In the first of a two-part series on India’s plans to increase palm oil production, CarbonCopy explores how an unexpected snag will change land relations in North Eastern states like Assam and Arunachal Pradesh. Read more

Oil palm is expected to exacerbate local water shortages, weaken soil health, and as studies have shown, oil palm plantations have the lowest biodiversity.

How India’s palm oil push is changing land relations in the North East

In the first of a two-part series on India’s plans to increase palm oil production, CarbonCopy explores how an unexpected snag will change land relations in North Eastern states like Assam and Arunachal Pradesh

India has embarked on a new push for oil palm cultivation in northeast India. Some of the attendant stakes are well known. Oil palm supporters point at India’s burgeoning edible oils import bill. With domestic oilseed production staying low, imports now meet 65-70% of India’s edible oil demand. It’s an expensive indulgence. Between October 2022 and October 2023, India’s edible oil import bill stood at ₹138,000 crore. Three-fifths of that—9.79 million metric tonnes—was palm oil, mostly from Indonesia and Malaysia. Growing oil palm locally, say supporters, can help India reduce that import bill.

The counterpoint to these arguments is also well known. Given its thirst for water, oil palm is expected to exacerbate local water shortages. It also weakens soil health. As studies have shown, oil palm plantations have the lowest biodiversity—lower than even teak plantations, and far lower than the traditional jhum landscapes. Forest bird abundance in the jhum cultivation landscape was similar to that in a rainforest, on average 304% higher than in oil palm plantations, biologists have found.

There is also the question of forest loss. Oil palm is mostly grown in areas that get lots of rain. Consequently, in countries like Indonesia, Malaysia and Cameroon, where governments cleared forests and planted oil palm, the plant has triggered massive deforestation, destroying habitats of endangered species like orangutans and reducing planetary resilience to climate change.

Even as this debate plays on, CarbonCopy heard about a puzzling new dimension to oil palm cultivation in North East India—large farmers seem to be more interested in the plantation crop than smallholders.

Big interests, slow progress

An unexpected snag has hit Patanjali’s oil palm ambitions for Assam.

Back in 2019, when Patanjali Ayurved acquired Indore-based Ruchi Soya, it also bagged the latter’s fledgling palm oil business.

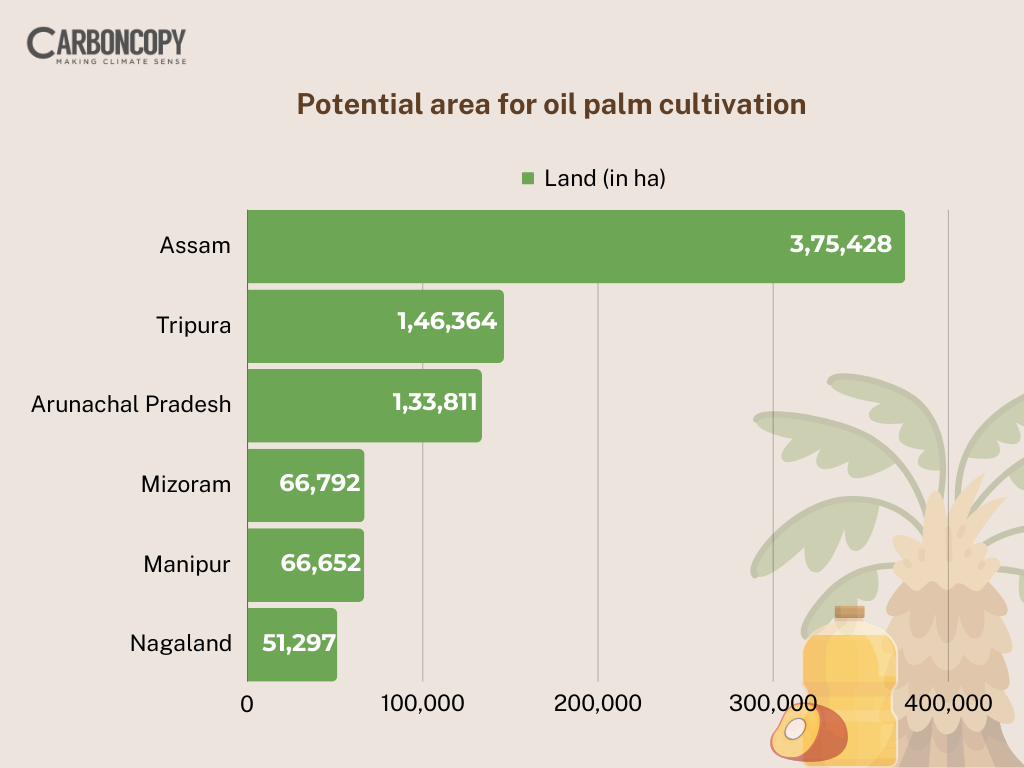

The acquisition was timely. Just two years later, the BJP-led NDA government would kick off a new mission on oil palm cultivation. By that time, the Indian Institute of Oil Palm Research (IIOPR) had identified Assam as the state with the highest potential for oil palm cultivation. Of the 10 lakh hectares (ha) of oil palm plantations India wants to add, Assam’s target alone stood at 3.75 lakh hectares.

