E-rickshaw drivers are resorting to often temporary, illegal and unsafe measures to keep their vehicles running in the face of ineffective government interventions—resulting in a chaotic e-rickshaw ecosystem. Experts tell CarbonCopy that solutions exist to turn the situation around, given the administration ensures immediate and effective implementation. Read more

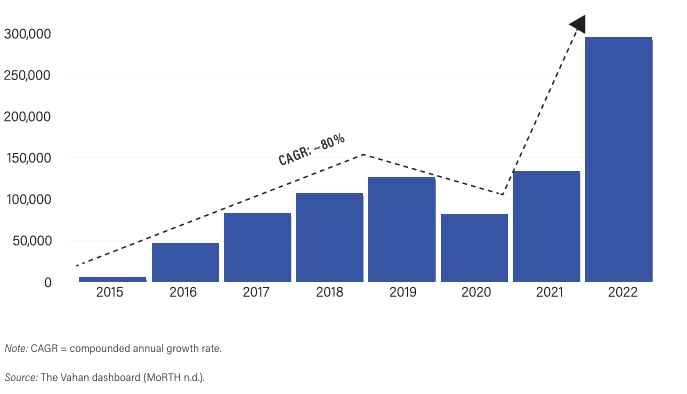

The annual registrations of e-rickshaws in the country have risen at a compound annual growth rate of 80% between 2015-2022.

India’s EV revolution: Are e-rickshaws leading the charge or stalling it?

E-rickshaw drivers are resorting to often temporary, illegal and unsafe measures to keep their vehicles running in the face of ineffective government interventions—resulting in a chaotic e-rickshaw ecosystem. Experts tell CarbonCopy that solutions exist to turn the situation around but the administration must ensure immediate and effective implementation.

Ever since Sunderbans native Indrajeet Burkait, 24, bought a second-hand e-rickshaw or toto as the locals call it, his electricity bill has gone up from ₹300 a month to around ₹900.

Sometimes, and especially during monsoons, when there is a long power cut, spread over days, he has to resort to charging the EVs using diesel generators. Each charge costs ₹250— about half of the day’s income— covering two litres of the oil for ₹200 and remaining ₹50 for the service. In Indian parlance, this sort of makeshift measure is called “jugaad”. In policy terms, this can be called an infrastructure breakdown. The repercussions of such stop-gap arrangements are long term—on the e-rickshaws, their drivers, users and on India’s larger energy transition plans.

It’s been said in the past that India’s “EV revolution” has been led by e-rickshaws, that “India’s rickshaw revolution has left China in the dust” — that too without much support from the state. The sector has grown rapidly despite lacking infrastructure, especially during the COVID-19 pandemic, when a lot of people lost jobs.

Back in 2010, the streets of Delhi were the first to witness e-rickshaws on the road during the Commonwealth Games. A little over a decade later, India became the biggest market for electric three-wheelers globally—with a sales figure of over 5,80,000 in 2023, according to the International Energy Agency (IEA).

“Aaj-kal competition bohot badh gaya hai. Sab yahi kar rahe hain. (There’s a lot of competition in this work [driving e-rickshaws] now. Everyone is doing this),” says Jugal Kishore Soni, 38, who drives an e-rickshaw in Jaipur.

In Delhi, e-rickshaws without number plates are ferrying passengers, violating traffic norms and endangering the safety of many on roads. There was a 53% rise in e-rickshaws’ road rule violations last year. Reports estimate that 40% of e-rickshaws on Delhi roads may be illegal. Unregulated e-rickshaws have also turned into a “menace” in Guwahati as well, among other cities. The Uttarakhand high court has taken a step towards addressing the mismanagement, encroachment and traffic violations by e-rickshaws. To top it all, the batteries used are not eco-friendly and, to a large extent, also illegal—running without the specific battery requirements or the paperwork.

This growth, therefore, can be compared to that of a petulant child—uncontrolled, without proper checks and balances and effective interventions. The result? Indiscipline and chaos. While e-rickshaws are causing mayhem on city roads, in remote towns, the ease of connectivity that they offer comes at a huge financial cost for the drivers, who are burdened with vehicle loans and infrastructural deficits.

But is it too late to rein in the wheels ? It isn’t, say experts, provided that the government acts immediately.

A hopeful start

It is important to remember that before the “menace” that they now are being seen as, e-rickshaws made life easier for many.

When Soni started riding his e-rickshaw in Jaipur more than two years ago, he earned around ₹1,200-1,000 every day, which has now come down to ₹700-500 a day because too many have taken to this profession. It is still better than his previous job as a cycle mechanic where he made ₹300/day, he adds.

More than 1,500 kms away from Soni, in the small, tranquil gullies of Baikunthapur in the Sundarbans, Burkait is among the only two toto (the local name for e-rickshaws) owners. The village has roughly 40 families.

Previously, Burkait’s mother would fetch water on foot from the nearest tube well— located about 1km away from their home. Now, Burkait brings home water on his toto, saving his mother the hassle.

Sujata Duari, 37, who works in a local NGO in Sundarbans, says, “Usually I go places on foot or use my bicycle. But if I have to go far, say, to someplace about an hour or two away, toto is more convenient. Riding a bicycle so far is not easy and toto also saves time.”

It is in the past four to five years that driving e-rickshaws emerged as a work opportunity in the region. Burkait, who previously worked as a mason in Kerala, has now returned to his hometown. While agriculture is a prominent occupation in the region, along with fishing, Burkait’s family owns no land or boats. Therefore, he decided to give riding toto a shot.

Burkait says that the number of totos in nearby villages will be somewhere between 30-40. But the lack of funding support from financial institutions to purchase the vehicles has pushed e-rickshaw dealers and buyers to resort to monetary “jugaad”—raising the funds from private lenders. According to the dealers and buyers of e-rickshaws that CarbonCopy spoke to, this is now the accepted norm. Burkait bought his second-hand toto for ₹1,20,000 at a loan from multiple people in his community. He estimates it to be not more than 2%.

Full speed ahead

A report by the World Resources Institute (WRI) says that the annual registrations of e-rickshaws in the country have risen at a compound annual growth rate of 80% between 2015-2022.

“After the COVID-19 pandemic, the trend of turning towards e-rickshaw for occupation has become more prevalent since a lot of people lost jobs in that time. Today, people from all socio-economic classes are driving e-rickshaws, even graduates,” says Devendra Agrawal, an e-rickshaw dealer in Ajmer, Rajasthan.

Since it is a low-entry-barrier profession, it attracts skilled, unskilled or low skilled workers alike. Currently, more than a lakh e-rickshaws ply on the streets of Delhi and about 29,000 in Jaipur.

