India’s renewable energy market is booming with opportunities, but challenges in financing, regulation and scalability pose risks to its long-term sustainability.

Read more

Installed renewables grew by more than 28 GW in 2024.

Green energy boom or bubble? Navigating the risks and rewards in India’s market

India’s renewable energy market is booming with opportunities, but challenges in financing, regulation and scalability pose risks to its long-term sustainability

“Green stocks are for the future. It’s not good for short term investments, as of now. But it will grow,” says 55-year-old Samir Sen, who has been trading professionally for the past two decades.

While he hasn’t dipped his beak in the green energy stocks as of now, he’s been keeping a keen eye on them for the past three years, as the stock values are rising. Moreover, he’s hopeful that the stock prices will stabilise once the companies grow and scale up.

His bet lies on India’s growing appetite for power, especially during the scorching summers when power demand shot up by 15% in May 2024 to 156 billion units. Renewable energy, especially solar, can offset this peaking demand caused by overuse of air conditioners, as there is longer and more intense sunlight.

The government, too, is hedging its bets on growing this segment, with a keen eye for hitting 500 GW of renewable energy capacity by 2030. According to a report by JMK Research, India’s total renewable energy generating capacity stands at 209.44 GW as of December 2024. Installed renewables grew by nearly 28 GW in 2024. More importantly, 46.3% of the country’s total installed capacity is renewables.

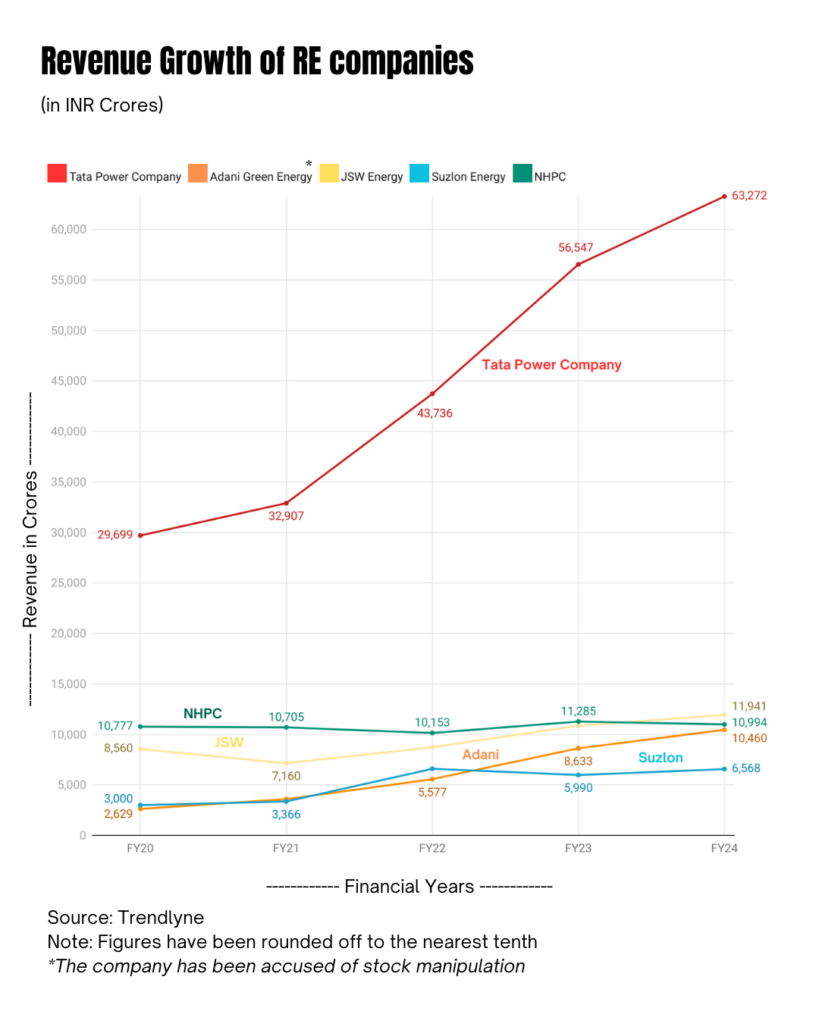

In turn, this means that companies have been growing. Some of the biggest green energy companies in India like Tata Power and JSW Energy have market capitalisations of ₹114,058 crore and ₹95,751 crore respectively, as of January 14, 2025.

Waaree Renewable Technologies – a subsidiary of the solar panel manufacturer Waaree Energies – which generates renewable power and handles engineering and construction services, had opened in the Indian stock market with share price of just ₹2.74 in 2012. The price started climbing gradually from 2022, until it hit its peak of ₹2480.50 in April 2024 – over 1200 times its listing price.