And so, joining the ranks of firms like Godrej Agrovet, 3F Oil Palm and Kanpur Edible, Patanjali, too, entered Assam, striking a deal with the state government to plant oil palm on 60,300 ha by 2026.

Thereafter, over the past two years, Patanjali has been setting up oil palm nurseries and processing units. Given state pressure to scale up quickly, not only has it sourced seedlings from countries like Indonesia and Malaysia, it even transferred saplings from Andhra Pradesh, and began rearing them all in its nurseries.

By October this year, the company had 300,000 sprouts in Assam. “These will be ready for transplanting by April-June 2024,” Subhas Bhattacharjee, a Guwahati-based advisor to Patanjali’s Assam operations told this reporter last October.

There is, however, one problem. By October 2023, Patanjali had finalised no more than 800 farmers, adding up to just 120 ha between them. Not only was it nowhere near its 60,300 ha target, this parcel of land was not even enough for the 300,000 sprouts already in its nurseries. “What we need [for these sprouts] is 2,100 ha,” said Bhattacharjee. “But we might get 500 ha.”

Why farmers are not coming—and what oil palm companies are consequently planning—has to be understood. Hardwired into that question are some lesser-known implications of India’s latest oil palm push for the northeast.

A fresh approach to a slippery slope

The current Indian government’s palm oil push is a significant upgrade from the previous scheme. That one, rolled out in states such as Mizoram from 2004, differed starkly from the model followed by Indonesia and Malaysia.

In those countries, large tracts of forests—as big as 20,000ha to 30,000 ha—were handed to palm oil companies. Not so in India. Here, land ownership stayed with farmers, who had to enter into contract farming arrangements with companies for 30-odd years.

Oil palm takes three years to produce its first crop. During that gestation period, farmers need financial support. Schemes such as Mizoram’s New Land Use Policy, which promised such support as the state tried to wean farmers off jhum cultivation, were undone by weak state finances. Subsidy payments came late, or not at all. “Not being paid on time dissuaded farmers,” Sanjeev Asthana, the CEO of Patanjali Foods, told CarbonCopy. “They do not have deep pockets to wait for a good crop.”

That was just the start. To protect millers’ investment, all growers in a district had been told to sell to only the local processing unit. This triggered concerns about possible abuses of market position. Yields were lower as well. “A country like Indonesia gets an output of 25 tons/ha,” Asthana had said. “Our yield is between 17-18 tonnes.”

Any hopes that efficiencies from local sourcing could, yet, keep domestic oil palm competitive against imports were dashed by other factors. Given the hilly terrain, farmers couldn’t collect all the fresh fruit bunches (FFBs). Once harvested, FFBs have to be processed within 24 hours. Given bad roads, FFBs didn’t reach processing units on time. Both factors reduced FFB supplies to processing units.

With economics not working out, firms like Ruchi Soya scaled back on processing plants, pushing farmers further into losses. Well before Covid, oil palm had been as good as abandoned in Mizoram.

Even in Nagaland, oil palm processing units did not come up. Farmers complained of payments that were low or never came.

From states like Arunachal, too, came similar complaints.

India’s new oil palm push corrects some of these glitches. In its study, the IIOPR abjured hilly tracts, focused on flatlands (flat but not vulnerable to flooding) and pegged suitable area for oil palm at 1.5 million ha across 11 states in the country, most of that in the north east. To ensure subsidies reach farmers on time, not only has the Centre’s share in the scheme hiked to 90%, payments are no longer routed through state treasuries.

For an oil palm mill to be viable, said Asthana, it needs produce from atleast 5,000 ha. And so, farmers in each district continue to be linked to a single processing unit. Such linking is one way to ensure that each factory gets enough feedstock.

To tackle accompanying fears about abuse of market position, the government pegged domestic prices to the price of imported crude palm oil. To insulate farmers from price fluctuations, it also created a viability price for farmers. This will be based, as a PIB press release says, on the annual average price of the crude palm oil over the past five years. “If the price is supposed to be $700 but falls to $500, the government will pay $200,” said Asthana.

This incentive will be around till October 2028. Thereafter, as Mint reported, it will be gradually phased out, declining by 25% every three years and ending altogether by November 2037. By then, said the paper, “Indian farmers are expected to compete with their international peers.”

There are two points to be made here. Oil palm plantations in Indonesia and Malaysia span 20,000-30,000 ha. It remains to be seen if domestic smallholders, planting oil palm on two or three hectares, can compete without subsidies.

In the short-term, however, these incentives add up to a remarkable picture. Farmers across India are beset by yield and price risk. Oil palm is the only crop where the government provides cash support while the plant is growing and eliminates price risk for the first 14 years. Even the cost of seedings and fertilisers will be subsidised, said Asthana. “What all this does is ensure predictability for farmers and for the companies,” he said. “Nothing is arbitrary. Not the price, not the financial support, not the output. This is one of the best policies that has been made.”