CarbonCopy earlier reported on how India’s decarbonisation plans are creating jobs in the informal economy. But do Indian cities and smaller towns alike have the infrastructural capacity to accommodate the need of many to make a living through e-rickshaws?

The unseen costs

Varun K, a PhD Student in Economics, University of Chicago, is working on measuring the congestion costs due to the e-rickshaws. According to him, there are two kinds of costs incurred due to these EVs. First is the “time cost”. “Their travel speed is low. So, when there are too many slow-moving e-rickshaws on the road, they prolong the travel time for other vehicles on the road as well,” explains Varun.

Second, there is a likely cost to air quality, which still needs to be confirmed by his research. The longer other vehicles are on the road due to e-rickshaws, the more vehicular emissions there are. In cases like Burkait’s, when drivers use diesel generators to charge their e-rickshaws, it also adds to pollution.

There’s a big safety issue as well with such lightly-built EVs, Varun tells CarbonCopy. “Their framework is very frail. Since they are powered by light-duty batteries, they need to be a light-weight vehicle, which those batteries can power. It is especially a challenge during monsoons, on bumpy roads and overall poses safety concerns, with many e-rickshaws running into accidents regularly.”

VIP काफिले के सामने गद्दे में पलटा ई-रिक्शा, और फिर… | Accident Viral Video | #Shorts |Sach Ki Raftar#eRickshawAccident #ViralVideo #VIPMoment #SocialMediaViral #SachKiRaftar pic.twitter.com/sqwcZhR5vS

— Sach Ki Raftar (@SachKiRaftar) October 12, 2022

Commenting on the reportedly frail and light-bodied e-rickshaws, Chandan Mundhra, Director, Savy Electric Vehicles — a manufacturer of the EV, says, “These e-rickshaws are not meant for high-speed roads. They are meant to be shuttle vehicles, to be plied on specific routes and service roads. Therefore, the speed limit for these e-rickshaws has been capped at 25-30km/hr. This needs to become clear to the end-user.”

The challenge of charging

Back in the Sunderbans, Burkait complains that current fluctuations are a major hassle for the local e-rickshaw owners. Some even resort to stealing electricity from the grid to charge their toto.

Pointing towards the electricity wires, Burkait says, “Isme bijli nahi hai, is taar ko haath laga lo toh bhi kuch nahi hoga. (There’s no current flowing in these wires. Even if you touch it with your naked hand, nothing will happen to you).”

Burkait recounts losing multiple tube lights and a couple of fans because of extreme current fluctuation. Sometimes it is too low to power anything. A full night charge is not enough to power the electric vehicle for the day.

Like Burkait, Soni also charges his EV at home at night, which could be lethal as the battery could explode due to overcharging. The norm is to leave the e-rickshaw charging overnight. There have also been incidents of e-rickshaw drivers not using headlights at night to avoid battery drainage.

Not a single e Rickshaw has its lights on during night time. Please Act. Stop waiting for a death in some tragic accident. @jaipur_police pic.twitter.com/xU7vOFelQS

— Aditya Gopal (@adixingh) May 24, 2017

“Lights nahi aaye to baithe raho, chutti karo (If there’s no electricity at night, we sit at home the next day),” says Soni.

According to the Ministry of Heavy Industries (MHI), there are 12,146 public EV charging stations operational across the country as of February 6, 2024. How many of these can be used for charging e-rickshaws? Barely any.

“The connector for other electric vehicles is different from e-rickshaws,”explains Anil Chhikara, former Deputy Commissioner, Transport, Government of National Capital Territory of Delhi. In short, it is like trying to charge an iPhone with an android charger. It will just not work. The connectors at public charging stations can’t cater to e-rickshaws.

“Besides that, other chargers have multiple sensors for temperature control, current control, voltage manipulation, fast or slow charging…it is all a micro process controlled activity. But nothing of this sort is for e-rickshaws,” Chhikara adds.

In such situations, it is the informal market that they have to look towards for help, where each charge can cost between ₹100-150/day.

“Largely, the e-rickshaw charging system is also informal. This is because you need a big space to park and charge them. These informal charging stations take a legal connection from DISCOMs in many cases, for example in Delhi, but they are overloaded,” says Chaitanya Kanuri, associate director- E-Mobility, WRI India.

Safety is another concern with such setups with multiple electrocution and blasts reported from such sites. “Normally, public charging stations need to be tested and commissioned after following due procedure. I’m not sure if these informal stations follow these processes. They are mostly makeshift, with many wires dangling, too many cables plugged in at one opening, etc. Informal operators offer packaged deals like charging and parking—which drivers account for in their income generation. The informal providers even choose locations that are more convenient to these e-rickshaw drivers. So that market has been captured,” adds Kanuri.

E-rickshaw drivers in multiple cities, including Jaipur and Varanasi, have gone on strike against the overcharging by privately-set charging stations, demanding public charging stations.

Battery swapping is out of the question in most cities because of a non-existent infrastructure. Despite these challenges, e-rickshaws have only grown. But how far can they go?

Battle of the batteries

In an effort to make e-rickshaws more eco-friendly, the Delhi government announced a ban on the registration of Lead-Acid Battery (LAB) e-rickshaws in the Capital in October 2022, allowing e-rickshaws with Lithium-ion batteries (LIBs) to register. The move was also aimed at weeding out illegally made e-rickshaws with poor safety standards.

Poor recycling of lead-acid batteries results in life-threatening lead pollution, which makes lithium-ion batteries the safer option. However, only a little over 20% of the e-rickshaws registered in Delhi in 2023 operate on lithium-ion batteries.

Both Burkait and Soni ride e-rickshaws with lead-acid batteries. They have to make a payout of ₹40,000 each year to get new batteries, which is still cheaper than getting lithium-ion batteries which could cost anywhere between ₹56,000-60,000, sources say.

According to WRI, e-rickshaws have largely been operating on lead-acid batteries since their formal introduction on Indian roads in 2010. The reasons for that include a lower upfront cost, mature technology, established resale market, and easy availability. As it is a homegrown battery technology that has a well-developed supply chain, it has emerged as the preferred choice in the e-rickshaw market.

The Delhi HC has even rejected a PIL seeking to continue the use of lead-acid batteries in e-rickshaws.

“Doing a sudden switch over is not the best way to go. There is an established and wide ecosystem for lead-acid batteries services that can fix the battery and supply it in an immediate manner. For lithium-ion batteries, there are significant delays. The battery has to go back to the centralised facility, which takes time, leading to a loss of income for the driver. So such a transition needs to be carefully considered. Build up the ecosystem first before you mandate one and ban another. It’s okay to offer incentives only for lithium-ion batteries though, but on the regulation side, it is good to wait till the ecosystem develops,” suggests Kanuri.

