In the first of a two-part series on India’s plans to increase palm oil production, CarbonCopy explores how an unexpected snag will change land relations in North Eastern states like Assam and Arunachal Pradesh

India has embarked on a new push for oil palm cultivation in northeast India. Some of the attendant stakes are well known. Oil palm supporters point at India’s burgeoning edible oils import bill. With domestic oilseed production staying low, imports now meet 65-70% of India’s edible oil demand. It’s an expensive indulgence. Between October 2022 and October 2023, India’s edible oil import bill stood at ₹138,000 crore. Three-fifths of that—9.79 million metric tonnes—was palm oil, mostly from Indonesia and Malaysia. Growing oil palm locally, say supporters, can help India reduce that import bill.

The counterpoint to these arguments is also well known. Given its thirst for water, oil palm is expected to exacerbate local water shortages. It also weakens soil health. As studies have shown, oil palm plantations have the lowest biodiversity—lower than even teak plantations, and far lower than the traditional jhum landscapes. Forest bird abundance in the jhum cultivation landscape was similar to that in a rainforest, on average 304% higher than in oil palm plantations, biologists have found.

There is also the question of forest loss. Oil palm is mostly grown in areas that get lots of rain. Consequently, in countries like Indonesia, Malaysia and Cameroon, where governments cleared forests and planted oil palm, the plant has triggered massive deforestation, destroying habitats of endangered species like orangutans and reducing planetary resilience to climate change.

Even as this debate plays on, CarbonCopy heard about a puzzling new dimension to oil palm cultivation in North East India—large farmers seem to be more interested in the plantation crop than smallholders.

Big interests, slow progress

An unexpected snag has hit Patanjali’s oil palm ambitions for Assam.

Back in 2019, when Patanjali Ayurved acquired Indore-based Ruchi Soya, it also bagged the latter’s fledgling palm oil business.

