trend was initiated under India’s solar and wind targets in the previous decade. It has been further strengthened under India’s commitment to the Nationally Determined Contributions (NDCs) in the Paris Agreement, where renewable energy capacity is supposed to increase to 40% of generation capacity, or 350 gigawatts (GW) in absolute terms by 2030.

This effect – i.e. coal power being under pressure – is known as the climate transition risk, which connects climate related policy, legal, technology, and market changes to the financial health of assets, companies, and sovereigns. In this case, the implications are not only via countries’ climate targets but also via rapidly falling costs of renewable energy and related technologies such as battery energy storage systems (BESS), and their interplay with policies and markets.

This begs the following question: What is the likely impact of the transition risk brought about by rapidly falling costs of renewable energy and BESS on Coal India? This is despite the fact that Coal India is a de facto monopoly that enjoys price certainty. It currently not only supplies more than 80% of domestic coal and more than 60% of total coal in India, but also enjoys government supported price certainty that ensures cost-plus pricing on their average cost of production.

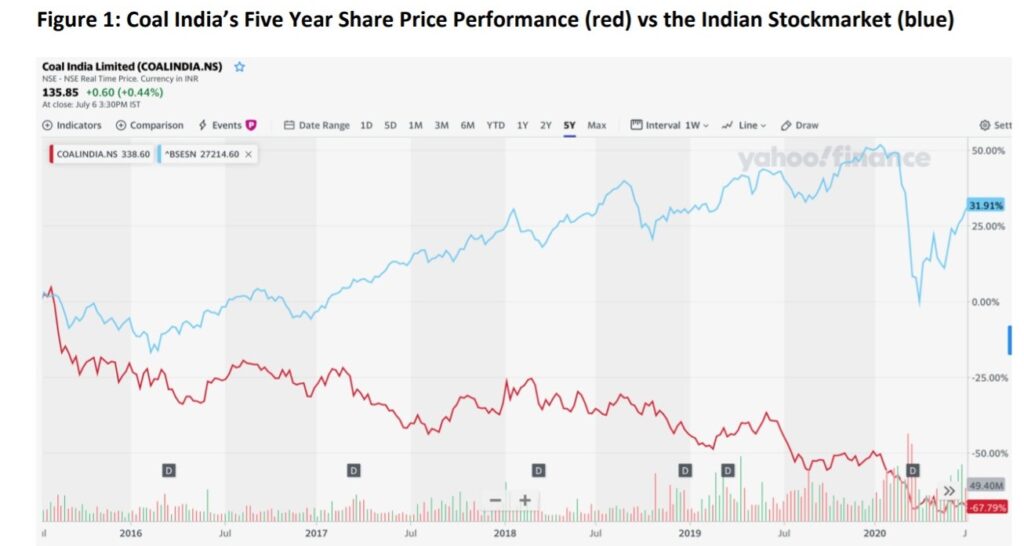

Despite the seemingly comfortable position of Coal India, climate transition risk exists in a significant way. In fact, it appears it has been partially factored into how the financial markets are perceiving Coal India over time. As evident from the chart below, despite a steady growth in the market itself over the last five years, Coal India’s stock market valuation has seen progressive, ongoing, and serious erosion.

This risk is going to increase as renewable energy becomes increasingly cost-competitive, as evident from recent auctions resulting in record low tariffs at Rs 2.36/kWh. This is likely to influence policy and markets to further support higher penetration of renewable energy at the expense of coal power, which would have direct consequences for Coal India revenues and cash flows via reduced coal sales, even if they continue to enjoy the de-facto monopoly along with price certainty.

Calculation of this risk requires identification of likely scenarios with high renewable energy penetrations, above and beyond India’s NDCs. In fact, given the rapidly falling costs of renewable energy and battery storage, a recent analysis at the Lawrence Berkeley Lab (LBL) shows that the most cost-effective option for India to manage its power supply options to 2030 is to deploy 450GW of renewable energy, i.e. at least 100GW (one third) higher than implied by India’s NDCs.

This high renewable energy scenario (i.e. 450GW by 2030), which is also recognized by the Indian government as an aspirational target, has been missed by most financial analysts so far, primarily due to the beliefs originally identified as supportive of coal power’s dominance. For example, a recent valuation, which is representative of the financial analyst industry, pegged renewable energy penetration at 310GW by 2030 (i.e. slightly lower than the NDCs), and calculated the value of Coal India at Rs.1.47 lakh crore or US$19.73bn.

To assess the impact of this high renewable energy scenario, we started with this existing valuation, and modified it to explore the impact of 450GW of renewable energy capacity by 2030. In this process, we assumed that the impact of increased renewable energy generation would be directly correlated with decreased coal power generation which would then ripple down to reduced coal production for Coal India, resulting in lower revenues, lower cash flows, and lower valuations.

We found that the high renewable energy scenario (i.e. 450GW by 2030) results in a ~14% reduction in the valuation of Coal India, with an absolute decrease of Rs 200 billion in valuation, which is a significant loss in value. In fact, given that the share of renewable energy generation increases by ~10% compared to the original valuation, there appears to be a near one-to-one correspondence in the percentage points increase in renewable energy’s share of power generation and the percentage decrease in Coal India’s valuation. On the one hand, this linear relationship between the increase in renewable energy’s share of power generation and the percentage decrease in Coal India’s valuation indicates the stable position of Coal India. On the other hand, given this potential (and significant) reduction in valuation, Coal India (and the Government of India) should not only acknowledge this risk but also explore avenues for reducing the risk, potentially diversifying Coal India into more climate friendly activities, such as mining other minerals of value (e.g. iron ore or lithium)19, or investing in renewable projects above and beyond what is currently planned.

The article has been republished with permission from IEEFA. This commentary was written by IEEFA Guest Contributor Gireesh Shrimali. Views expressed are personal.

About The Author

You may also like

Converting Coal Mines to Solar Can Add up to 15% of Global Capacity: Report

Targeted co-financing can solve the challenge of just transition in emerging economies: Report

One-third of SE Asia’s data centres can be powered by renewables by 2030: Report

India’s coal heartland is powering down, with no safety net

Fossil fuel industry emits one-third of global methane: IEA Report