A detailed analysis shows how major European oil producers continue to greenwash as their investments in fossil fuels and profits from the same continue to rise

According to the IEA’s Oil Market Report August 2023, the oil and gas industry is set to increase upstream investment in 2023 to their highest levels since 2015. European oil majors BP and Shell have abandoned any pretence that they’re committed to a rapid energy transition.

Despite climate impacts accelerating across the globe, BP weakened its commitment to cut oil production and Shell is instead focusing on returning capital to shareholders and “core competencies”, i.e. producing oil and gas. As a result, oil majors’ capital expenditure on clean energy (which for some includes biofuels and CCS) remains a fraction of capital expenditure on upstream oil and gas.

In an interview with the BBC, new Shell CEO Wael Sawan said it would be “dangerous and irresponsible [to cut] oil and gas production so that the cost of living, as we saw last year, starts to shoot up again.

While profits have declined significantly from the records of 2022, the oil majors remain highly profitable, booking first half earnings well above the long-term average.

Recently, ExxonMobil acquired Denbury Inc for its network of CCS plants and CO2 pipelines, and Occidental Petroleum (Oxy) acquired Carbon Engineering for its Direct Air Capture technology. This confirms what has been long suspected, that the majors would use CCS/DAC to provide cover for business-as-usual. As Oxy CEO Vicki Hollub said earlier this year, “We believe that our direct capture technology is going to be the technology that helps to preserve our industry over time. This gives our industry a licence to continue to operate for the 60, 70, 80 years that I think it’s going to be very much needed.”

What’s the oil and gas industry up to?

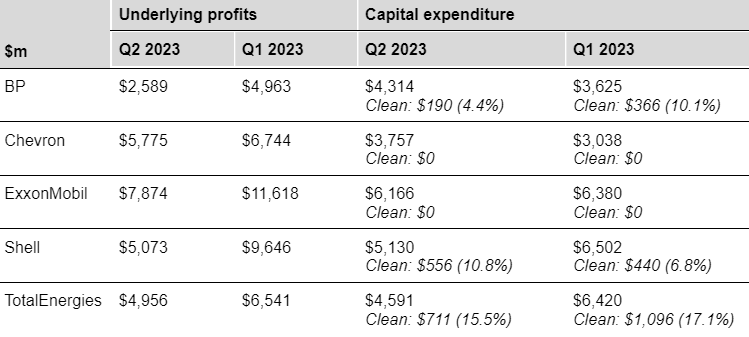

The oil and gas industry is still heavily investing in upstream development; investment in clean energy and “solutions” such as CCS, remains a relatively small part of industry-wide capital expenditure.

The oil majors continue to return large amounts of capital to shareholders, through dividends and buybacks, some are even using cash reserves to do so this year. While the majors retain significant cash reserves, expect to see further consolidation or acquisitions, especially those that may accelerate “low carbon solutions”, as seen with ExxonMobil & Denbury and Oxy & Carbon Engineering.

Oil majors profits and capital expenditures:

Goldman Sachs stated that the oil and gas industry has emerged from a prolonged period of underinvestment and is embracing significant new projects: the industry has 70 major projects under development worldwide, a 25% increase from 2020. While most of the capex growth last year was driven by U.S. shale. It was clearly a U.S. onshore-led capex recovery. This year, it’s led by deepwater and liquified natural gas (LNG).

The report added that the oil and gas industry currently has 70 giant projects under development, 25% more than in 2020, but still 35% below the 2014 level.

Flaws in the oil and gas business model

Oil and gas supermajors need high prices to thrive. A recent report found that compared to the second quarter of 2022, the price of oil fell by a third and the supermajors’ collective free cash flows—the cash generated by their operations, minus capital expenditures—fell by 56%. The industry needs their revenues from oil, gas, refined products, and petrochemicals to grow quickly enough to cover the escalating cost of labour and materials, and to compensate for the ever-increasing difficulty of extracting new oil and gas reserves out of the ground.

Moreover, the “Ukraine dividend” has faded. In 2022, for the first time in decades, the supermajors generated enough spare cash that they could boost payouts to shareholders, retire some debt, and stockpile cash, all at the same time. Oil prices have fallen back to earth over the past two quarters. The supermajors have seen their cash flows dwindle as a result.

Consequently, the oil industry has reverted to its old, deficit-spending ways. ExxonMobil, Chevron, and Total—have had to dip into their cash reserves in order to maintain dividends and share buybacks. According to the calculations in the report, from 2005 through 2020 the supermajors collectively paid about $325 billion more to investors than they generated in free cash flow.

What’s to come?

IEA’s Oil Market Report August 2023 said world oil demand hit a record 103 million barrels per day (mb/d) in June and August could see yet another peak, boosted by strong summer air travel, increased oil use in power generation and surging Chinese petrochemical activity. The report also said global oil demand is set to expand by 2.2 mb/d to 102.2 mb/d in 2023, with China accounting for more than 70% of growth.

Talking about the demand for oil, the report from IEA found that the petrochemical sector will remain the key driver of global oil demand growth, with liquified petroleum gas (LPG), ethane and naphtha accounting for more than 50% of the rise between 2022 and 2028.

Moving on to gas, the IEA’s Global Gas Security Review 2023 (July) found European buyers have increased their LNG contracting activity since Russia’s invasion of Ukraine, though they still account for just 20% of total LNG volumes contracted since the start of 2022—while China’s share topped 25%. Global gas demand is expected to remain broadly flat in 2023 and return to moderate growth of 2% in 2024, with the Asia Pacific region expected to account for around 80% of incremental gas demand by the end of 2024.

About The Author

You may also like

India asks power companies to order $33 billion in equipment to boost coal power output

India’s first pilot project for underground coal gasification launched in Jharkhand

Increasing oil and gas production among top priority, says India’s petroleum minister

A faster clean energy transition will make energy cheaper, not more costly: IEA

India’s energy sector: Ten years of progress, but in fits and starts