The country has abundant reserves of coal to achieve its 100 MT by 2030 gasification target, but issues such as poor quality coal, questions regarding price competitiveness and lack of effective carbon capture and utilisation technologies need to be addressed in order to make it sustainable

In recent years, India has embarked on a massive coal gasification push. The reasons for this are simple— India has pledged to combat the climate crisis by “transitioning away” from fossil fuel and reducing its carbon emission intensity. India also intends to achieve the net-zero by 2070. But at the same time, it faces the prospect of leaving its abundant supply of cheap domestic coal unutilised. In such a scenario, India views coal gasification as a viable “cleaner option compared to burning of coal” to reduce the emissions and cut its rising import bills of natural gas and energy fuels like methanol, ethanol, and ammonia.

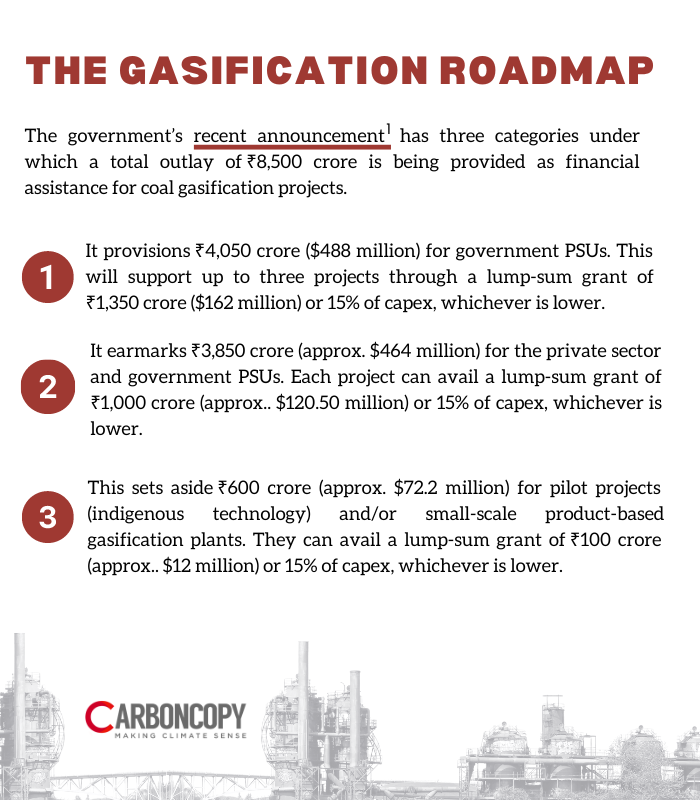

Planning for gasification of coal and lignite has gained momentum over the past decade. Two years ago, in September 2021, the government published its first comprehensive mission document outlining the country’s Coal Gasification Mission. Niti Aayog and the Union coal ministry formed key committees to steer and implement the gasification roadmap. Then in January this year, the Union Cabinet approved the scheme to promote coal/lignite gasification projects in the country. The government announced an outlay of ₹8,500 crore (approx. $1.02 billion) for these projects. This was followed by the coal ministry issuing three draft requests for proposal (RFP) to “solicit feedback from interested Government PSUs and Private Investors” to establish coal gasification plants in India.

But there are, however, some significant obstacles to overcome on this path. These include the poor quality of coal found in India to absence of effective technology to store and utilise the carbon (CCUS) emitted during the process. Public and private companies have shown interest in setting up the plants, but expect huge subsidies by the government. This makes gasification a financial challenge. India is looking to use coal gasification for industries such as steel and fertilisers. But a big question will be about competitiveness. Will gasification provide products cheaper than they are already available in the international market? These are some of the critical issues that need to be addressed urgently to make this mission a success.

The need and targets

In 2017, the then coal secretary Susheel Kumar had claimed that coal gasification will reduce India’s import bill (of natural gas, coking coal and other chemicals like urea, methanol and ammonia etc) by $10 billion in five years.

According to the government’s mission document: “With environmental concerns and development of renewable energy, diversification of coal for its sustainable use is inevitable.”

The government touts coal gasification plants as “strategically important” assets because “coal prices are non-volatile and domestic coal is abundantly available”. India has set a target of 100 million tonnes (MT) of coal gasification by 2030. However, there is no clarity if this is an annual or cumulative amount of coal to be gasified.