Additionally, the higher up-front cost of lithium-ion batteries, an underdeveloped service network, and heavy dependence on raw material imports are some of the serious hurdles to the adoption of lithium-ion batteries in e-rickshaws.

Ineffective interventions

“Pehle to khoob chala diye sarkaar ne ye e-rickshaw, ab sakhti kar rahe hain. First the government encouraged e-rickshaws and now they are bringing in strict regulations”, laments Soni from Jaipur. The government regulations have been challenging the way he earns his livelihood.

What Soni is referring to here is a series of strict actions undertaken by the city’s Regional Transport Office (RTO) — levying penalties ranging from ₹500 to ₹5,000 on breaking traffic norms and failing to show required certificates like a health certificate for the e-rickshaw, insurance along with driving licence — to let him legally drive his EV on roads.

The Jaipur administration has been cracking down hard on e-rickshaw drivers to contain the situation, which seems to have spiralled out of control, congesting the city roads.

But do such interventions work? “When I would conduct enforcement drives and confiscate e-rickshaws with poor safety standards, I used to face a lot of political pressure, demanding that I let those go. This group forms a substantial vote bank and such drives were never successful,” reveals Chhikara.

In September 2023, Jaipur raised the number of rickshaws plying the city roads from 29,000 to 32,000 —well before the election season in early 2024.

Regulating these e-rickshaws is another challenge. “In order to regulate the number of e-rickshaws, it is crucial to allot city-specific quotas and licensing permits. Establish quotas for the number of e-rickshaws permitted in each city based on its population density, infrastructure capacity, and existing public transport options. Additionally, implement stringent licensing and permit systems to control the number of e-rickshaws. Ensure regular audits and renewals to maintain quality and compliance,” advises Randheer Singh, CEO, ForeSee Advisors Pvt Ltd and Ex-Director, e-Mobility, NITI Aayog.

But a well-thought-out intervention is as important as communicating it properly.

Last year, Jaipur considered dividing zones for e-rickshaws and marking specific routes where the vehicles will ply based on a colour scheme. What followed was confusion amongst the e-rickshaw drivers as well as the media over whether the colour of the e-rickshaw is in question or the colour of a strip that will be given to these EVs depending on their zones.

Talking about the colour of his e-rickshaw, Soni says, “If you follow what they are saying, my zone will be 15 kms away from my house. So, going back and forth between my home and the allocated zone will be easily 30km—draining half the capacity of my battery.”

The intervention was actually about different colour strips. However, there were loopholes as well. For instance, if a passenger has to go from one place to another which is across, say, three zones. So, she will have to change three e-rickshaws to get to one place.

Eventually, the regulation never saw the light of the day because of continuous opposition from stakeholders.

Singh notes that often, there is a lack of coordination among different municipal bodies, transport authorities, and law enforcement. “A unified approach with clear roles and responsibilities can improve the management of e-rickshaws,” he says.

Technology integration is another way to streamline the sector, Singh says. For example, fleet management systems should be created to encourage the adoption of GPS-based fleet management systems for e-rickshaws. This can help in monitoring their movements, preventing overcrowding in specific areas, and improving dispatch efficiency, he says. “Additionally, developing digital platforms for booking e-rickshaws, similar to taxi services, can streamline operations, reduce roadside hailing, and ensure better route management,” says Singh.

Earlier this year, Lucknow attempted to divide zones and allocate e-rickshaws by assigning a QR code to each vehicle to provide details about the driver and routes permitted to them. So far, the plan hasn’t worked. Amritsar planned the same.

Start with the basics

While pointing to a corner in Jaipur Soni says, “Ye dekho yeh tempo walo ka stand hai, aisa hamara stand nahi hai, yeh hamko savari nahi lene dete (See this is the stand for tempos/autos. We don’t have any such designated spots. These guys don’t let us board passengers).”

The lack of basic infrastructure like stands and parking areas force e-rickshaws to occupy roadsides and add to the road congestion. Creating designated parking zones for e-rickshaws can prevent this. “Such zones should be strategically located to serve high-demand areas without disrupting traffic flow. Also, pickup and drop-off points should be established away from main roads to minimise traffic disruption. These points should be well-marked and integrated with other public transport nodes. Upgrade road infrastructure to include dedicated lanes for e-rickshaws and other slow-moving vehicles. This separation can reduce accidents and improve overall traffic flow,” recommends Singh.

Developing an efficient network of charging stations and upgrading road infrastructure to include dedicated lanes for e-rickshaws and other slow-moving vehicles can make a big difference. This separation can reduce accidents and improve overall traffic flow as well.

E-rickshaws were introduced as they are a cleaner way to commute. “So, if more e-rickshaws are being added in the system, it makes sense to take away some polluting vehicles from the road. For instance, some auto rickshaws can be rolled back. While e-rickshaws are not a perfect substitute for autos, the latter can be replaced where commuter distances are short,” suggests Varun.

The incessant mushrooming of the e-rickshaw has led to major civic mobility issues and has raised questions about the government’s planning and infrastructure strategy when it comes to clean mobility and just transition.

However, despite all roadblocks and bumps, e-rickshaws flourished, putting food on the table for many in the times of a deepening unemployment crisis. E-rickshaws also emerged as a solution to rising fuel prices and enabled better commuting. The country desperately needs to form more inclusive and holistic transportation policies to integrate e-rickshaws and all the benefits that come with it. The sooner, the better.

The rainfall deficit was attributed to the delayed monsoon onset, by a week to 10 days in many parts of the country.

India’s June rainfall 11% below normal, fifth-lowest since 2020

The all-India rainfall for June 2024 stood at 147.2 mm, 11% short of normal. India received the lowest June rainfall this year since 2020 — the third consecutive year when the country’s rainfall in this month was below average, reported the Indian Express. The rainfall deficit was attributed to the delayed monsoon onset, by a week to 10 days in many parts of the country.

The outlet wrote, “being the onset month, the monsoon does not cover the whole of India and some rainfall deficit is normal. June rainfall amounts to 15% of the country’s total southwest monsoon seasonal rainfall of 880mm (1971-2020 data).” Rainfall deficit was reported from 17 states in June, whereas 19 states recorded normal or above normal rainfall, according to the India Meteorological Department (IMD). The Southwest Monsoon arrived over Kerala on May 30 and progressed on time up until Maharashtra, where it advanced around June 9. Thereafter, the weak monsoon currents and the absence of favourable synoptic systems stalled the monsoon advance over the Eastern states of West Bengal, Odisha, Jharkhand, and Bihar, along with areas of Chhattisgarh, Madhya Pradesh, and Uttar Pradesh, the newspaper reported.