And yet, farmers aren’t coming. Why?

Landed liabilities

One morning in Guwahati, CarbonCopy met Bhattacharjee at Patanjali’s old office in the centre of the city. It was mid-2023. In that chat, and a subsequent one last October, the consultant cited two reasons why the company is struggling to find smallholders in Assam.

One, concerns about oil palm cultivation—its ecological costs; the experiences of farmers who have already tried oil palm—have been doing the rounds. “Even those 800 farmers we signed up with, some are now saying they heard something about oil palm and so they don’t want to commit just yet,” he said.

Two, most cultivation in the state happens on community land with hereditary titles that do not show up in government records. Most farmers have some patta land under their own name and a larger tract for which they have use rights from the gaonbura (village head).

This arrangement has left Patanjali struggling. Assam doesn’t help companies procure land for nurseries or plantations. Patanjali has to find this land on its own—and then take it to the state government for approval so that subsidy payments can start. The catch is: farmers are unwilling to commit patta land to oil palm, and Assam is unwilling to hand out subsidies to oil palm planted on non-patta land.

In that conversation, Bhattacharjee used nurseries to illustrate the problem. “For Assam, we need 11 nurseries,” he said. “There, we can plant 900,000 saplings immediately.” A nursery needs, he said, at least 10 ha. “Getting such a tract of land, where everyone has a patta—and is willing to sell—is not easy,” he said.

This problem magnifies manifolds with plantations. By the middle of this year, Patanjali had convinced 363 farmers, adding up to 2,497 ha. “Farmers have been using this land for 50-60 years,” said Bhattacharjee. “We gave certificates from the gaonburas as well. But the DAO [District Agricultural Officer] and the ADO [Agricultural Development Officer] say they want only legitimate land for cultivation. They say ‘Take patta land only’.”

Why don’t farmers plant oil palm on patta land? “People here have 2 bighas of patta land and 8 bighas of non-patta land,” said another Patanjali employee who works at the district level. “They use this land for their house, for growing rice for their household consumption. They will not want plantations on this land as it will get blocked for 30 years.”

Chandan Kumar Sharma, a senior professor at Tezpur University’s sociology department made similar assertions. “The owners of patta land are not likely to give their land for oil palm,” he said. “De facto ownership will go to the companies. People will not give farmland on lease for such a duration.”

The government is not resolving this deadlock, said Patanjali officials. “Officials say you signed this MoU, so you solve this problem,” said one official, on the condition of anonymity. “They say: ‘We have other interested parties if you cannot do this’.”

This construct has pushed oil palm companies into a vise. They have to invest without knowing how much land will eventually come under oil palm. “Once we set up a nursery, the saplings will be ready for planting in 14-16 months,” said Bhattacharjee. “In this period, we have to find enough farmers.”

CarbonCopy wrote to the state government asking why non-patta titles are not being considered for subsidy support. This article will be updated when it responds.

In the meantime, smallholders’ reluctance is pushing Patanjali’s oil palm plans into new directions. On one hand, its attempts to persuade farmers continue. It has asked IIOPR to talk to state agriculture department officials about farmers’ concerns—and about other states’ experience with oil palm. “This is to prepare them before they go to talk to farmer societies,” said Bhattacharjee. In tandem, the company is also trying to create Farmer Producer Organisations (FPOs). “An FPO can have anywhere between 100 and 700 farmers,” he told CarbonCopy. “They might work because the CEO has to be an agricultural graduate —and so, he might understand the technology of palm oil better.”

Till now, the company has created 51 FPOs in Assam. “We are not counting these in our farmer numbers right now because there is no PMT (Project Management Team) approval yet,” said Bhattacharjee. “It should come by next May or June.” Patanjali is also thinking of setting up a model palm oil nursery, a plantation programme, and running a complete day-in-day-out training programme for farmers.

In the meantime, however, there is another development. Even as smallholders stay away, larger landholders are evincing interest in oil palm. “One businessman came to our office saying his family has 28 bighas,” said Bhattacharjee. Tea estates, which have been slowly losing productivity, are interested as well.

If a subsidy is given to them, they are willing to switch.

Shark tank

This pattern—of large landholders being drawn to oil palm—is seen elsewhere in the northeast as well.

Of the eight states in the region, Meghalaya and Sikkim have not signed up for oil palm. Assam, Arunachal, Nagaland, Manipur, Mizoram and Tripura have. Of these, CarbonCopy took a closer look at Arunachal Pradesh.

There are other similarities. Like Mizoram, Arunachal Pradesh, too, has lived through the previous palm oil push.

Here, too, farmers complain about processing plants not coming up, FFBs going unsold, and low prices – as low as ₹7 a kilo.