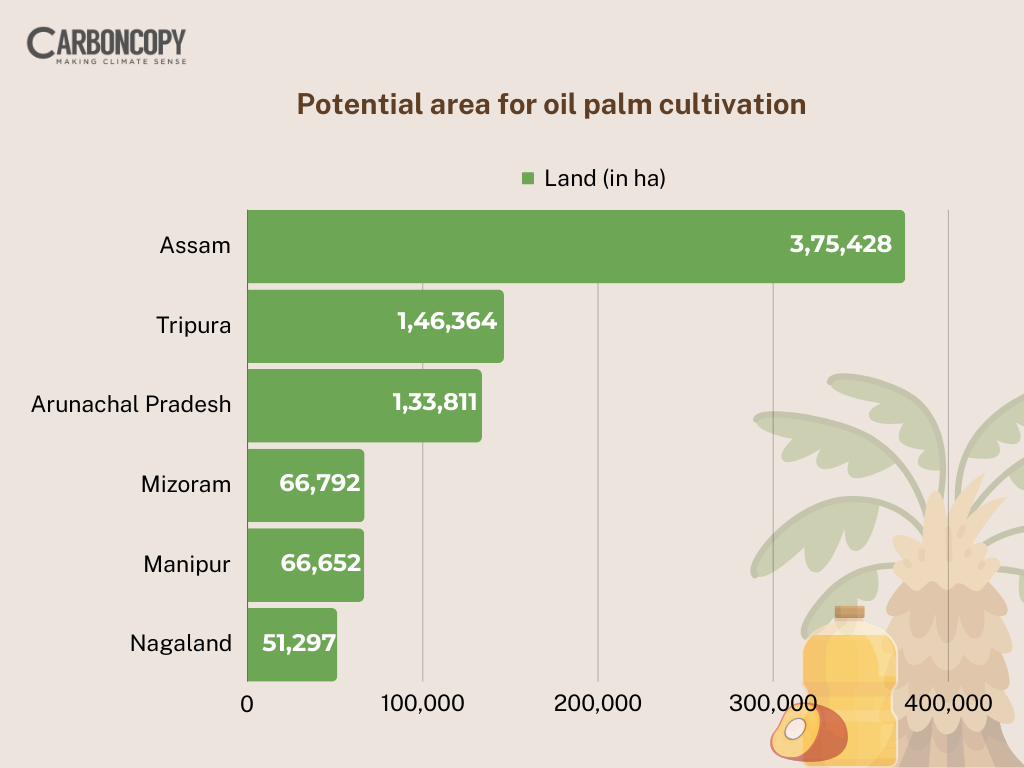

The acquisition was timely. Just two years later, the BJP-led NDA government would kick off a new mission on oil palm cultivation. By that time, the Indian Institute of Oil Palm Research (IIOPR) had identified Assam as the state with the highest potential for oil palm cultivation. Of the 10 lakh hectares (ha) of oil palm plantations India wants to add, Assam’s target alone stood at 3.75 lakh hectares.

And so, joining the ranks of firms like Godrej Agrovet, 3F Oil Palm and Kanpur Edible, Patanjali, too, entered Assam, striking a deal with the state government to plant oil palm on 60,300 ha by 2026.

Thereafter, over the past two years, Patanjali has been setting up oil palm nurseries and processing units. Given state pressure to scale up quickly, not only has it sourced seedlings from countries like Indonesia and Malaysia, it even transferred saplings from Andhra Pradesh, and began rearing them all in its nurseries.

By October this year, the company had 300,000 sprouts in Assam. “These will be ready for transplanting by April-June 2024,” Subhas Bhattacharjee, a Guwahati-based advisor to Patanjali’s Assam operations told this reporter last October.

There is, however, one problem. By October 2023, Patanjali had finalised no more than 800 farmers, adding up to just 120 ha between them. Not only was it nowhere near its 60,300 ha target, this parcel of land was not even enough for the 300,000 sprouts already in its nurseries. “What we need [for these sprouts] is 2,100 ha,” said Bhattacharjee. “But we might get 500 ha.”

Why farmers are not coming—and what oil palm companies are consequently planning—has to be understood. Hardwired into that question are some lesser-known implications of India’s latest oil palm push for the northeast.

A fresh approach to a slippery slope

The current Indian government’s palm oil push is a significant upgrade from the previous scheme. That one, rolled out in states such as Mizoram from 2004, differed starkly from the model followed by Indonesia and Malaysia.

In those countries, large tracts of forests—as big as 20,000ha to 30,000 ha—were handed to palm oil companies. Not so in India. Here, land ownership stayed with farmers, who had to enter into contract farming arrangements with companies for 30-odd years.

Oil palm takes three years to produce its first crop. During that gestation period, farmers need financial support. Schemes such as Mizoram’s New Land Use Policy, which promised such support as the state tried to wean farmers off jhum cultivation, were undone by weak state finances. Subsidy payments came late, or not at all. “Not being paid on time dissuaded farmers,” Sanjeev Asthana, the CEO of Patanjali Foods, told CarbonCopy. “They do not have deep pockets to wait for a good crop.”

That was just the start. To protect millers’ investment, all growers in a district had been told to sell to only the local processing unit. This triggered concerns about possible abuses of market position. Yields were lower as well. “A country like Indonesia gets an output of 25 tons/ha,” Asthana had said. “Our yield is between 17-18 tonnes.”

Any hopes that efficiencies from local sourcing could, yet, keep domestic oil palm competitive against imports were dashed by other factors. Given the hilly terrain, farmers couldn’t collect all the fresh fruit bunches (FFBs). Once harvested, FFBs have to be processed within 24 hours. Given bad roads, FFBs didn’t reach processing units on time. Both factors reduced FFB supplies to processing units.

With economics not working out, firms like Ruchi Soya scaled back on processing plants, pushing farmers further into losses. Well before Covid, oil palm had been as good as abandoned in Mizoram.

Even in Nagaland, oil palm processing units did not come up. Farmers complained of payments that were low or never came.

From states like Arunachal, too, came similar complaints.

India’s new oil palm push corrects some of these glitches. In its study, the IIOPR abjured hilly tracts, focused on flatlands (flat but not vulnerable to flooding) and pegged suitable area for oil palm at 1.5 million ha across 11 states in the country, most of that in the north east. To ensure subsidies reach farmers on time, not only has the Centre’s share in the scheme hiked to 90%, payments are no longer routed through state treasuries.