Currently, it is trading at ₹1145.95 as of January 14. The recent dip can be attributed to a bearish movement in the overall market.

In November, NTPC Green had one of the biggest IPOs in 2024, aiming to raise ₹10,000 crore, offering share prices at ₹102-108. It was oversubscribed 2.5 times. Currently, its market cap is ₹101,132 crore and it is trading close to its listing price, hitting a peak of ₹149 on December 11.

“The renewable energy market has grown and matured. Renewables are commercially viable and can stand on their own. Investment will come through sustainable financing markets, or through bank finance,” says Shantanu Srivastava, the sustainable finance and climate risk lead at the Institute for Energy Economics and Financial Analysis (IEEFA).

For renewable energy companies to scale up, they need to invest in physical assets. For that, nearly 80-85% of the financing is through debt at the moment, so there shouldn’t be a problem raising equity now, according to Srivastava.

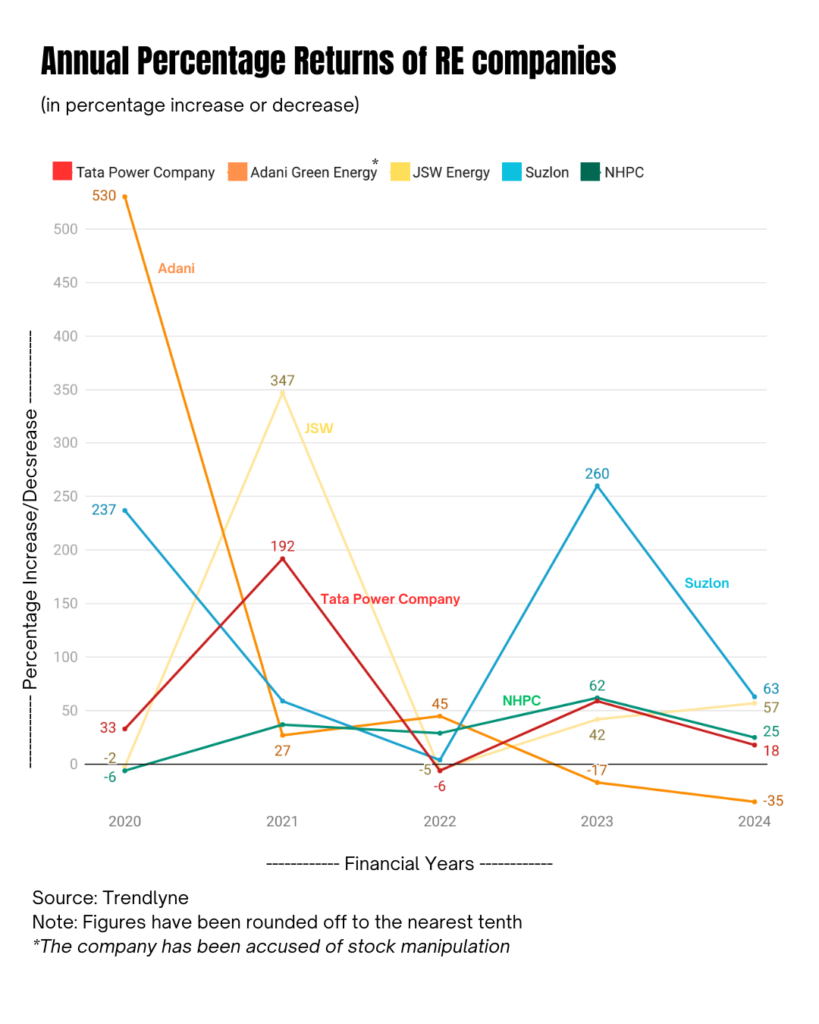

The renewable energy market has undoubtedly reached a stage where investors, including retail, are putting in money. Most stock prices have shot up considerably in the past few years, till the recent slowdown. The market will only get bigger with at least five more companies planning to launch IPOs in 2025 — more avenues for investors to pump in money. But that doesn’t ensure that the risks are completely eliminated. The question lies in whether the returns are trumping the risk.

Steady returns

With green energy companies growing, the returns on investment are also growing.

“The next generation of boom is in green stocks. In 5-10 years, it will be more useful. In order to get good returns, we need to buy them for a very long term for 10-15 years,” says 38-year-old Srinivas Chava, an engineer who has been actively trading since 2008. His investment in Inox Wind has rewarded him with around 30% returns.

A recent investor in green stocks, Shubham Thakur also plans to be dug in for the long haul. “Every sector that encourages green innovation and solutions for a climate-conscious economy will be at an economically advantageous position,” says the 27-year-old climate policy analyst.