Palm oil concessions have also been handed out to companies like Patanjali and 3F Oil Palm. Patanjali has been given nine districts—Tirap, Namsai, Chawlong, Tezu, East Siang, Lower Siang, Papumpare, Pakke and Kamla—and set a target of scaling oil palm to 40,000 ha by 2027. As in Assam and Mizoram, there is little individual land holding in Arunachal. Much of the state is unclassed state forest—or de facto community forest. People have use rights over this land—but few pattas.

And so, to understand how palm oil is faring in Arunachal, CarbonCopy travelled to Namsai. Patanjali has a nursery here with 200,000 seedlings—half from Malaysia and the other half from Thailand. The company’s local staff is confident of meeting its target—about 4,000-odd ha. There are two reasons.

One, the state government is handing out subsidies even for non-patta land. “Unlike in Assam, where every name has to be cleared by the revenue department, landholdings in Arunachal can be certified by the gaonbura,” said Bhattacharjee.

This approach, however, comes with its own costs. Patanjali has seen multiple claimants for the same tract of land. “In Namsai, we had taken 40 ha of land from a person who had a letter from the gaonbura,” he told CarbonCopy. “And then another person showed up saying these are his lands. He, too, had some documents dating back to 1973 or so. Such issues are coming up.”

Two, in Namsai, too, large farmers are evincing interest in the crop. Deputy chief minister Chowna Mein, who has a house in Namsai, is interested in oil palm, said Mahendra Singh Jadhav, Patanjali’s local incharge. “He can easily put as much as 500 to 1,000 ha into oil palm.”

This pattern, of local elites putting land into palm oil, has to be understood.

More in Part 2.

The average temperature was 0.17°C higher than in 2016, the previous record year–this is quite a significant jump. Photo: Damian Gadal_Wikimedia Commons

2023 world’s hottest year ever; reached very close to 1.5°C warming limit

Last year was the hottest year on record by a huge margin. According to the EU’s Copernicus Climate Change Service (CCCS), the planet was 1.48°C warmer in 2023 than pre-industrial levels—almost reaching the 1.5°C warming limit set in the Paris Agreement. The average temperature was 0.17°C higher than in 2016, the previous record year–this is quite a significant jump. The main causes were record CO2 emissions coupled with El Nino.

Land on which Rabi crop was sown in 2023 lower than 2022; erratic rainfall to blame?

India’s Rabi crop production may be low for the season, according to preliminary data. Acreage is approximately 1,651,000 hectares less than usual, with pulses experiencing the lowest acreage, according to the data. Changes in rainfall patterns is most likely the reason for the fall. The government records show rabi crop was sown on 62.96 million hectares of land until December 2023. The current season’s sowing area has decreased by 1.65 million hectares. The sowing of pulses has also seen a decline last year, with gram cultivation suffering the most serious hit. Karnataka, Maharashtra, Rajasthan, Odisha, Andhra Pradesh, Chhattisgarh and Gujarat among states affected.

Not enough land available to implement biodiversity targets along with mitigation strategies: Study

The lack of available land could prove to be an impediment in implementing biodiversity targets and climate mitigation measures, according to a recent study. The research published in the journal Frontiers in Climate stated countries have pledged 120 million square kilometres for land-based carbon dioxide removal (CDR) to achieve net-zero goals. This includes afforestation or reforestation, peatland management, and soil carbon sequestration, among others. In 2022, nations agreed on a biodiversity “30×30” target, which aims to safeguard 30% of the world’s terrestrial and marine areas by 2030.

All of these targets depend on land use and are in conflict with each other, the study stated. It recommended governments should prioritise degraded lands for CDR activities to minimise the conflict with regions valuable for biodiversity.

Today’s CO2 concentration highest in 14 million years: Study

A new study mapped changes in atmospheric levels of CO2 in the past 66 million years. It found that today’s concentration–420 parts per million—is higher than it has ever been over the past 14 million years. The study, published in the journal Science, tried to reconstruct CO2 concentrations going back until the Cenozoic era, when dinosaurs turned extinct and mammals first began roaming the Earth.

In order to measure CO2 levels from so long ago, the scientists relied on direct evidence such as air bubbles in glaciers, which carry evidence of CO2 levels going back 800,000 years, along with indirect evidence such as isotopes in minerals and the morphology of fossilised leaves, among other things.

India’s Nationally Determined Contributions (NDC) target is to reduce the emissions intensity of its GDP by 45% by 2030 from the 2005 level. Photo: Janak Bhatta_Wikimedia Commons

India’s policies will help achieve 2030 emission targets, but GHG emissions to rebound in 2031: IMF

A new working paper by the International Monetary Fund (IMF) predicted that while India may achieve its 2030 emission target, greenhouse gas emissions will rise again in 2031. This trend will continue till 2040, according to the paper. It is considering five major emitting sectors while making its policy impact predictions—power, agriculture, manufacturing, transportation and residential. India’s Nationally Determined Contributions (NDC) target is to reduce the emissions intensity of its GDP by 45% by 2030 from the 2005 level.