Meanwhile, in a trend that is becoming severe every year extreme rainfall in July is wreaking havoc over certain parts of the country, but some others, particularly the rice-growing region in eastern India, continue to record deficient rain. reported HT.

The southwest monsoon intensified in July leading to unprecedented rainfall over the western Himalayan states of Uttarakhand and Himachal Pradesh, and Uttar Pradesh, Maharashtra and the Konkan region.

Baheri in Bareilly recorded 460 mm of rainfall on Sunday; Banbasa in Uttarakhand’s Champawat recorded 430 mm, Chorgalia in Nainital recorded 310 mm; Panjim in Goa logged 360 mm; Tala in Raigad 290 mm; and Mumbai’s Santacruz recorded 270 mm in 24 hours between Sunday and Monday morning.

The newspaper stated that “some of this is unusual” adding that the weather office (IMD) categorises over 200 mm rain to be “extremely heavy” and most of the rain at these stations was not only beyond IMD’s “extremely heavy” category, but was also recorded in the span of a few hours. On the other extreme, eastern regions like Gangetic West Bengal continued to record 52% deficiency since June 1; Jharkhand 49%; Chhattisgarh 25% and Odisha 27%. Kerala also recorded a 26% deficiency.

Assam flood waters recede but situation remains grim, death toll touches 100

The flood situation in Assam remained grim even after waters started to recede in parts state, Business Standard reported. The toll in this year’s flood, landslide, storm and lightning has reached 100. A report by the Assam State Disaster Management Authority (ASDMA) said five more people lost their lives and over 14 lakh people are reeling under the deluge across 25 districts.

The flood situation improved marginally as the number of people reeling under the deluge in 27 districts decreased to around 18.80 lakh compared to almost 22.75 lakh people suffering from the deluge on Sunday, the officials said.

Dhubri is the worst hit with over 2.37 lakh people suffering, followed by Cachar (1.82 lakh) and Golaghat (1.12 lakh), the report said. The administration has been operating 365 relief camps and relief distribution centres in 20 districts, taking care of 1,57,447 displaced people at present.

Wildlife Board will now take call on clearance to projects in protected area

From now on, the standing committee of the National Board for Wildlife (SC-NBWL) will decide on clearance to projects in protected forest areas. The projects will not be considered for forest clearance unless standing committee of NBWL gives a nod, MoEFCC informed states.

The newspaper added that all project proponents can apply for environmental clearances, including forest and wildlife simultaneously, on Union environment ministry’s Parivesh 2.0 website and National Single Window System (NSWS) through which investors can apply.

Almost all decisions of the Standing Committee to clear projects in protected areas are not in compliance with Section 29 and Section 35(6) of Wildlife Protection Act, which specify that there shall be no destruction unless it is for the improvement of wildlife, experts have flagged.

Northwest India recorded its hottest June since 1901: IMD

June 2024 was the warmest for northwest India since record keeping began in 1901, the India Meteorological Department (IMD) said, reported HT. The deadly heat spell over Delhi, Uttar Pradesh and other parts of the region killed at least 100 people, the report said, adding that at 31.73°C, the mean temperature over northwest India was 1.65°C above normal. The region’s average maximum temperature was 38.2°C, nearly 2°C above normal. The minimum temperature was the second-highest since 1901 at 25.44°C, 1.35°C above normal, the newspaper report said. East and northeast India recorded its warmest June in terms of night time temperatures, recording an average minimum temperature of 25.14°C, nearly 1°C above normal. Parts of Indo-Gangetic plains, northwest India, central and north India recorded 10 to 18 heatwave days in June (normal range is 2 to 3 days).

Africa to Vermont, mapping Hurricane Beryl’s 6,000-mile path of destruction

Hurricane Beryl, the exceptionally long-lived system (tracked for two weeks since June 28) traveled over 6,000 miles, passing through the Atlantic, the Caribbean, the Bay of Campeche and the Gulf of Mexico, making three landfalls as a destructive hurricane while setting records, reported the Washington Post.

Nearly two million households are still without power in Texas, two days after Hurricane Beryl hit the state, leaving “many to swelter in the baking summer heat without air conditioning”, reports the Financial Times. The hurricane caused widespread damage when it hit the US Gulf Coast on Monday, triggering extensive flooding and downing power lines, with at least 10 people killed, it adds. According to preliminary figures from AccuWeather, Hurricane Beryl caused up to $32bn worth of damages and losses in the US, reports the

Beryl has become the earliest Atlantic storm on record to become a Category 5 hurricane, killing six people in the Caribbean.

‘Wartime’ situation as worst flooding in 70 years hits country in central China

Local authorities in China’s Hunan province declared a “wartime” emergency situation after torrential rainfall led to “the most severe flooding seen in 70 years” in Pingjiang, a county of 1.2 million people, the Hong Kong-based South China Morning Post (SCMP) reported. It added that flood water in some areas was said to reach 3m high, and that more than 5,300 people have been evacuated.

The Miluo River – which flows through Pingjiang county and eventually joins the Yangtze – had reached 77.7 metres (255 feet) by 12.30am on Tuesday, the county government said.

That was the highest water level recorded since 1954, and it exceeded the alert level by more than 7 metres.

The L&D Fund should provide grants and not impose further harm through debt-creating instruments, the campaigners say.

Loss and Damage Fund board meets to decide on key issues, Philippines chosen the host

At the second meeting of the Loss and Damage Fund’s board, the Philippines was chosen to host the fund board in Songdo, South Korea. The fund was created by the UN to provide financial help for countries to rebuild from the impact of global warming. The World Bank’s move to act as interim host was opposed by some countries who voiced concern that allowing it to host would give donors, including the United States, which appoints the World Bank’s president, too much influence.

The board is addressing key issues such as funding from donors, how to disburse the fund and who pays for loss and damage (L&D), one of the most intractable issues at UN climate talks. Developed countries blamed for historic emissions have been nervous about the bill for redressing damage they might face. COP27 in Egypt in 2022 established the fund, but did not decide on detail.

The board will decide on the aspirations and the vision of the L&D fund. Campaigners are opposed to the US framing of the “business model” for fund, reminding that the L&D Fund is a fund, not a bank and decisions must be conducted through the lens of equity and climate justice to those who are bearing the brunt of climate change for no fault of their own. The L&D Fund should provide grants and not impose further harm through debt-creating instruments, the campaigners say.