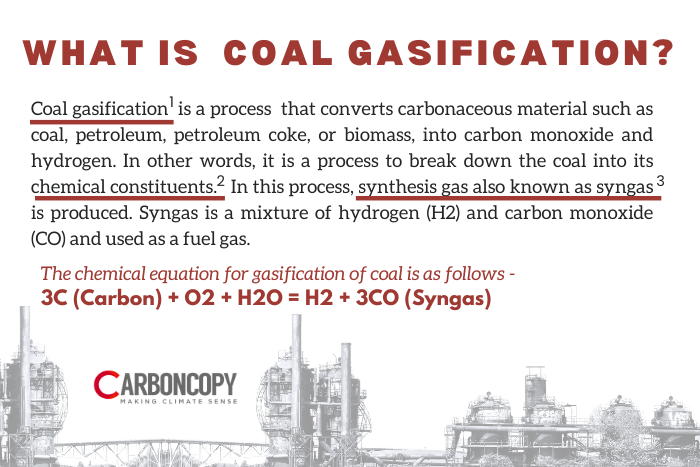

The document further says, “Coal gasification is considered a cleaner option compared to burning of coal. Gasification facilitates utilisation of the chemical properties of coal. SynGas produced from Coal gasification can be usable in producing Synthetic Natural Gas (SNG), energy fuel (methanol & ethanol), ammonia for fertilisers and petro-chemicals.”

“In line with the mission document, Coal India Limited has signed MOUs with BHEL, GAIL and IOCL to take up coal gasification projects in the country,” the press release by the Ministry of Coal said on July 26, 2023.

It further stated, “In order to promote coal gasification, Ministry of Coal has formulated a policy wherein, a provision has been made for 50% rebate in revenue share for all future commercial coal block auctions for the coal used in gasification purpose provided the coal quantity used for gasification is at least 10% of total coal production. Further, a separate auction window under NRS (non- regulated sector) has been created for making coal available for new coal gasification plants.”

Union minister for chemical and fertiliser Mansukh Mandaviya announced last year that the country’s first-ever coal gasification-based Talcher Fertiliser plant in Odisha will be ready by October 2024. This will be just one of the many projects in the pipeline when India’s coal gasification becomes a reality.

“By utilising new technological interventions like coal gasification in our fertiliser plants and using our own sampada (resources) like coal, India is moving towards self-sufficiency in the Urea sector. With this vision, the Government of India has been reviewing the progress of Talcher unit which will be India’s largest and first coal gasification urea plant,” Mandaviya said, while reviewing the progress of Talcher Plant.

Old plan, new initiatives

Coal gasification was envisioned under the Integrated Gas Combined Cycle (IGCC) in early 2000. But before that, the fertiliser plant in Sindri gasified coal for fertiliser production in the 1960s. Public sector company BHEL planned a 400 MW coal to gas plant as early as 2006. In December 2022, the then Union coal secretary Amrit Lal Meena and Coal India Limited (CIL) Chairman Pramod Agrawal visited Jindal Steel’s (JSPL) facility in Angul, Odisha, which the company claimed to be the “world’s largest gasification plant.”

“JSPL, in its Angul plant, is operating a gas-based Direct Reduced Iron (DRI) plant by domestic coal. Talcher Fertilizer Limited (TFL) is also going ahead with mixing pet coke in high ash domestic non coking coal for urea production,” the coal ministry’s mission paper stated.

Proponents say a successful coal gasification mission can be beneficial for India on two fronts. First, as mentioned earlier, the import of natural gas, coking coal and chemicals will be significantly reduced and second, it may help in controlling carbon emissions and air pollution.

According to the government’s own data, in FY 2022-23, India imported around 56 MT of coking coal, which was almost 23.5% of total imported coal. It cost the exchequer more than $19.2 billion. Similarly, around 50% of natural gas is imported by India.

Parth Kumar, programme manager at Centre for Science and Environment (CSE), New Delhi, says “Syngas produced through gasification of domestic coal can help reduce the dependence of blast furnace technology on coking coal and the direct reduced iron technology on natural gas, which are the two major iron-making technology routes in India, currently dependent on these imported fuels. It further leverages the advantage of being a cleaner technology in terms of air pollution, compared to traditional processes of burning coal directly, therefore improving regional air quality.”

The mission paper of the government also clearly stated that “syngas can be made available for steel making through the Direct Reduced Iron (DRI) route and increase in usage of Electric Arc Furnace (EAF) and Direct Reduced Iron (DRI) will also help towards reduction of import bill for furnace oil.”

India also imports over 90% of its ethanol consumption and roughly around 15% of ammonia. Ammonia or methanol is produced during the process of coal gasification. Ammonia is used in agriculture (to produce fertilisers) and other sectors like leather, refrigeration and pharmaceuticals, whereas ethanol and methanol are used in fuel as well as in the paint industry.