Some of the policies the paper is analysing are production-linked incentive (PLI) schemes, Renewable Purchase Obligation (RPOs) and the Perform Achieve and Trade (PAT) schemes and the carbon trading market policy. The paper urges India to do more in order to reach its net-zero by 2070 goal announced at COP26.

SC stays post-facto memos clearing mining projects with no green nod

Two office memos that allow post-facto clearing of mining projects that did not have green clearance when they began work were stayed by the Supreme Court on January 2. This has raised questions about whether the Apex court can similarly intervene in other projects related to post-facto clearances.

The memos, dated January 2022 and July 2021, explained the standard operating procedure of mining projects that had violated the Environment Impact Assessment Act 2006, by starting work without a green nod. The memo stated its goal was to regularise such projects and quickly get violators under the regulatory regime. The memos also detailed the penalties for the violations along with remedial measures. The SC’s stay on this memos is also significant because the government is also granting similar post-facto clearances to forest-related projects as well.

Tree cutting begins to expand coal mines in Chhattisgarh’s Hasdeo Arand

Tree felling for Parsa East and Kete Basan (PEKB) phase-2 extension coal mines in the biodiversity-rich Hasdeo Arand region of Chhattisgarh’s Surguja district has begun amid police security cover. Police said they had visited the residences of some locals to advise them not to create a law and order situation.

Permission for non-forestry use of 1,136.328 hectares of forest land for PEKB phase-II mine (Surguja), was allotted to Rajasthan Rajya Vidyut Utpadan Nigam Limited (RRVUNL) last year. 762 hectare of land in PEKB block allotted in 2007 to RVUNL began in 2013 has already been completed.

Local gram sabhas have not given their consent for the coal mine. The Chhattisgarh Assembly had unanimously passed a resolution on July 26 last year that mining activities will not be carried out in Hasdeo area. Instead of honouring that resolution, the new government launched cutting of trees under heavy security force after detaining protestors of Hasdeo Aranya Bachao Sangharsh Samiti, including sarpanch of Ghatbarra Jainandan Porte and Thakur Ram, Alok Shukla, Convener of Chhattisgarh Bachao Andolan (CBA) said. 30,000 trees have been chopped in Hasdeo. Tribals who were protesting were arrested, Leader of Opposition Charan Das Mahant stated in the Assembly.

Globally, at least 3 cases challenging climate inaction were filed every week in 2023

Last year, globally there were a minimum of three new cases that were filed each week challenging climate inaction, according to New-York based Sabin Center for Climate Change Law. The report found at least 183 new cases related to climate change were filed in 2023. The Intergovernmental Panel on Climate Change’s 2022 report had also identified climate litigation as an important way to highlight climate issues and influence climate policy.

Children, youth, women, senior citizens, and indigenous peoples especially were using climate litigation as a tool to ensure their voice is taken into account for climate plans and decisions made by governments and the private sector. The cases were related to human rights, carbon capture and sequestration, corporate accountability and increased climate disclosures.

German farmers protest nationwide against subsidy cuts

Farmers in Germany began a nationwide protest against subsidy cuts. They are protesting against the government’s decision to phase out a tax break for agricultural diesel. The decision was taken after a constitutional court stopped the government from utilising funds from the unused pandemic emergency funds worth 60 billion euros. It had been earmarked for green initiatives such as sustainable renewable energy and energy-efficient infrastructure. This has put the government’s budget plans in disarray. Farmers used tractors to block roads despite sub-zero conditions. They said the tax breaks save them around 900 million euros a year, and without them, they fear they will run out of business.

The target was set in 2019 with the launch of the National Clean Action Programme (NCAP) , which was then further increased to 40 per cent by 2026.

National Clean Air Programme miss 2024 target to cut air pollution: Study

Most major cities in the country are way behind the target of reducing 20 to 30 % particulate pollution by 2024, according to a study by Climate Trends and group of climate scientists and engineers Respirer Living Sciences, based on Central Pollution Control Board. data. The target was set in 2019 with the launch of the National Clean Action Programme (NCAP) , which was then further increased to 40 per cent by 2026.

However, The cities fell short despite about Rs 9,650 crore being pumped into controlling air pollution across 131 non-attainment cities so far, out of which nearly 60 per cent — Rs 5,835 crore — being utilised by the cities. Non-attainment cities are designated as such if they consistently fail to meet the National Ambient Air Quality Standards (NAAQS) for fine particulate matter (PM10 that has a diameter of 10 microns or less) or nitrogen dioxide over a five-year period.

The study, revealed that of 46 cities tracked over the years (others do not have continuous data, which is a failure in and of itself), the PM10 level in 22 cities has deteriorated over the last five years, while only 8 cities have met the initial target of reducing pollution levels by 20 to 30 per cent, it found.

NTPC makes hydrogen cooking stove that emits zero carbon

NTPC Energy Technology Research Alliance (NETRA), the R&D wing of India’s largest integrated power utility NTPC, has demonstrated successful hydrogen cooking with zero carbon emissions, using hydrogen from an existing green hydrogen plant at its campus in Greater Noida.