World Bank approves $1.5 bn loan to support India’s green hydrogen push

The World Bank approved a $1.5 billion loan to “promote a market for green hydrogen, electrolysers, and increased renewable energy penetration” said the bank statement reported by Business Standard. This is the second round of funding from the WB for India’s green energy push. In June 2023, it approved $1.5-billion to accelerate India’s development of low-carbon energy.

The Centre also launched the ₹17,000-crore National Green Hydrogen Mission to promote manufacturing of electrolysers and green hydrogen.

The fund will help subsiding battery energy storage solutions and improve RE integration by amending the Indian Electricity Grid Code, the WB said. The first $1.5-billion loan supported the waiver of transmission charges for renewable energy in green hydrogen projects, the issuance of a clear path to launch 50 GW of renewable energy tenders annually and creating a legal framework for a national carbon credit market.

The loans are expected to result in the production of at least 450,000 metric tonnes of green hydrogen and 1,500 MW of electrolysers per year from FY25-26 onwards, WB said. The financing for the operation includes a $1.46-billion loan from the International Bank for Reconstruction and Development (IBRD) and a $31.5-million credit from the International Development Association (IDA), the Business Standard reported.

European carbon removal companies eye investments in projects in India

European carbon removal companies will help Indian businesses develop projects that suck carbon dioxide out of the atmosphere and mitigate global warming, The Reuters reported. The Amsterdam-based group, called remove, will help Indian start-ups. The group helped businesses to raise more than 220 million euros ($238 million) to support carbon dioxide removal (CDR) projects throughout Europe.

“We believe this is a global problem and there is tremendous potential in other geographies beyond Europe.” CDR refers to a wide range of interventions that sequester CO2 that has already been emitted. It includes reforestation and filters that extract carbon directly from the air.

Indian projects are expected to focus on charcoal produced from burning organic matter — as well as “enhanced weathering”, where materials like basalt are spread across land to absorb CO2. Around 7-9 billion metric tonnes of CO2 need to be removed annually to keep temperature rise below the key 1.5°C threshold, up from 2 billion tonnes currently, researchers have said.

Proposed coal mine threatens Mirzapur forest, home to protected animal species

Environmentalists alerted the Centre about large-scale clearing of vegetation using heavy machinery, and construction of roads and other structures in a forested area adjoining Dadri Khurd in Marihan Range of Mirzapur Forest Division of Uttar Pradesh. The area risks being developed under the terms of a new law passed last year, HT reported.

The activists alleged that the deemed forest land is under consideration for an Adani thermal power project. The FC Amendment Act or the Van (Sanrakshan Evam Samvardhan) Adhiniyam 2023, which was passed last year, exempts unrecorded deemed forests altogether from its purview, paving the way for their diversion for various infrastructure and other projects, the report stated.

Activists said the area is part of the proposed Sloth Bear Conservation Reserve and is a crucial habitat for exceptionally rich and threatened wildlife of the savannah and tropical dry deciduous hill forests of the unique Vindhyan-Kaimoor ecosystem.

US: Biden launches first-ever extreme-heat rules for workplace

US president Joe Biden launched a first-ever federal workplace standard for extreme heat, and “railed against” Republicans working to repeal his climate measures, the Guardian reported. According to the newspaper, Biden said extreme heat was the largest weather-related killer in the US, adding: “More people die from extreme heat than floods, hurricanes and tornadoes combined.” Biden said the new plans, if finalised, “will substantially reduce heat injuries, illnesses and deaths for over 36 million workers…construction workers, postal workers, manufacturing workers and so much more”.

The national standard for fine, particulate matter or PM 2.5 (24 hours) is 60 micrograms per cubic metres.

Air pollution levels lower than Indian norms causing deaths: Study

Air pollution levels much lower than Indian approved standards can cause deaths, according a new study published in Lancet Planetary Health, reported HT.

The newspaper added that Lancet found that across 10 major cities in India — Delhi, Ahmedabad, Bangalore, Chennai, Hyderabad, Kolkata, Mumbai, Pune, Shimla, and Varanasi – around 33,000 deaths every year are attributable to PM 2.5 pollution levels that breach the WHO guideline of only 15 micrograms per cubic metres. The national standard for fine, particulate matter or PM 2.5 (24 hours) is 60 micrograms per cubic metres.

The report pointed out that Delhi recorded the highest deaths attributable to air pollution across all cities studied – 11.5% of all deaths – amounting to 12,000 each year. Varanasi is estimated to have recorded 10.2% of all deaths (830 each year) during the study period, which were attributable to short-term PM2.5 exposure higher than the WHO guideline value of 15 micrograms per cubic metres.

Sewage: Yamuna becomes 42 times more polluted when it crosses Delhi

Delhi is making the Yamuna 42 times more polluted between the time it enters and exits the city, according to a new study. The biological oxygen demand (BOD) levels in the Yamuna in June were 2mg/litre at Palla, where the river enters Delhi, but rose to 85mg/l at Asgarpur, where it exits Delhi, according to the latest water quality report uploaded by the Delhi Pollution Control Committee (DPCC), the HT reported.

The permissible BOD level in the river is 3mg/l. The difference in BOD levels at the two sites — Asgarpur recorded nearly 28 times more than Palla — is indicative of the decaying water quality in the river. Water samples are collected manually from the Yamuna from eight locations by DPCC every month. The collection begins at Palla, where the river enters Delhi, followed by Wazirabad, ISBT Kashmere Gate, ITO bridge, Nizamuddin bridge, Okhla barrage, Agra Canal and Asgarpur.The monthly reports also measure faecal coliform — bacteria living in the intestines of warm-blooded mammals, including humans, thus indicating the presence of sewage and human waste in the river. This ranged from 1,600 parts per million (PPN) at Palla to 24,00,000 PPM at Asgarpur, according to the June report. The permissible limit is only 2,500 PPN.

The data for drains points out if sewage is flowing through the drains or reaching sewage treatment plants (STPs) instead. Of the 27 major drains assessed in June, 11 had “no flow” — no sewage or stormwater flowing through them, at the time of testing. The remaining 18 had a BOD value over the permissible standard of 30mg/l for drains. The highest value of 120mg/l was recorded at the Shahdara drain.

Delhi plans to set up vertical forests, solar-powered EV charging infra to fight air pollution

To control air pollution, the Delhi government is planning a rapid rollout of solar-powered EV charging infrastructure and vertical forests. The plan involves repurposing petrol stations, parking lots and lamp posts to create charging sites and battery swapping stations, ET reported. The news outlet quoted a government official who said “smart poles” combining fast-charging functions, public Wi-Fi, and the internet of things could soon become a reality in Delhi.