In 2024, the renewable energy sector saw an influx of roughly ₹100,000 crore in total, nearly double the funds that went into traditional energy sectors like coal and refinery, according to a senior analyst with a prominent securities firm, who wished to remain anonymous.

By 2027, the investment in the renewable segment is expected to grow by 3X, while conventional energy forms will see similar investments as now.

“In relative terms, old energy sectors will decline. Once more renewables get into the system, conventional energy will decline further. It will have to,” said the analyst.

Also, some retail investors are looking to pump money in companies which have a hopeful outcome or rationale behind their technology, like green energy.

Most importantly, India’s renewable energy market itself is attractive to investors. Why?

“The performance of these projects have been pretty good. On the debt side, lenders get their money back and the credit ratings of the loans have improved over time. For foreign investors on the equity side, the runway of capacity addition is attractive, and this sector is going to see continued ability to deploy capital as pension, wealth and private equity funds are interested,” says Gagan Sidhu, director of the Center for Energy Finance, Council on Energy, Environment and Water (CEEW).

Citing the DRHP of Indian Renewable Energy Development Agency (IREDA), a government company that finances renewable projects, before it filed its IPO in 2023, Sidhu said the non-performing assets (NPAs) were insignificant when it came to solar and wind.

Also, as the technology for renewable has matured over time, domestic financial institutions have overcome hesitancy in lending for such projects. Sidhu says that an overwhelming part of the debt for funding renewable energy projects in India have come through domestic banks and non-banking financial companies (NBFCs).

Initially, the financing of under-construction renewable energy projects is mostly done through domestic bank debt, says IEEFA’s Srivastava. “Financing from domestic funds has been increasing more than foreign banks in the past three years, especially for under construction projects. Foreign investment was subdued, except for big conglomerates like Adani and JSW, which have existing foreign financing lines. Once the project is running, it is refinanced through bond markets,” he says.

Also, for the investor, there are multiple avenues to invest. “Power, electric mobility, decarbonisation of industries, and the technologies which cater to these sectors, are potential destinations for investment,” says CEEW’s Sidhu.

He further points out that the investor has choices as to which part of the segment they can put their money in – from manufacturers like Waaree, finance lenders like IREDA to companies like NTPC Green which deploy renewable energy.

Furthermore, investment opportunities are arising in other clean technologies like battery storage and pumped hydro, while sectors which still have to take-off, like offshore wind and green hydrogen, can be potential bets for the future.

Government push

Also, the government’s clean energy ambitions are helpful. Its target setting – of achieving net zero by 2070, and 500 GW renewable capacity by 2030 – is “underrated in its ability to inspire confidence” in the market, according to Sidhu.

In the past few years, the government has emphasised on pushing renewable energy projects, with major investments flowing into wind and solar. As of December 2023, there were 10 ongoing schemes and programmes to support renewable energy, including PM-KUSUM, developing solar power parks and mega solar projects, Green Energy Corridors, and outlaying ₹ 19,744 crore for the National Green Hydrogen Mission.

In 2020, the Production Linked Incentives scheme came into place to incentivise the manufacturing of solar modules, batteries and other clean energy equipment.

Furthermore, India marketed two tranches of green bonds valued at $1 billion (₹ 80 billion) in January 2023 to speed up expansion of renewable energy projects, major infrastructure undertakings such as metro rail lines, and low-carbon hydrogen production.

With the government’s manufacturing push through the ‘Make in India’ initiative, power demand will increase massively in the next ten years. It is expected to grow at around 8% annually, giving renewable energy a chance to play its part in meeting the enormous demand.

This, in turn, will impact green stocks positively, which are expected to have a minimum compound annual growth rate of 15-20%, according to a stock broker who wished to remain anonymous.

According to the International Energy Agency (IEA), investments of around $68 billion were undertaken in 2023 in India’s clean energy space, up by nearly 40% from the 2016-2020 average. Fossil fuel investment, however, grew by only 6% over the same period to reach $33 billion in 2023.

De-escalating possible risks

Over the past few months, however, share prices of green energy companies have been declining a bit, readjusting their valuations. While this might raise questions regarding a possible bubble, it is quite normal, according to an analyst at SBI Securities, who wished to remain anonymous.

“When there is large growth, valuations of companies are high, and reach bubble territory. But since these ventures are backed by good companies, there isn’t too much volatility,” they say.

According to them, there is enough institutional interest that is driving the growth of some of the green stocks, and retail investors will catch up when they see value.

Adani Green, one of the biggest players in the game, however, is an outlier.

It listed in June 2018 with share price at ₹29.45, and grew to hit its peak of ₹2874.80 in May 2022 in just four years. In the current declining market, however, it has fallen to ₹889.75.