“Burning characteristics of hydrogen are much different from LPG or PNG wrt flame color (almost invisible), flame temperature (1200-1500 degrees C), flame propagation speed, etc. Also, unlike LPG or PNG, hydrogen cannot be premixed with air before its ignition – else it would form an explosive mixture,” stated NETRA.

“Considering the above, a hydrogen burner was designed and used in a modified cookstove to prepare food. It may also be mentioned that the emission from hydrogen burner is only water vapor with zero carboneous element.”

Oil spill in Ennore brings fishing to a standstill

As many as 2,301 fisher families have been affected, and 787 boats remain damaged as a massive oil spill has damaged their fishing territory. Crude oil, reportedly from the Chennai Petroleum Corporation Limited (CPCL), a public sector refining company, leaked into the Kosasthalaiyar river, Ennore Creek, and the sea. This was exacerbated by floods because it resulted in a quick spread of the oil, confirms an expert (on condition of anonymity) from the Indian Institute of Technology – Madras (IIT-M), reported Mongabay-India.

The report added that the tested water contained eight volatile organic compounds, including Benzene, Toluene, and Styrene, as well as sixteen Polycyclic Aromatic Hydrocarbons (PAHs) such as Naphthalene, Fluorene, and Anthracene. “As per the Bureau of Indian Standards for drinking water, the total petroleum hydrocarbons should be 0.1 parts per billion. However, the tested water showed a significantly higher level of 3,240 parts per billion. Volatile Organic Compounds such as Benzene, Styrene, and Ethylbenzene, on the other hand, are 50 to 60 times higher than the standards,”

Flights, trains delayed as dense fog wraps India

A thick layer of toxic smog wreathed Bangladesh’s capital of Dhaka on Wednesday as the air quality index plummeted into the “hazardous” category, while similar conditions prevailed in New Delhi, the capital of neighbouring India. The air quality in Dhaka, one of the world’s most crowded cities with more than 20 million people, has deteriorated as large projects spring up and fossil fuels get overused, bringing health problems for many.

Images from drones equipped with cameras showed smog at 9 a.m. (0300 GMT) that put Dhaka in top spot among the world’s most polluted cities, with a “hazardous” index level of 325, Swiss group IQAir said. But conditions improved slightly, with the index dropping to 177, in the “unhealthy” range, by 1.35 p.m. (0735 GMT).City authorities spray the streets with water to help the dust settle, but residents called for greater efforts.

In New Delhi, the Indian capital, pollution was also high, with an index reading of 378, according to the Central Pollution Control Board, for a rating of “very poor”.

More than 100 flights were delayed and rail services disrupted by an enveloping fog amid temperatures of 11 degrees Celsius (51.8 degrees Fahrenheit), said news agency ANI, in which Reuters has a minority stake.

Reliance Electrolyser Manufacturing (Reliance), John Cockerill Green Hydrogen Solutions, Jindal India, won 300 MW per year capacity with a maximum incentive allocation of ₹4.44 billion (~$53.6 million) each.

Reliance, Adani, Jindal among big winners of SECI’s 1.5 GW electrolyser manufacturing programme

Solar Energy Corporation of India’s (SECI) announced winners to set up 1.5 GW of electrolyser manufacturing capacities across India under the Strategic Interventions for Green Hydrogen Transition (SIGHT) program. Reliance Electrolyser Manufacturing (Reliance), John Cockerill Green Hydrogen Solutions, Jindal India, won 300 MW per year capacity with a maximum incentive allocation of ₹4.44 billion (~$53.6 million) each. Adani New Industries won 198.5 MW/annum capacity with an incentive allocation of ~$35.49 million.

Homihydrogen won 101.5 MW/annum capacity with an incentive allocation of ₹1.5 billion (~$18.11 million). Other winners included Ohmium Operations, who won 137 MW/annum for a maximum incentive allocation of ₹2.03 billion (~$24.51 million), Advait Infratech (consortium with Rajesh Power Service) won 100 MW with an incentive allocation of ₹1.48 billion (~$17.87 million). L&T Electrolyzers won 63 MW out of the 300 MW per annum quoted capacity with an incentive allocation of ₹932.4 million (~$11.26 million).

Manufacturing must be set up within 24 months. The guaranteed life of electrolyzers must be at least 60,000 hours. The base incentive for both buckets will start at ₹4,440 (~$53.13)/kW in the first year and progressively reduce to ₹3,700 (~$44.68)/kW in the second year, ₹2,960 (~$35.74)/kW in the third year, ₹2,220 (~$26.81)/kW in the fourth year, and ₹1,480 (~$17.87)/kW in the fifth year.

India adds 10 GW of new solar in 2023

In 2023 solar installations fell by 28% compared to 2022 while wind installations rose 52% up year on year, according to a new report by JMK Research, PV Magazine reported. India installed 10,016 MW of solar and 2,806 MW of wind power in 2023. The decline in utility-scale solar installations was due to low tender issuance activity during the period from 2020 to 2022. The solar additions in 2023 included about 6.5 GW of utility-scale solar installations, 3 GW in the rooftop segment, and nearly 500 MW in the off-grid/distributed solar segment.