Air pollution is shortening the lives of Delhi residents by 11.9 years, the report said. The Delhi government plans to set up vehicle-to-grid (V2G) technology that allows energy to be pushed back to the power grid from an electric vehicle’s battery, balancing variations in energy production and consumption. The city government is contemplating a complete transition to a zero-emission bus fleet by 2035-2040.

Currently, Delhi has 1,650 electric buses in operation, the highest among all Indian cities. The government aims to have more than 8,000 e-buses operational in Delhi by the end of 2025.

The final draft is ready and awaiting approval from the city government’s environment minister before being sent to the Union environment ministry. The work on a new plan began in 2021, with the first draft completed in 2022. It took around two years to finalise the consultations and fine-tune the plan.

Massive fish kill in Periyar river attributed to industrial pollution

The severe fish mortality event in May in Kerala’s Periyar river was caused by the opening of the gates at the Pathalam regulator-bridge upstream, leading to the release of polluted water, according to the Kerala University of Fisheries and Ocean Studies (KUFOS) and the Central Marine Fisheries Research Institute (CMFRI) study.

The severity escalated to catastrophic levels due to increased pollution from industrial sources. “Alarming concentrations of heavy metals and toxic chemicals were detected in the water, sediment, and fish,” the report claimed. It emphasised how this disaster underscored the urgent need for stringent controls on effluent treatment and discharge, enhanced monitoring of polluting industries, and real-time surveillance of surface and bottom water as well as sediment both upstream and downstream of the Pathalam regulator.

The discharged water contained “harmful substances and reduced oxygen levels, resulting in a significant number of fish dying downstream”. The report found that water upstream of the regulator had stagnated, accumulating organic matter like household waste, public drain runoff, decaying plant and animal matter and anthropogenic effluents from markets, hotels and other sources. This led to the production of harmful gases like hydrogen sulphide, methane, ammonia, and more.

US: Marathon Oil agrees to record penalty for oil and gas pollution

Big Oil company Marathon Oil will pay a record $64.5m penalty and invest around $177m in “pollution-cutting measures”, to pay up for violations of the Clean Air Act, the Washington Post reported. The newspaper added that the fine is the largest ever for Clean Air Act violations at stationary sources, which include oil refineries, power plants and factories, according to the Environmental Protection Agency. The EPA and justice department had alleged that Marathon had violated Clean Air Act requirements at nearly 90 facilities, resulting in “thousands of tonnes of illegal pollution”, according to the newspaper report. It added that Marathon is required to take steps to reduce more than 2.25 million tonnes of carbon dioxide emissions over the next five years – roughly equivalent to the emissions avoided by taking 487,000 cars off the road for a year, the EPA said in a news release. The settlement will also prevent nearly 110,000 tonnes of volatile organic compound emissions, according to the agency.

Solar power generation rose to 63.6 billion kilowatt-hours (kWh) in the first half of 2024, the data showed, up 14.7% compared with the same period last year and 18.5% in the calendar year 2023.

India’s solar output grows at slowest pace in six years in first half of 2024

According to government data, India’s solar power generation grew at the slowest pace in six years in the first half of 2024, as the country further stepped up reliance on coal to address surging power demand,t the Reuters reported. Coal-powered electricity grew 10.4% during the six months ending June 30, a review of daily load dispatch data from Grid-India showed, outpacing overall power generation growth of 9.7% during the period.

Solar power generation rose to 63.6 billion kilowatt-hours (kWh) in the first half of 2024, the data showed, up 14.7% compared with the same period last year and 18.5% in the calendar year 2023.

The report added that India has prioritised coal to address a surge in power demand in recent years, with coal-fired power output last year outpacing renewable energy output for the first time since the Paris accord in 2015. India’s fuel use patterns have largely been in line with trends in the region, with Indonesia, Philippines, Vietnam and Bangladesh all firing up coal for generating inexpensive power.

The share of fossil fuel in power output rose to 77.1% in the first half of 2024, compared with 76.6% in the same period last year, putting it on track to rise for the fourth straight year, the report said.

Shortage of India-made solar modules hits projects, installers using second-hand modules

Shortage of domestically produced solar modules has hit solar projects adversely. “In some cases, owing to the shortage, installers have even resorted to using second-hand solar modules,” Mercom reported. Domestically produced modules are expensive so many installers are using second-hand modules, labelling them with new warranties. These used modules are refurbished by manufacturers and are available at significantly lower prices, the outlet reported, citing a West-Bengal-based solar company.

These practices are not only unethical, but they also risk impacting the project’s health in the long term, the report said. “Imported solar modules are selling for ₹13.50 (~$0.16) to ₹14.50 (~$0.17) per watt, compared to domestic modules that are priced around ₹23 (~$0.27) per watt. The price disparity is exacerbated by the shortage of DCR cells, which currently stand at around 3 GW annually, which is insufficient to meet the burgeoning demand.

Govt expands ALMM by adding 2.67 GW of solar module capacity

The Centre expanded the Approved List of Models and Manufacturers (ALMM) adding 2,674 MW of new solar module capacity. The cumulative module manufacturing capacity under ALMM now stands at 50,675 MW (50.6GW), reported Mercom.

The companies with enlisted capacity of over 1 GW each include Waaree Energies, Adani Solar, ReNew FS India Solar Ventures, Tata Power Solar, Goldi Solar, Premier Energies, Vikram Solar, Rayzon Solar, Emmvee Photovoltaic Power, Grew Energy, and RenewSys India. They contribute 37,682 MW or 78.5% of the total cumulative module manufacturing capacity under ALMM.

The highest capacity module listed in the ALMM is at 685 Wp. The government reimposed the ALMM mandate on April 1, 2024, after putting it on hold for a year. Only modules from the ALMM must be used in projects that receive government subsidies.

‘Solar overcapacity’: China issues tougher draft investment rules for solar PV manufacturing

To tackle the issue of overcapacity in solar sector, China issued draft rules to tighten investment regulations for solar manufacturing projects. If enacted, the new norms will increase the minimum capital ratio of such projects from 20% to 30%, as the country seeks to reduce overcapacity in the sector, The Reuters reported.

According to news portal BJX News (translation and report by Carbon Brief), the new rule will guide solar manufacturers in China to “reduce projects that solely expand capacity, and instead focus on strengthening technological innovation, improving product quality and lowering production costs”.

China’s utilisation rate of solar power generation reached 97.5% in May, while wind power stood at 94.8%. Meanwhile, a China research body under the National Energy Administration (NEA) claims that China’s solar and wind power expansion means the country will “meet its 2030 renewable targets” by the end of 2024, “six years ahead of schedule”.

