The beginning of June marked an important juncture in India’s power reforms journey as the Indian Energy Exchange (IEX) launched the country’s first operational real-time trading platform for electricity. The Central Electricity Regulatory Commission (CERC) approved framework for the Real-Time Electricity Market (RTM) in December 2019, but the launch of the platform was delayed by two months due to the novel coronavirus pandemic. Despite the unceremonious delay, the first days of the platform has seen its popularity grow. While the RTM currently functions mainly to stabilise the grid due to unscheduled changes in supply and demand of power by DISCOMs, an increased role of real-time trade in the future could have a hand in determining the direction of India’s energy expansion.

Although only 6% of India’s electricity scheduling is done through trade exchanges and the Deviation Settlement Mechanism (DSM), and long-term transactions including PPAs account for 87% of the total dispatch, power distributors have increasingly grown wary of long-term agreements. The RTM is a significant step in the country’s power reforms which are nudging it closer to a system that is more reliant on the energy market.

The initial runs and the path forward

The RTM is orchestrated by the country’s two energy exchanges- IEX and Power Exchange India (PXIL), through 48 auction sessions during the day, with delivery of power within one hour of closure. The dynamic market with half-hourly auctions is expected to provide greater flexibility and help DISCOMs better plan their power requirements. Currently power planning and scheduling by DISCOMs beyond the power agreed through Power Purchase Agreements (PPAs) is predominantly done through the day-ahead market (DAM). In this system, unplanned power requirements are subject to penalties determined by the Deviation Settlement Mechanism (DSM). The RTM offers an alternate process for unplanned schedule management, and initial trade volumes on the platform indicate that DISCOMs are beginning to appreciate the flexibility that the market offers.

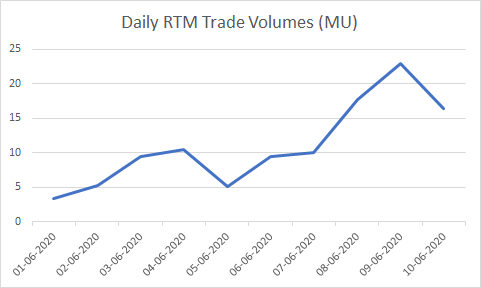

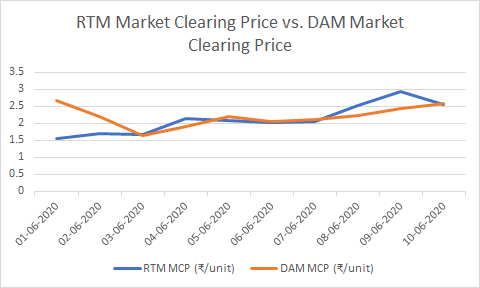

After clearing 3.4 million units on the first day of trading on the platform, trade volumes have quickly scaled up to 110 MU between 1 June and 10 June. While still only a fraction of the total energy dispatched in the day, and much below volumes traded on the day-ahead market, a significant 22 MU was traded on 9 June. Prices too have ticked up considerably over the first 10 days of the market. Interestingly, while the first day of trading saw prices on the RTM 42% cheaper than the rates on the DAM, the difference has narrowed over the first 10 days. In fact, RTM prices were even a little higher that their DAM counterparts on 8 and 9 June.

Still, the broad consensus is that over a sustained time, real-time trading of energy will help optimise planning for DISCOMs and result in substantial savings. According to simulations included in a CERC discussion paper released in December 2018, savings through RTM over 2016-17 would have averaged to 7.37% in five states namely Maharashtra, Andhra Pradesh, Telangana, Chhattisgarh and Karnataka. A higher efficiency in grid management and optimisation of power planning are strong arguments for an increased role of the RTM in the power scheduling process. “The next phase planned by CERC is broader market-based dispatch which can be expected to be rolled out within the next three or four quarters,” says one industry insider who works closely with the regulatory commission.

However, not everyone is convinced that this movement towards real-time trading will be as smooth as we are led to believe. “The RTM does offer greater flexibility and adaptability to DISCOMs for power planning and scheduling. There is good reason to believe that as we move further towards this model of trading, the DSM process will eventually be merged with the RTM. This might aggravate the forecasting problem for DISCOMs as planning requirements will become more dynamic and granular, at least initially,” said a senior official with one of the country’s most prominent DISCOMs. Experts, though, believe that such issues will be addressed with the higher forecasting ability offered by the RTM. “The dynamism of the market also improves forecasting tools and precision. As data points accumulate and forecasting gets finetuned, it will actually improve power planning processes and accuracy,” says Deepak Krishnan, Associate Director for WRI India’s Energy Program.