Rajasthan installed 2,193 MW large-scale PV capacity additions, followed by Gujarat (1,317 MW) and Maharashtra (979 MW). Gujarat led wind installations by commissioning more than 1,300 MW of new projects in 2023. India’s installed renewables capacity has now hit 133.89 GW, according to the Ministry of New and Renewable Energy (MNRE). Solar energy accounts for the largest share of around 55% of the total renewables capacity, followed by wind, the report stated.

Maharashtra Commission Says No to 50% RPO Procurement Within State

Maharashtra Electricity Regulatory Commission (MERC) has rejected a plea for a 50% renewable energy obligation (RPO) procurement mandate from projects within Maharashtra stating that

It was against the Electricity Act 2003 and that such restrictions on distribution licensees alone would be discriminatory, Mercom reported.

The report said, distribution licensees have the right to import more economic power from any location in the country. Currently, renewable energy project tariffs in Maharashtra are higher than in other states, so consumers in Maharashtra should be allowed access to more cost-effective power.

According to the report, Maharashtra Energy Development Agency (MEDA) had sought directions for distribution licensees to meet 50% of the total RPO requirement by purchasing energy from renewable sources within the state as per the state’s Renewable Energy Generation Policy 2020. Tata Power Company – Distribution (TPC-D) supported MEDA’s proposal with suggestions for gradual implementation and coordination.

The state’s transport corporation, BEST Undertaking, said it had secured agreements for wind-solar hybrid power and solar power, which is expected to fulfill 98% of the RPO in FY 2025-26 through Solar Energy Corporation of India (SECI), with only 2.64% sourced from within the state, added Mercom report.

Tata Motors and Adani to invest in Telangana; Hero Futures to invest Rs 4,000 cr in clean technology projects in UP

Tata Motors will invest 150 billion rupees in Telangana, while the Adani portfolio of companies will invest over Rs 12,400 crore to set up a data centre, pump storage projects, a cement plant and counter drone and missile facilities in the state. The Hero group will invest Rs 4000 cr in clean technology in UP. The MoUs were signed in Davos.

Over the next 5-7 years Adani will set up RE-run Rs 5000 cr 100 MW data centre to work with local MSMEs to develop supplier base for the project. It will invest Rs 5000 cr to set up two pump storage projects. Adani-owned Ambuja Cements will build Rs 1,400 crore 6 million tonne a year (MTPA) cement plant and Adani Defence and Aerospace will invest another Rs 1,000 crore to set up counter drone and missile facilities.

Hero Future Energies currently has a portfolio of 3 GW of grid connected wind, solar, and rooftop solar power generating assets operating in India and Europe and another 2 GW of projects are in the pipeline across India, Vietnam, Bangladesh, and UK.

Adani wins transmission project to evacuate 7 GW of renewable energy

Adani Energy Solutions (AESL), a power transmission and distribution company, will acquire Halvad Transmission from PFC Consulting (PFCCL) to evacuate 7 GW of renewable energy from the Khavda RE park in Gujarat. At a cost of ~$360.6 million Adani will own, run and maintain the over 301 km (656 ckm) transmission project for 35 years.

PFC Consulting, a wholly-owned subsidiary of Power Finance Corporation, invited bids to develop an interstate transmission system to evacuate 7 GW of power from the Khavda RE Park expected to have a generation capacity of 30,000 MW. Recently, Adani’s AESL commissioned the Karur Transmission project in Tamil Nadu, facilitating the evacuation of 2,500 MW of power from renewable sources in the Karur/Tiruppur Wind Energy Zone.

US announces rules to access credit to produce clean hydrogen

The U.S. announced rules to access billions of dollars in tax credits for producing low-carbon hydrogen using new clean energy sources, Reuters reported adding that the companies could get the credit based on the life-cycle greenhouse gas emissions from the power source used in hydrogen production, and ranges from 60 cents to $3 per kilogram.

“The 45V clean energy hydrogen production tax credit is an important part of our strategy to unlock private investment across sectors to build a clean energy economy and tackle the climate crisis,” John Podesta, a White House climate adviser, told reporters in a call.

To get the credit, hydrogen producers would have to prove they have used clean electricity built within three years that a hydrogen plant went into service.

The PLI certification is expected to offer the company benefits worth Rs 15,000 to 18,000 per unit.

Ola Electric to be the first EV company to benefit from govt’s PLI scheme

According to the Economic Times, Ola Electric has become the first Indian e-scooter (e2W) enterprise to qualify for the government’s production-linked incentive (PLI) programme. The PLI certification is expected to offer the company benefits worth Rs 15,000 to 18,000 per unit. A number of other significant firms have also registered for the PLI scheme, including Hero MotoCorp, TVS Motor Company, and Bajaj Auto. According to experts, this financial boost should make electric cars more affordable, leading to a rise in the number of EVs on the road in the country. However, neither Ola Electric nor the government has provided an official confirmation. The minimum investment required by e-scooter firms to be eligible for this plan is Rs 1,000 crore. It is noteworthy that Ola Electric has experienced a notable rise in net loss. The company recorded a net loss of Rs 1,472 crore for the fiscal year 2022–2023, which is nearly twice as much as the Rs 784.1 crore loss from the year before.