Kerala receives investment proposals worth over ₹72,000 cr to set up green hydrogen, ammonia plants

Four big companies proposed to invest ₹72,760 crore to get state subsidies under the state’s draft green hydrogen policy for setting up green hydrogen and green ammonia facilities in the state, reported ET.

The companies plan to export green ammonia aiming at an export-led growth, the report said, adding that the subsidy on capex to these four companies will be about ₹275 crore for each project. The outlet said Kerala plans to give 100% exemption on electricity duty to these companies for 25 years. One of these four companies has proposed two separate investment amounts of ₹22,062 crore and ₹4,511 crore. Kerala’s draft green hydrogen policy has been approved and is awaiting the approval by the Council of Ministers.

India aims to set up 5 MTPA green hydrogen production capacity by 2030 and promote exports of green hydrogen and its derivatives under the National Green Hydrogen Mission.

Global target of tripling renewables by 2030 still out of reach, says IRENA

Renewable energy must grow at higher speed and scale, its sources are still not being deployed quickly enough to put the world on track to meet an international goal of tripling renewables by 2030, that’s according to figures published by the International Renewable Energy Agency (IRENA).

At the COP28 climate summit in Dubai in 2023, nearly 200 countries committed to tripling global renewable energy capacity – measured as the maximum generating capacity of sources like wind, solar and hydro – by 2030, in an effort to limit global warming to 1.5°C, reported Climate Home News, adding that according to new data, renewables are the fastest-growing source of power worldwide, with new global renewable capacity in 2023 representing a record 14% increase from 2022.

But IRENA’s analysis found that even if renewables continue to be deployed at the current rate over the next seven years, the world will fall 13.5% short of the target to triple renewables to 11.2 terawatts. A higher annual growth rate of at least 16.4% is required to reach the 2030 goal, IRENA said.

According to Indonesian President Joko Widodo, the factory is "the biggest in Southeast Asia" and is situated in the town of Karawang in West Java.

First EV battery plant launched in Indonesia, the country with largest nickel reserve

Indonesia launched its first EV battery plant. The nation— which is the biggest economy in Southeast Asia and has the world’s largest nickel reserve— has been attempting to establish itself as a major participant in the global supply chain for electric vehicles. The plant is a joint venture between LG Energy Solution (LGES) and Hyundai Motor Group, two South Korean manufacturers, and has the capacity to generate up to 10 Gigawatt hours (GWh) of battery cells annually. According to Indonesian President Joko Widodo, the factory is “the biggest in Southeast Asia” and is situated in the town of Karawang in West Java. Additionally, he stated that although Indonesia has an abundance of natural resources, for many years it has just exported raw commodities with no additional value. But now that smelters and battery cells for EVs are being built, Indonesia will take part in the global EV supply chain, he said. The plant is a part of an agreement between LG and Indonesia for $9.8 billion in 2020. It will manufacture batteries for Hyundai’s electric cars; the Indonesian-made battery is anticipated to power 50,000 Kona Electric SUVs.

Chinese lithium producers face big financial losses amid high global supply

Chinese lithium producers are witnessing financial losses from falling prices of lithium—a key component in making EVs. Two of the largest Chinese producers of the critical mineral, Tianqi and Ganfeng Lithium, separately disclosed that they had suffered significant financial losses in the first half of this year. The businesses attribute this to declining lithium prices. The EV market in China is still expanding, although the rate of growth has slowed recently due to low customer demand. Lithium markets around the world are experiencing structural difficulties as a result of new competitors and ongoing excess. According to Tianqi, it anticipates a halftime net loss of 4.88 billion yuan–5.53 billion yuan ($670 million–$760 million), as opposed to a halftime net profit of 6.45 billion yuan for the same period last year. Ganfeng estimated a net loss of between 760 million yuan-1.25 billion yuan, compared to a net profit of 5.85 billion yuan.

New method for recycling end-of-life solar panels separates 99% of PV cell component materials

Researchers from the University of New South Wales (UNSW) created a method to recycle end-of-life solar panels that enables them to separate 99% of the components that make up PV cells. In order to increase dependability and make it simpler to separate and extract component components like silicon, glass, aluminium, silver, and copper for reuse, researchers are also revamping PV panels. Using conventional techniques, the team’s unique procedure separates the larger parts, including the aluminium frame and glass sheets, and crushes the cell. The crushed bits are then placed inside a vibrating container. The panel bits are crushed even more and sieved into various-sized particles using stainless steel balls. According to tests, it takes five to fifteen minutes to fully separate 99% of the materials, including silver, through crushing and sifting. The scientists have been granted AUD 5 million by the Australian Research Council (ARC) to develop a new research base for solar panel recycling.

Biggest sodium-ion battery energy storage system globally now running

The largest operational sodium-ion battery energy storage system in the world is now running under China’s state-owned power generation company, Datang Group. The group announced that a 50 MW/100 MWh facility in Qianjiang, Hubei Province, has been connected to the grid. With 42 battery energy storage containers and 21 sets of boost converters, the project is the first phase of the Datang Hubei Sodium Ion New Energy Storage Power Station. It is outfitted with a 110 kV transformer station and runs on large-capacity sodium-ion batteries with a capacity of 185 amp hours, provided by HiNa Battery Technology in China. The Fulin 10 MWh BESS plant, which is situated in Nanning, Southwest China, was previously the largest operational sodium-ion system. It was operated by China Southern Power Grid.

The sources stated that the government's unprecedented action will contribute to the addition of 31 gigawatts (GW) in the next five to six years.

India asks power companies to order $33 billion in equipment to boost coal power output

India, which is struggling to meet the country’s soaring electricity demand, urged power providers to acquire equipment worth $33 billion this year in order to expedite capacity increases of coal-fired power in the years ahead, according to two government sources, Reuters reported. The sources stated that the government’s unprecedented action will contribute to the addition of 31 gigawatts (GW) in the next five to six years. This is because it will result in record tendering in a year for the equipment by key power corporations like state-run National Thermal Power Corporation (NTPC) and Satluj Jal Vidyut Nigam (SJVN) as well as by private companies Adani Power and Essar Power. India experienced its worst power outage in 14 years in June, and the country had to scramble to prevent nighttime blackouts by postponing scheduled plant maintenance and using an emergency provision to require businesses to run plants based on imported coal and power. The targets are high considering that, with the exception of last year’s purchases for 10 GW, the nation has historically ordered equipment with a capacity of roughly 2-3 GW yearly. With its current fleet only able to supply the country’s heavy power demand during non-solar hours, India is racing to install more coal-fired reactors. Following the pandemic, the nation’s power consumption broke all previous records due to a rise in heatwave frequency and the quickest pace of economic development among major nations.