Minister of Road Transport and Highways Nitin Gadkari has been advocating for production of methanol from gasification of coal. He asked Niti Aayog to study the automobile specifications that China has developed for running its vehicles on ethanol.

The question to be asked here is how competitive will the products from coal gasification be? This is an open question with few answers. Coal gasification comes with added costs that include capital expenditure for the infrastructure needed for gasification and carbon capture as well as the costs of energy required for both processes. These are likely to be passed down to the consumers.

However, optimum use of resources and creation of value chains that feed into other industries could make these products more competitive. For example, captured carbon/CO2 can be fed into the cement industry or the fertiliser industry in the case of ammonia, which is a by-product of gasification.

Its success would also depend on how low-carbon technology is incentivised (or conventional steel is dis-incentivised) through the Carbon Credit Trading Scheme (CCTS), since steel is a targeted industry for the scheme.

India has abundant reserves of coal and our energy needs are increasing. In view of the rising impacts of global warming, the government has set ambitious targets to reduce carbon emissions. Our renewable energy capacity is growing fast. Along with it, coal gasification is a structured step aimed at ensuring energy security following a low-carbon path.

Rajnath Ram, advisor (energy) of Niti Aayog, India’s apex planning body and think-tank

India’s increasing coal production

The zest for the coal gasification policy is also linked to the abundance of coal in the country and governments increasing urgency to harness this resource. India has among the top five coal reserves in the world, besides the USA, Australia, Russia and China. The country has around 344-billion tonnes (BT) in coal reserves and 163 BT of it is proven reserves.

Production of coal in the country has increased steadily over the years and it plays a vital role in India’s energy security. India is the second-largest coal producer in the world after China. According to the official data, India achieved 47% of growth in coal production in the past nine years. The government has set a target of more than 1,000 million tonnes of coal production in the financial year of 2023-24. India aims to gasify around 10% of its total coal produced, but the road to achieve this will be challenging.

Quality over quantity

One of the other major challenges is the poor quality of coal found in India. Coal, which is mined in the country, has very high ash content–roughly 25%-40%, whereas the average ash content of imported coal is 10%-20%.

This was confirmed by coal and mines minister Prahlad Joshi in June 2019 in a written reply to a question in Parliament (see below).

Experts say that high ash content in coal can make the gasification process challenging by reducing efficiency, ash agglomeration, increasing slag production, and thus increasing the disposal cost and affecting quality of gas produced. Coal washing can help reduce the ash content, but the washability characteristics of coal found in India are also poor.

In 2020, Delhi based not-for-profit policy research organisation The Energy and Resources Institute (TERI) prepared a report for Niti Aayog. It clearly says, “Indian coal has high ash content (35-55%), high moisture content (4-20%), low Sulphur content (0.2-0.7%) and low calorific value (between 2,500-5,000 Kcal/kg), which is much less than the normal range of 5,000 to 8,000 kcal/kg observed in other countries.”

The report highlights that “more than 75% of the Indian coal has ash content more than 30%, even as high as 50%. It also has poor washability characteristics.”

“This is a real challenge,” Alok Kumar, former power secretary, told CarbonCopy. “Other countries like China and South Africa are using better quality coal for the process of (coal) gasification. India still needs technological advancement before we use our coal effectively for gasification,” He added.

Rajnath Ram, advisor (energy) of Niti Aayog, acknowledges the challenge caused by poor coal, but says “technology is being developed” to address the issue. “We are trying to find a way to deal with the high ash content of coal found in India. Our pilot projects are doing test runs for coal with up to 40% ash content,” he said.

The coal gasification process is energy- and water-intensive and produces high CO2 emissions. There are several claims about these emissions being higher than direct coal combustion processes, like in this paper published by Princeton School of Public and International Affairs. That is why the capture, utilisation and storage of emitted carbon is very important to make gasification successful. The government’s mission document admits the “need to develop research and development facilities on similar lines of China to promote gasification technology in India.”

The effectiveness and cost of CCUS, however, is debatable.

CSE’s Parth Kumar says, “Due to the huge amount of CO2 emissions (during the gasification), CCUS has always been linked with this technology. But the lack of clear government policy and support on CCUS, no progress in establishing actual storage potential in the country and no substantial success in terms of an economically viable CO2 utilisation model, leaves the circle of this technology incomplete.”

Despite several questions on its effectiveness, CCUS technology is gaining traction at energy forums and its importance for energy transition was recognised by G20 member nations in 2019. Last year, the G20 energy ministers accepted “encouraging mature clean energy technologies, including carbon capture utilisation and storage (CCUS)” during the summit held in India.