New material can lead to better hydrogen-based batteries and fuel cells

In a breakthrough, researchers in Japan have developed a solid electrolyte for transporting hydride ions (H−) at room temperature. In order to generate energy, the hydrogen protons in the fuel cells used in electric automobiles currently go across a polymer membrane from one end of the fuel cell to the other. Water is necessary for the efficient, high-speed hydrogen movement in these fuel cells, so the membrane needs to be kept hydrated at all times to prevent drying out. The viability of a next-generation hydrogen-based energy economy is hampered by this limitation, which raises the cost and complexity of battery and fuel cell design. The novel substance enables high-rate hydride ion conduction at room temperature. It is a lanthanum hydride compound that has been altered with strontium and oxygen. This innovation reduces the need for water and constant hydration in hydrogen fuel cells, which simplifies design and reduces cost.

New solid state battery design gets charged in minutes, runs for thousands of cycles

A new lithium metal battery that can be recharged in a couple of minutes and charged and drained at least 6,000 times, more than any existing pouch battery cell, has been developed by researchers at the Harvard John A. Paulson School of Engineering and Applied Sciences (SEAS). This research provides fresh insights into the materials utilised in these potentially revolutionary solid state batteries, in addition to describing a novel approach to producing them with a lithium metal anode. The battery was constructed by the researchers as a postage stamp-sized pouch cell, which is 10–20 times bigger than the coin cells produced in the majority of university labs. The battery outperformed other pouch cell batteries on the market today, retaining 80% of its capacity after 6,000 cycles.

The MCL will invest equity capital of Rs 4,784 crore for the proposed 2x800 MW Super-Critical Thermal Power Plant in Sundargarh District, Odisha with an estimated Project Capex of Rs.15,947 crore.

Cabinet gives go-ahead for two CIL power projects worth Rs 21,547 cr

Centre approved proposals to set up pithead thermal plants worth Rs 21,547 crore through Coal India Limited (CIL) subsidiaries South Eastern Coalfields Limited (SECL) and Mahanadi Coalfields Limited (MCL). The CCEA has approved the proposal of equity investments by SECL, MCL and CIL.

The SECL will invest equity capital of Rs.823 crore considering a debt-equity ratio of 70:30 and 49 per cent equity investment in the JV company with an estimated project capex of Rs 5,600 crore for the proposed 1×660 MW Supercritical Thermal Power Plant in Madhya Pradesh’s Anuppur district. The MCL will invest equity capital of Rs 4,784 crore for the proposed 2×800 MW Super-Critical Thermal Power Plant in Sundargarh District, Odisha with an estimated Project Capex of Rs.15,947 crore.

US largest LNG exporter in 2023, China largest buyer

For the first time, the US has become the largest exporter of liquefied natural gas (LNG). It surpassed Australia and Qatar to take the top spot. According to Bloomberg, the US exported 91.2 million tonnes of LNG in 2023, the highest ever for the country. The jump has been attributed to the restarting of the Freeport LNG plant in Texas last year. The plant had been shut down after a fire and explosion was reported in June 2022. Qatar, which had claimed the top spot in 2022, saw its LNG volume fall by 1.9%, placing the country in the third spot, according to Bloomberg. Australia’s LNG volume has had little to no change since 2022. China regained its title as the world’s largest buyer of LNG. According to Bloomberg, China’s LNG imports rose by 12% last year. The country is expected to drive global demand growth for the next 10 years.

Canada oil sands set to expand as delayed pipeline is almost complete

Some of Canada’s biggest oil producers are planning to boost production in the short to medium term this year in anticipation of the completion of the much-delayed Trans Mountain Pipeline, which is expected to begin service soon. The pipeline will triple its capacity to 890,000 bpd. Heavy hitter Canadian Natural Resources announced in its 2024 capital budget its plans to reach exit 2024 production levels of around 1.455 million barrels of oil equivalent per day (boepd), up by around 40,000 boepd from last year. It is also targeting a 2025 average annual production growth of approximately 4% to 5% compared to 2024. Cenovus Energy also announced plans to invest in an offshore project called West White Rose along with expanding its existing oil sands facilities.

Germany: New heating law comes into force – what that means

Germany’s the Building Energy Act (GEG) stipulates that from 2024, every newly installed heating system must be powered by 65% renewable energy, Carbon Brief cited Zeit Online report. The outlet adds that the new regulations apply from January, primarily for new buildings in a new development area, with transition periods for existing buildings. Therefore, functioning oil and gas heaters are allowed to continue their operation, and in the event of a need for a complete replacement due to irreparable issues, transition periods spanning several years are in place.