India’s fuel taxes have long been a subject of contention, often with political ramifications. Now with transition to clean energy on the horizon, the equitability of fuel taxes garners renewed attention. In this first part of a two-part series, Carbon Copy untangles how India’s population bears the burden of India’s high tax rates and explores how it translates to future-oriented clean and inclusive system of transportation.

As a result of the COVID-19 epidemic and the associated lockdown of the Indian economy, the government’s fiscal revenues have collapsed, while its borrowings have soared. At the same time, the global oil price has fallen again, from almost $70 per barrel at the start of the year to about $40 per barrel at the time of writing. In response to this, the government has hiked the tax rate on transport fuels, in order to soak up some of the economic windfall from the decline in global oil prices and protect some of its revenues during the COVID-19 crisis. As a result of this, pump prices for consumers have not fallen, instead they are near record highs. The effective tax rate for petrol and diesel is now above 60%. Indeed, the excise duty share of the final price is itself above 40%, with the other 20% being state VATs, which vary somewhat from state to state. At a time when the future of fossil fuels is in sharp focus, there are some important questions India must contend with- What does this mean for energy transition in India? Are these taxes fair and proportional? What could a sustainable strategy to facilitate a gradual transition look like?

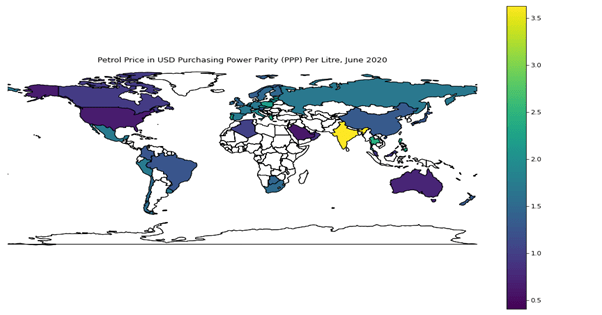

On the face of it, fuel taxes may seem to be a great source of much-needed fiscal resources at this challenging time. Firstly, fuel expenses are understood to be relatively price-inelastic in the short-term. In simpler terms, higher prices driven by the tax wedge will not drive consumers to consume less. Secondly, transport fuel consumption is understood to be progressive with rising income. Rich people consume more transport fuels, and therefore high fuel taxes generally fall on the richer segments of society (we will return to this point). Third, high fuel taxes help to discourage consumption of a product that produces a number of social ‘bads’: congestion, air pollution, and CO2 emissions (with the caveat mentioned above that fuel consumption is relatively price-inelastic in the short-term). Fourthly, high fuel taxes discourage consumption of a product that has a high import intensity, with India importing 86% of its crude oil requirement, and thus help to lower the trade deficit. As a result of the very high tax share in the end-use price, India now has among the highest fuel prices in the world, when measured in purchasing power parity. Figure 1 shows the petrol price in US dollars at purchasing power parity for selected major economies around the world. India’s petrol price, adjusted for the actual purchasing power of the rupee in the country, is more than 5 times higher than in the US, and more than two times higher than prevailing prices in Europe.

Petrol Prices in Selected Major Economies Expressed in USD at Purchasing Power Parity per litre

Because oil prices are (essentially) equal across the world, the disparity in end-consumer prices is down to the difference in tax regimes around the world (as well as the international purchasing power of different countries’ currencies).

Are projected increases in India’s crude oil demand feasible with such a high consumer price? Global oil and gas majors are entering India’s energy sector in a big way, hoping to get a piece of what seems to be the perspective of ever growing transport fuel demand. Certainly, India’s transport energy consumption will continue to grow in a baseline scenario. However, high fuel costs will dampen this growth compared to a counterfactual of lower fuel prices. Additionally, India’s extreme urban congestion, present already at a relatively low level of car ownership, suggests that a model of high private transport demand is simply not feasible in India. Likewise, the growing competitiveness of electric vehicles in major transport segments (urban buses, two- and three-wheelers), will also put a dampener on transport demand. We should thus expect India’s transport energy demand to grow, but more slowly than the trajectory charted in developed countries fifty or sixty years ago, and to peak at ‘earlier and lower’ than the peaks achieved in developed economies.

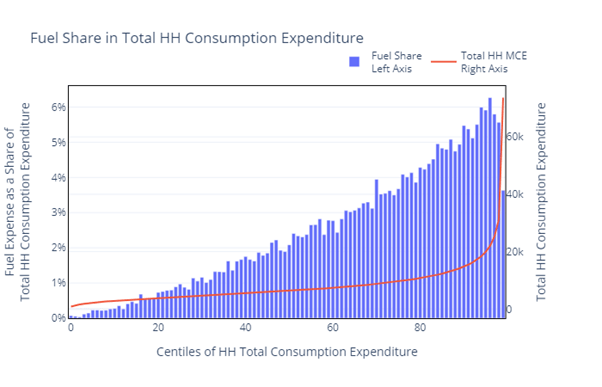

This brings us to the second point: are fuel taxes fair? Let us answer this question by dividing India up into 100 groups (centiles). Each centile has an equal share of the population (one percent to be precise), and people are grouped in centiles according to their level of household consumption expenditure. The first centile includes everyone whose monthly household consumption expenditure is less than 99% of the population, and so on up to the hundredth centile, into which we put everyone whose household consumption expenditure is greater than 99% of the population.