For an oil palm mill to be viable, said Asthana, it needs produce from atleast 5,000 ha. And so, farmers in each district continue to be linked to a single processing unit. Such linking is one way to ensure that each factory gets enough feedstock.

To tackle accompanying fears about abuse of market position, the government pegged domestic prices to the price of imported crude palm oil. To insulate farmers from price fluctuations, it also created a viability price for farmers. This will be based, as a PIB press release says, on the annual average price of the crude palm oil over the past five years. “If the price is supposed to be $700 but falls to $500, the government will pay $200,” said Asthana.

This incentive will be around till October 2028. Thereafter, as Mint reported, it will be gradually phased out, declining by 25% every three years and ending altogether by November 2037. By then, said the paper, “Indian farmers are expected to compete with their international peers.”

There are two points to be made here. Oil palm plantations in Indonesia and Malaysia span 20,000-30,000 ha. It remains to be seen if domestic smallholders, planting oil palm on two or three hectares, can compete without subsidies.

In the short-term, however, these incentives add up to a remarkable picture. Farmers across India are beset by yield and price risk. Oil palm is the only crop where the government provides cash support while the plant is growing and eliminates price risk for the first 14 years. Even the cost of seedings and fertilisers will be subsidised, said Asthana. “What all this does is ensure predictability for farmers and for the companies,” he said. “Nothing is arbitrary. Not the price, not the financial support, not the output. This is one of the best policies that has been made.”

And yet, farmers aren’t coming. Why?

Landed liabilities

One morning in Guwahati, CarbonCopy met Bhattacharjee at Patanjali’s old office in the centre of the city. It was mid-2023. In that chat, and a subsequent one last October, the consultant cited two reasons why the company is struggling to find smallholders in Assam.

One, concerns about oil palm cultivation—its ecological costs; the experiences of farmers who have already tried oil palm—have been doing the rounds. “Even those 800 farmers we signed up with, some are now saying they heard something about oil palm and so they don’t want to commit just yet,” he said.

Two, most cultivation in the state happens on community land with hereditary titles that do not show up in government records. Most farmers have some patta land under their own name and a larger tract for which they have use rights from the gaonbura (village head).

This arrangement has left Patanjali struggling. Assam doesn’t help companies procure land for nurseries or plantations. Patanjali has to find this land on its own—and then take it to the state government for approval so that subsidy payments can start. The catch is: farmers are unwilling to commit patta land to oil palm, and Assam is unwilling to hand out subsidies to oil palm planted on non-patta land.

In that conversation, Bhattacharjee used nurseries to illustrate the problem. “For Assam, we need 11 nurseries,” he said. “There, we can plant 900,000 saplings immediately.” A nursery needs, he said, at least 10 ha. “Getting such a tract of land, where everyone has a patta—and is willing to sell—is not easy,” he said.

This problem magnifies manifolds with plantations. By the middle of this year, Patanjali had convinced 363 farmers, adding up to 2,497 ha. “Farmers have been using this land for 50-60 years,” said Bhattacharjee. “We gave certificates from the gaonburas as well. But the DAO [District Agricultural Officer] and the ADO [Agricultural Development Officer] say they want only legitimate land for cultivation. They say ‘Take patta land only’.”

Why don’t farmers plant oil palm on patta land? “People here have 2 bighas of patta land and 8 bighas of non-patta land,” said another Patanjali employee who works at the district level. “They use this land for their house, for growing rice for their household consumption. They will not want plantations on this land as it will get blocked for 30 years.”

Chandan Kumar Sharma, a senior professor at Tezpur University’s sociology department made similar assertions. “The owners of patta land are not likely to give their land for oil palm,” he said. “De facto ownership will go to the companies. People will not give farmland on lease for such a duration.”

The government is not resolving this deadlock, said Patanjali officials. “Officials say you signed this MoU, so you solve this problem,” said one official, on the condition of anonymity. “They say: ‘We have other interested parties if you cannot do this’.”