Renewables gaining ground

While there might be teething problems on the scheduling side, there is little doubt that on the supply side, an increased role of real-time trading will be a boost to renewable energy producers. On the surface, the advantages of an RTM for RE is clear. In addition to providing an avenue for generators to sell their surplus energy, real-time trading helps tide over the variability and intermittency of renewable sources. This is indeed great news for RE investors, but it could also hold greater implications for India’s energy policies.

India’s current installed capacity stands at about 370 GW while the highest peak demand noted over the past couple of years has not surpassed 180 GW, indicating an utilisation of just around 50%. India has a target of 175 GW capacity of renewables by 2023-24 and currently plans to add another 100 GW of capacity over the next few years including over 60 GW of thermal power. The capacity additions far outstrip domestic demand, and with an increased role of real-time trading, economic viability of new additions may be significantly impacted by the relative operating costs of renewables and thermal power.

Like any other market, optimisation through the RTM entails regulation of supply and demand through dynamic fixing of prices. Producers selling on the market look to recoup at least operating costs and conversely, lower the operating costs, greater the chances of profitability in the RTM. Ultimately, on the generators’ side, who adapts better to real-time trading will be heavily influenced by profitability vis-à-vis the market. And the trends to this end are quite clear. Operating costs and tariffs for new solar and wind power projects have continued a downward trend, and over the past couple of years have become increasingly competitive with thermal power. On the other hand, favourability of coal has taken a massive hit in recent times as the country has failed to meet its capacity addition targets for the last three years. Further, according to a recent analysis by Carbon Tracker, around 23% of India’s 66 GW of planned thermal power additions will enter the market with a negative cashflow. As operating costs fall further for renewables, real-time trading ostensibly holds the greatest benefits for RE generators.

The potential of real-time trading for renewables is not lost on generating companies. The launch of the RTM has rekindled demands for a separate real-time trading platform for green energy which is directly linked to the renewable energy certification process as well so that energy traded on the real-time market can be used to fulfil DISCOMs’ renewable purchase obligations. “Once energy enters the grid, it becomes indistinguishable by source. So, there is a possibility that a special green energy trading platform is developed for a smooth integration with the renewable purchase obligations that currently exist,” says Krishnan.

Planning key to true optimisation

Irrespective of whether a separate trading platform is constituted, the fact that renewables hold a considerable edge over thermal power in real-time trading is exceedingly clear, according to experts. “If and when the RTM is expanded beyond its current limited purview, the comparative price advantages of renewables over thermal power are likely to start showing through. Under a free market trade of energy, I foresee great difficulty for profitable operations of thermal power, and under such situations this could add to the financial stress of thermal power sector if an exercise of balancing of projected demand and planned capacity is not done,” adds Krishnan.

While the RTM is also being viewed as the first step towards the recently announced ambitious “One Sun One World One Grid” (OSOWOG) plan, what it will actually deliver in the larger scheme of things is likely to depend on how the country plans its energy. Although the Indian government has ensured a must-run status for renewables, the government also has expansive plans for coal power. Experiences from other nations that have implemented a RTM for electricity, especially from Europe, indicate that simultaneous progressive policies towards clean energy and abandonment of coal power are crucial to maximise economic and environmental gains of the market. With the current mismatch between capacity additions and projected increase in energy demand in India, it is imperative for the country to rethink current plans and policies to optimise its power supply chain to prioritise renewables, especially as DISCOMs grow increasingly averse of long term PPAs. Markets, after all, decide the winners and losers of an economy. For the Indian energy economy in the real-time era, the odds are already heavily stacked against coal.

About The Author

You may also like

India’s EV revolution: Are e-rickshaws leading the charge or stalling it?

Is pine the real ‘villain’ in the Uttarakhand forest fire saga?

NCQG’s new challenge: Show us the money

India’s energy sector: Ten years of progress, but in fits and starts

9 years after launch, India’s solar skill training scheme yet to find its place in the sun