India is already providing financial assistance and rebate to promote the coal gasification projects. In the National Coal Gasification Mission document, the government has announced a number of steps to support public and private projects of coal gasification. They include a proposal of waiver of GST cess, reduction of additional cess and duties, tax holiday for 15 years of projects, subsidy of purchase of capital equipment, interest rate subvention and import duty exemption for capital goods.

Some other incentives were also announced in Lok Sabha last year, by coal minister Joshi (see image below).

Niti Aayog’s Ram says “geological studies are going on for carbon sequestration”, but researchers and energy experts are sceptical about the viability of CCUS, terming it an expensive and unproven technology and question the economic viability of the project.

Vibhuti Garg, director, South Asia, at Institute for Energy Economics and Financial Analysis (IEEFA) says, “The issue for India is whether we should be investing in such an expensive technology. We have limited financial resources and we should know how to optimise them. Now the government is coming up with subsidy schemes and ways like viability gap funding to promote some of these projects. Globally, a review of 16 projects by IEEFA finds that even though the industry claims a 95% capture rate is achievable, no existing project has consistently captured more than 80% of carbon. The success of these is limited and it is costly.”

According to Alok Kumar, “If you want to use the coal (for gasification) you will have to do it with carbon capture and utilisation (CCU), otherwise you will end up increasing the CO2 emission. However, in gasification, the cost of carbon capture is low because of the (high) concentration of CO2 emission as the gasification will be done in-situ. But yes, advanced (carbon capture and utilisation) technology is a must.”

Industry interested, but innovations needed

Is Industry really keen on using coal for gasification? At least two big companies, Adani Power and Jindal Steel and Power (JSPL) gave detailed presentations to the government, which can be found on the website of the coal ministry. Both companies listed the benefits and utility of coal gasification as well as the challenges and support required from the government. In both these presentations, China has been cited as a success story. Even the government of India officials claim that hydrogen produced during “successful” coal gasification will be cheaper than it obtained from renewable sources.

“India can emulate the success achieved by China with the development of effective technology. We should not allow this richly available resource (coal) to go unused.,” a senior industry official said.

One of the reports of the coal ministry titled “Roadmap for Coal to Hydrogen production” notes “… coal to hydrogen may be one of the cheapest options and can produce hydrogen in the targeted price of USD 1-1.5 per kg without CCUS. CCS costs are estimated to be of the order of $ 0.5/Kg, but the technologies are still to mature and this number would be refined in times to come.”

Dr Mukesh Kumar, former director, Steel Research and Technology Mission of India (SRTMI) and senior advisor with JSPL, who is also working as a CEO of Vulcan Mozambique, cautions that in the absence of effective CCU, the gasification route won’t work in reducing carbon emissions, particularly in the iron and steel industry. He added the cost of production of methanol during gasification may also prove to be economically unviable based on present prices and the fact that this methanol may not be considered as green methanol as it is fossil-fuel based.

“We often talk about production of methanol (during the gasification process), but the cost is too high. To produce 1 tonne of methanol or ethanol we need 1.8 tonnes of CO2 and 200 kg of hydrogen. Even if we use RE-generated hydrogen (at the rate of $3 per kilogram) we will spend $600 only for hydrogen to produce every single tonne for methanol production. The total cost per tonne of methanol may go up to $800-$900 per tonne. But the same (methanol) is available in the market at the cost of $370-400 per tonne.”

Experts instead recommend investing in forward-looking technology like production of green hydrogen from RE. This will be more cost effective with time thanks to advanced technology and continuous development being made in hydrogen-based steel making.

India is trying to develop technologies that effectively work with poor quality domestic coal, but China already has mature technology that achieves 99% carbon conversion efficiency. According to Karthik Ganesan, Fellow and Director (Research Coordination) in Delhi-based Council on Energy, Environment and Water, it will be important to watch how much investment and time it will take for the industry to catch up with China, if it intends to market this technology domestically or outside. “We might be better off investing in the hydrogen and energy storage ecosystem because there is a lot of R&D needed there as well and it may bear better fruit for industry,” he says.

About The Author

You may also like

Fossil fuel extraction in UNESCO sites to rise nearly 50% in coming decades: Report

Relaxing fertility and retirement policies can drive up emissions in China: Study

Price surge or power surge? India’s solar conundrum

India clears 1 million sq km cleared for oil exploration in ‘no-go’ area

Centre’s panel says digging tunnel for mining under forest land ‘environment friendly activity’