This construct has pushed oil palm companies into a vise. They have to invest without knowing how much land will eventually come under oil palm. “Once we set up a nursery, the saplings will be ready for planting in 14-16 months,” said Bhattacharjee. “In this period, we have to find enough farmers.”

CarbonCopy wrote to the state government asking why non-patta titles are not being considered for subsidy support. This article will be updated when it responds.

In the meantime, smallholders’ reluctance is pushing Patanjali’s oil palm plans into new directions. On one hand, its attempts to persuade farmers continue. It has asked IIOPR to talk to state agriculture department officials about farmers’ concerns—and about other states’ experience with oil palm. “This is to prepare them before they go to talk to farmer societies,” said Bhattacharjee. In tandem, the company is also trying to create Farmer Producer Organisations (FPOs). “An FPO can have anywhere between 100 and 700 farmers,” he told CarbonCopy. “They might work because the CEO has to be an agricultural graduate —and so, he might understand the technology of palm oil better.”

Till now, the company has created 51 FPOs in Assam. “We are not counting these in our farmer numbers right now because there is no PMT (Project Management Team) approval yet,” said Bhattacharjee. “It should come by next May or June.” Patanjali is also thinking of setting up a model palm oil nursery, a plantation programme, and running a complete day-in-day-out training programme for farmers.

In the meantime, however, there is another development. Even as smallholders stay away, larger landholders are evincing interest in oil palm. “One businessman came to our office saying his family has 28 bighas,” said Bhattacharjee. Tea estates, which have been slowly losing productivity, are interested as well.

If a subsidy is given to them, they are willing to switch.

Shark tank

This pattern—of large landholders being drawn to oil palm—is seen elsewhere in the northeast as well.

Of the eight states in the region, Meghalaya and Sikkim have not signed up for oil palm. Assam, Arunachal, Nagaland, Manipur, Mizoram and Tripura have. Of these, CarbonCopy took a closer look at Arunachal Pradesh.

There are other similarities. Like Mizoram, Arunachal Pradesh, too, has lived through the previous palm oil push.

Here, too, farmers complain about processing plants not coming up, FFBs going unsold, and low prices – as low as ₹7 a kilo.

Palm oil concessions have also been handed out to companies like Patanjali and 3F Oil Palm. Patanjali has been given nine districts—Tirap, Namsai, Chawlong, Tezu, East Siang, Lower Siang, Papumpare, Pakke and Kamla—and set a target of scaling oil palm to 40,000 ha by 2027. As in Assam and Mizoram, there is little individual land holding in Arunachal. Much of the state is unclassed state forest—or de facto community forest. People have use rights over this land—but few pattas.

And so, to understand how palm oil is faring in Arunachal, CarbonCopy travelled to Namsai. Patanjali has a nursery here with 200,000 seedlings—half from Malaysia and the other half from Thailand. The company’s local staff is confident of meeting its target—about 4,000-odd ha. There are two reasons.

One, the state government is handing out subsidies even for non-patta land. “Unlike in Assam, where every name has to be cleared by the revenue department, landholdings in Arunachal can be certified by the gaonbura,” said Bhattacharjee.

This approach, however, comes with its own costs. Patanjali has seen multiple claimants for the same tract of land. “In Namsai, we had taken 40 ha of land from a person who had a letter from the gaonbura,” he told CarbonCopy. “And then another person showed up saying these are his lands. He, too, had some documents dating back to 1973 or so. Such issues are coming up.”

Two, in Namsai, too, large farmers are evincing interest in the crop. Deputy chief minister Chowna Mein, who has a house in Namsai, is interested in oil palm, said Mahendra Singh Jadhav, Patanjali’s local incharge. “He can easily put as much as 500 to 1,000 ha into oil palm.”

This pattern, of local elites putting land into palm oil, has to be understood.

More in Part 2.

About The Author

You may also like

BRICS bloc proposes more multilateralism, sustainable development of Global South

Climate Talks in 2025: Converging Crises, Rising Stakes, and Diminished Returns

Countries agree 10% increase for UN climate budget

Targeted co-financing can solve the challenge of just transition in emerging economies: Report

Can biochar be India’s missing link to carbon capture?