Figure 2 shows how much each centile spends on fuel as a percentage share of total household monthly consumption expenditure (blue bars, left axis). It also shows total household monthly consumption expenditure by centile in INR/ per month (red line, right axis). It can be seen that fuel expenses as a share of total monthly consumption expenditure increase across the centiles. In other words, the poorest centiles cannot afford direct fuel consumption. The share of total household consumption expenditure spent on fuel increases almost linearly up the centiles, up to about the 95th centile. Hereafter, the share spent on fuel drops precipitously. The reason for this is shown in the red line: household consumption expenditure is spread so unevenly around India’s population that the richest 1% (100th centile) spend four times more than the richest 5% (95th centile) in monthly consumption expenditure.

Clearly, the richest centile cannot travel so much as to continue to spend 6% of their monthly consumption expenditure on fuel, and hence the share of monthly consumption expenditure spent on fuel declines after the 95th percentile. Thus, we can say that fuel taxes are generally progressive up to the 95th percentile.

Fuel Expense as a Share of Total Household Consumption Expenditure for Indian households

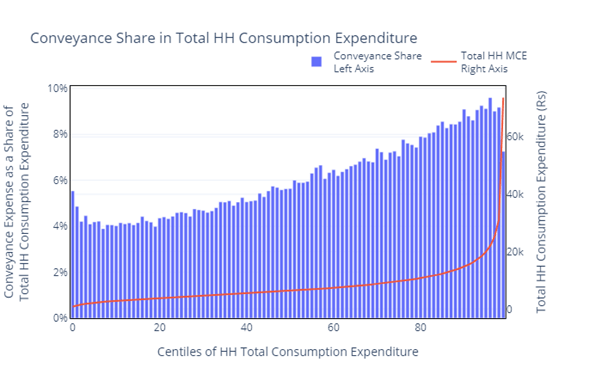

However, households do not just consume fuel in order to move around, they also consume transport services: taxies, rickshaws, ubers, and public transport. Some of these forms of transport services are fueled by petroleum products, notably shared road transport (taxies, ubers, rickshaws, etc). We can reproduce the same graph as above, but this time instead of fuel expenses we can put the share of total conveyance expenses in household consumption expenditure on the vertical axis. This includes total fuel expenses, but also expenditure on transport services.

Conveyance Expenditure as a Share of Total Household Consumption Expenditure for Indian households

The picture changes substantially under this representation. As a share of total consumption expenditure, conveyance is much less progressive than fuel expenses (i.e. increasing with increasing household economic standing). This is because even poor households spend a substantial share of their income on conveyance, which is an essential consumption item for households (for example, to get to work, access shops, etc). To the extent that some of this consumption of transport services will be based on petrol and diesel prices that are passed into the final price of the service (taxi or bus fare, for example), higher fuel taxes are not necessarily progressive. Moreover, if higher fuel taxes are not passed through into end-user prices (for example in state bus transport fares), then somewhere this extra cost has to be borne: either the state budget, the taxi driver or uber driver seeing lower margins, etc.

We can conclude this part of this two-part series with several observations. Firstly, India’s rate of oil and diesel taxation is among the highest in the world, and this, combined with the low international purchasing power of the rupee, translates to the highest transport fuel prices in the world, when measured in purchasing power parity. Secondly, these high fuel prices are likely to provide a significant dampener to the – at times over-optimistic – projected rate of transport fuel consumption growth.

Secondly, although fuel taxes are generally progressive, they are not a good instrument for increasing the progressiveness of the tax system for the richest Indians: for that, there is no substitute to direct taxes on both labour and capital gains income. Thirdly, although the poor don’t consume fuel directly, they do consume transport services, and these services represent a high share of their monthly expenses. One should thus be very careful that high fuel prices don’t adversely affect the weakest segments of society.

Emerging from these observations is a clear conclusion: a sustained rate of very high fuel taxation cannot be the only component of a policy for clean and inclusive transport. Part two of this series is dedicated to describing the components of a more balanced policy.

Part 2 of this series will look at how India’s fuel taxes can be reimagined into elements of a sustainable and inclusive transport policy.

This series has been written under the “Climate Transparency” project, a global partnership with a shared mission to stimulate a “race to the top” in climate action in G20 countries through enhanced transparency. Climate Transparency publishes a set annual reports on the state of climate action in G20 countries, as well as sector-specific policy papers on sectoral climate policies in G20 countries.