While high costs and losses in thermal power are making RE increasingly attractive across India, large gaps in realised potential in Central, North India remain a worry

India’s power sector is in the middle of a transition. Coal, although still India’s primary source of electricity, is no longer being seen as indispensable in states with high RE potentials. While Gujarat and Chhattisgarh both announced their ‘no coal’ policies this year, new analyses from New Delhi-based communications group Climate Trends claims that Rajasthan, Tamil Nadu and Karnataka are also well positioned to ditch coal completely in favour of renewables.

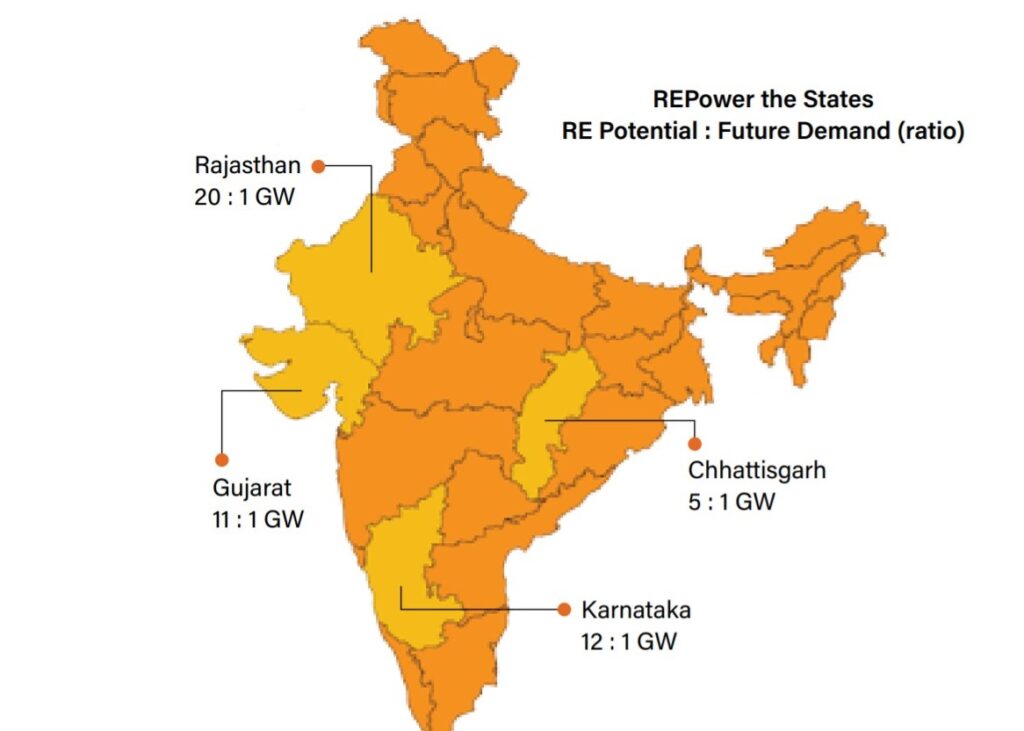

The three states poised for transition have three of the highest RE potentials in the country and all have installed RE capacities either already exceed capacities of coal, or are on the path to do so. In Rajasthan, the total installed coal capacity stands at 11.6GW whereas RE + hydro stands at 11.1GW. In Karnataka installed capacity of non-fossil stands at 63%, coal capacity stands at 9GW whereas RE + hydro stands at 17.9GW. Similarly, in Tamil Nadu non-fossils exceeds fossils by 2.3GW, coal stands at 13.5GW whereas RE + hydro stands at 15.6GW. The Climate Trends report concludes that it would be economically viable for states to move away from coal completely for plans of future capacity addition after considering current economic indicators, the states’ installed power capacities, electricity generation and renewable energy (RE) potential, as well as the impacts of air pollution and water stress, that is aggravated by coal power.

The analyses finds that for the three states, solar and wind power costs are about 60% lower than costs of coal power when considering low availability, transportation costs, low plant utilisation and water shortages. All three states have been plagued by falling efficiency and high costs of coal, coupled with long-term high cost power purchase agreements (PPAs). While Rajasthan saw the average plant load factor (PLF) for thermal power plants in the state fall below the national average of 61% over the past year, PLF for Karnataka was a meagre 26%. Stresses in the coal sector has resulted in a cumulative DISCOM debt of the three states of ₹43,562, which is over half the country’s total DISCOM debt of ₹82,000 crore.

Falling commercial prices of RE has also contributed to the increased economic viability in the three states, and indeed across the country. The reduction in commercial prices is reflected in the increased adoption of RE across the country. Rajasthan, with the highest renewable energy potential, has the lowest discovered per unit price for solar energy (₹2.44/unit or $0.034/unit). Similarly, Tamil Nadu has the highest installed capacity of wind energy, as well as the largest wind power farm at 1500MW. Karnataka, with a population of 65 million (about the same as the population of France, and twice that of Canada), met more than 50% of its electricity demand from solar and wind energy projects for three consecutive days in July this year.

The new analysis comes at a time of economic slowdown in the country which has resulted in declines in electricity demand across the country. The slowdown, along with an extended monsoon season, and increasing capacity of solar and wind power, has had the unintended but welcome consequence of electricity output from conventional sources in October 2019 dropping by 12.9% (year-on-year) while RE generation growing by 9.3% during the same period.

After adding 140.27GW of thermal capacity over the 11th and 12th five-year plans from 2007-17- close to three times the RE capacity added during the same period, an uptick in RE addition has been observed from 2017. Since then, RE addition has outstripped thermal power addition 2.4 to 1. While 7.48GW of coal capacity has already been retired, and an additional 48.3GW is planned to be retired by 2027, the 2018 National Electricity Plan (NEP) released by the Central Electricity Authority (CEA) has prescribed that the 46.4GW to be added between 2022-27 come from flexible sources rather than coal. The prescription indicates that the time for coal power to be dominant in the country might be coming to an end.

So far, Gujarat and Chhattisgarh are the only states to have announced plans to ditch any new coal power, while Assam has also announced its intention to do so. Although the Climate Trends analysis has highlighted the cases of Rajasthan, Tamil Nadu and Karnataka has prime candidates to move towards 100% RE addition, a further 12 including Himalayan states, Northeastern states and Kerala are also well positioned to switch to RE completely as they are heavily affected by high prices and the effects on their fragile ecosystems. The analysis also notes that Gujarat, Maharashtra, Andhra Pradesh, Madhya Pradesh, Telangana, Chhattisgarh, Assam, Delhi, Punjab, Haryana, Odisha and Bihar are still quite far from achieving their state RE targets to reach 175GW cumulatively by 2021-22 despite high RE potentials.

Disclaimer: Carbon Copy is a Climate Trends initiative.

About The Author

You may also like

World, led by China, added 50% more RE capacity in 2023 than in 2022: IEA report

Renewables, not coal, the energy of choice for investors in India for second year in a row: Report

Hope to raise $50 million for solar in next few months; focus on Africa: ISA chief

About 6 lakh new technicians needed globally for wind energy sector by 2027: Report

12% of global growth in solar generation in first half of 2023 came from India: Report