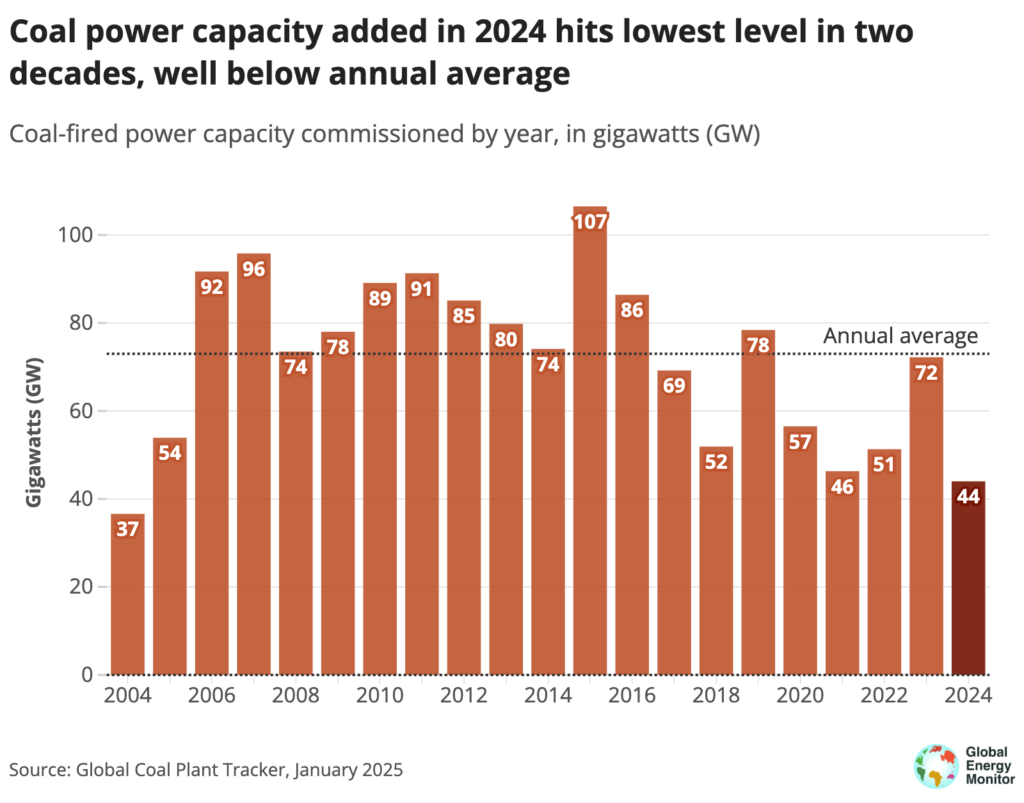

While new coal additions amounted to 44 GW, retirements of coal power was around 25.2 GW

In 2024, around 44 GW of new coal power was added globally. This is the lowest amount of new coal power added in 20 years, according to Global Energy Monitor.

This data is from the organisation’s Global Coal Plant Tracker, which was used to make its new report, titled ‘Boom and Bust Coal’. According to the tracker, new coal addition was less than 1% in 2024.

Overall, there was a net increase of 18.8 GW, as around 25.2 GW of coal capacity was retired, driven primarily by a quadrupling of retirements in the EU. According to the report, only eight countries proposed new coal plants in 2024, down from twelve countries in 2023.

Only India and China project high construction numbers for new coal projects, found the report, following a brief slowdown in both countries.

Slowdown in new coal

Globally, the capacity of new coal plants commissioned was around 30 GW below the annual average for 2004 to 2024, which was 72 GW, according to the report. But added capacity of 44 GW in new coal power exceeded the amount of retired coal capacity retired by nearly 20 GW.

In Europe, the highest coal capacity retirement came from Germany—6.7 GW, while the UK downed shutters on its last coal plant, becoming the sixth country to phase out coal since the 2015 Paris Agreement, found the report.

In fact, coal power capacity overall decreased by 9.2 GW, if one excluded China from the calculations. Then, retirements would be 22.8 GW, compared to 13.5 GW addition, according to the report.

In the US, there are plans to retire coal by 2035, but utilities like PacifiCorp, Duke Energy, and Georgia Power are delaying or withdrawing planned retirements, found the report. In summation, only ten countries now account for 96% of coal power capacity development.

Development still powered by coal

The report found that while OECD countries are moving away from new coal plants, meeting the Paris Agreement requires more to be done. Coal retirements in OECD countries have to more than triple — from 19 GW in 2024 to 70 GW annually through 2030.

China and India’s development needs, however, are still powered to a large extent by coal. At 94 GW, China had the highest year for new construction coal plants since 2015, while India also proposed setting up around 38 GW of new coal. Together, India and China account for 92% of all newly proposed coal power capacity across the globe in 2024 — 107 out of 116 GW, according to the report.

In Africa, and particularly the countries of Zimbabwe and Zambia, there have been spikes in proposed coal power capacity, but majorly sponsored by Chinese companies, found the report.

“Coal power set records last year but not the ones the industry would like to see. Last year was a harbinger of things to come for coal as the clean energy transition moves full speed ahead. But work is still needed to ensure coal power is phased out in line with the Paris climate agreement, particularly in the world’s wealthiest nations,” said Christine Shearer, Project Manager of Global Energy Monitor’s Global Coal Plant Tracker.

About The Author

You may also like

Gas Exploitation Threatens To Severely Harm Marine Area in Mozambique: Report

MCL to invest ₹40,000 crore to set up 4GW thermal power plant

Converting Coal Mines to Solar Can Add up to 15% of Global Capacity: Report

Targeted co-financing can solve the challenge of just transition in emerging economies: Report

Global North Countries Responsible for 70% of Oil and Gas Expansion: Report