Pak’s PM says country to get $5 billion for of oil and gas exploration

Shehbaz Sharif, the prime minister of Pakistan, stated that exploring the country’s local gas and oil reserves is a major priority at a meeting with a group of companies involved in the oil and gas production and exploration industry. During the meeting, it was mentioned that Pakistan is anticipated to receive $5 billion in investment over the next three years from both domestic and foreign companies for the exploration and development of its gas and petroleum reserves. This will help the cash-strapped nation avoid losing its valuable foreign exchange and alleviate the burden of high fuel prices on the average citizen. In order to investigate Pakistan’s potential for oil and gas, the state-run Associated Press of Pakistan reported that over 240 locations would be dug up in three years. The prime minister invited petroleum and gas exploration and production companies to also find offshore reserves, adding that Pakistan spent billions of dollars every year on importing oil and gas.

India to import coking coal from Mongolia on trial basis

India is looking to diversify imports of coking coal— a key steelmaking raw material—to cut over-reliance on Australia and will import coking coal from Mongolia on a trial basis from later this month, the Hindustan Times reported. Steelmakers, including JSW Steel and the state-owned Steel Authority of India Ltd (SAIL), are poised to receive coking coal shipments from Mongolia after months of negotiations, said the sources. JSW Steel is expected to receive around 30,000 metric tonnes of coking coal from Mongolia and SAIL is likely to get 3,000 to 5,000 metric tonnes, the sources said.

This would be JSW Steel’s second cargo of that kind, following the purchase of 8,000 metric tonnes of coking coal from Mongolia in 2021. The supplies would enter India through Chinese ports, but the Indian authorities oppose depending solely on China to provide a consistent supply of Mongolian coking coal. Mongolia, a country abundant in mineral resources, finds it difficult to sell raw materials to nations like India without a reliable and sustainable route. Additionally, a few Indian businesses are considering leasing or buying coal and copper properties in Mongolia.

In-principle nod to set up coal-based thermal power plant in Uttarakhand received

The establishment of a coal-based thermal power plant in Uttarakhand by THDCIL – UJVNL Energy Company Limited (TUECO), a joint venture between Uttaranchal Jal Vidyut Nigam Limited (UJVNL) and THDC India Limited, received in-principle clearance from the Centre.

Chief minister Pushkar Singh Dhami had stated that the state government was willing to establish a coal-based thermal power plant in the state when he asked the central government for coal allocation in April 2024 under the Scheme for Harnessing and Allocating Koyala (Coal) Transparently in India (SHAKTI) policy. The SHAKTI policy permits Coal India Limited to supply coal at specified rates to joint ventures and production businesses of the federal and state governments. It is anticipated that the state’s power condition will improve because of the electricity generated following the coal allotment.

Tamil Nadu to look into coal import scam allegedly involving Adani group

An inquiry into a multi-crore coal import scandal involving the Adani company and other firms has been approved by the Tamil Nadu government. According to The Hindu, the Directorate of Vigilance and Anti-Corruption (DVAC) opened a preliminary investigation into claims of major anomalies in coal imports and tender terms that allegedly caused the state government to suffer huge losses. According to reports, the government has given the authorities permission to file a preliminary inquiry and look into claims regarding the import of coal by the Tamil Nadu Generation and Distribution Corporation (Tangedco). The Prevention of Corruption Act, 1988, Section 17A punishment was given in response to a complaint filed by the private organisation Arappor Iyakkam. According to Arappor Iyakkam, a city-based organisation that works towards transparency and accountability in governance, there was massive corruption in the import of coal involving Tangedco officials, Adani Global Pte Ltd. and others to the tune of ₹6,066 crore between 2012-2016.

Global oil demand to peak in 2025, says BP

According to major oil and gas company BP, global oil demand will peak next year, putting an end to rising carbon emissions by the middle of the 2020s even as wind and solar power continue to soar, as reported by the Guardian. According to the company’s most recent outlook report, oil consumption will rise by almost 2 million barrels per day and peak at 102 million barrels in 2025. This is based on two forecasts: one depicts the world attaining global net-zero targets by 2050, while the other tracks the current trend of the world. According to BP, in both scenarios, carbon emissions would peak in the middle of the decade as wind and solar power grow rapidly due to declining technology costs. But the paper lays out very divergent paths for future gas demand, which has become a major growth sector for energy corporations like BP in recent years. In comparison to 2022 levels, gas use would peak in the middle of this decade and then halve by 2050 under the report’s net zero scenario. However, based on the present trend, gas demand is expected to rise during the projection, increasing by around a fifth by 2050.

China establishes new state organisation for deep exploration of gas and oil reserves

China is creating a new state body that unites national oil producers and other state-owned businesses to look for ultra-deep oil and gas reserves and take on more difficult-to-extract non-conventional resources. This is in response to President Xi Jinping’s call for the oil and gas sector to have “new productive forces” to contribute to the nation’s energy security, according to Reuters. The new organisation unites seven additional state businesses, including China Aerospace Science and Industry Corp, steel group Baowu, equipment builder Sinomach, Dongfang Electric Group, and Minmetals, in addition to state energy groups CNPC and Sinopec, the nation’s two main producers of oil and gas. The consortium intends to drill conventional resources at ultra-deep wells that reach a depth of up to 10,000 metres (6.21 miles) below the surface in regions such as the Tarim basin region in northwest Xinjiang, where CNPC and Sinopec are significant stakeholders. Additionally, it will try to access coal-seam gas and deep shale oil deposits. China imports over three-quarters of its crude oil needs, making it the largest crude oil importer in the world.

Biden administration ordered to resume permits for gas exports

Earlier in January, the Biden government had stopped the process of granting permits for new liquefied natural gas export facilities in order to assess the effects of those exports on national security, the economy, and climate change. However, a federal judge ordered the Biden administration to continue the process, the New York Times reported. The United States District Court for the Western District of Louisiana rendered its ruling in response to a complaint filed by 16 Republican state attorneys general, who claimed that the suspension amounted to a ban that would negatively impact the economies of their respective states. Significant volumes of natural gas are produced in a number of those states, including Wyoming, Texas, West Virginia, Louisiana, and Oklahoma. The states had proven they had lost jobs, royalties, and taxes that would have flowed had gas permits been obtained, the court wrote in his conclusion. Texas, for example, projected that it would lose $259.8 million in tax revenues associated with natural gas production over five years as a result of the pause of permitting.