Besides the bear market, the sharp fall can also be attributed to the bribery charges brought against two of the company’s senior executives by the U.S. Securities and Exchange Commission. In the past, the conglomerate has also been accused of stock manipulation by Hindenburg Research, a US based investment research firm. This poses both greater risks and rewards for potential investors. In fact, one particular investor made $1 billion in less than 100 days after investing in four Adani Group companies.

Going by current policies, clean energy investment is expected to double by 2030. But it’s not enough to meet India’s climate goals, and needs to rise by another 20%, according to the IEA.

But even though the renewables market has matured, the question remains whether domestic funds alone are sufficient to sustain it?

Just not yet, according to Ashish Fernandes, CEO of Climate Risk Horizons. His opinion is that while India has sufficient resources to generate a lot of investment, domestic investment is not as high as they should be.

“We need to be installing 40-50 GW every year to meet 2030 goals, but we installed 28 GW in 2024, just over half. While we are tendering close to the target, domestically we are raising only 50% of what we can raise,” he says.

According to him, there are two major hindrances at play here: skepticism about excessive valuations in the Indian equity market, and the lower returns of free market renewables compared to the regulated coal power sector.

“If there is doubt about the valuations of green energy companies, that could play a negative role. On the other hand, costs of electricity from conventional sources, mainly coal, are rising. So, solar and wind are clearly advantageous for common consumers and the Indian economy as a whole, but we cannot realise these benefits while coal — whose prices are regulated with guaranteed returns of 15.5% — grows and competes with renewables,” says Fernandes.

The scepticism is further fuelled by the market’s volatility and possibilities for corruption.

“We still don’t have a green taxonomy. As a result, there is too much ambiguity about what a green bond in India means. Our disclosure policies are not great – the BRSR framework has been weakened by SEBI, where mandatory disclosures regarding ESG were made voluntarily. By not having safeguards, we are sending wrong signals to investors, both in the Indian market and overseas,” says Fernandes.

During the July 2024 Budget, the Indian government had promised to introduce green taxonomy, and it is expected this year.

CEEW’s Sidhu also points out that risk perception is specific to the technology and the business model. “The newer the technology, the higher the risks. It’s simply because the cost of financing newer technology is higher than established ones,” he says.

Then, there are inherent risks like acquiring land for big renewable projects like solar parks.

At the core, risks boil down to three factors – the finance isn’t flowing, it is too expensive, or the investment is just not enough, according to Sidhu. A possible solution lies in blended finance models.

“In the case of the technology being too expensive, blended finance can lower purchase costs. If the flow of finance is not smooth, unlocking finance will work,” says Sidhu.

But the financial health of discoms is certainly a concern, according to both Sidhu and IEEFA’s Srivastava.

“At the end of the chain, it is going to be a discom which is going to be paying the bill. Being a very complex sector with different shades of financial performance, there was a clear risk perception amongst investors. To mitigate that risk, government intermediaries like SECI (Solar Energy Corporation of India) and NTPC (National Thermal Power Corporation) were utilised to execute purchase power agreements (PPAs) with discoms,” says Sidhu.

Through PPAs, discoms can purchase electricity reliably at a fixed price.

While India may be pushing on the pedal for coal, renewable energy combined with other forms of clean technology is undoubtedly the answer for a net zero future. It is growing and needs to grow more, especially if developing nations cannot rely on climate finance from the developed world.

Much of Southern California had almost no rainfall since July 2024, despite being halfway into the normal rainy season – the second-driest period in 150 years.

California wildfires death toll crosses 25, Santa Anas winds amplify the inferno

As the California wildfires death toll crosses 24 and “fierce gusts” of wind called the Santa Anas amplify the spread of raging fires, CarbonCopy highlighted research suggesting that climate change is a significant factor fuelling these fires. The January 2025 fires are being driven by strong winds. While the winds are not unusual at this time of year, the delayed onset of the rains means that it is unusually dry.

Climate change is making it less likely to rain in late fall and early winter when the hot, dry, Santa Ana winds peak. Much of Southern California had almost no rainfall since July 2024, despite being halfway into the normal rainy season – the second-driest period in 150 years. Carbon Brief highlighted a new timely research that attributed to climate change induced “hydroclimate whiplash” conditions (rapid swings between periods of high and low rainfall) allowing lots of vegetation to grow, which dry up during a switch to very dry conditions, providing ideal fuel for the wildfire.

Afghanistan to be the most affected region by rising temperatures: study

A new study found that Afghanistan is the worst hit by the rising temperatures in South Asia and Bangladesh is the least affected, CarbonCopy reported. The study looked at the rate South Asia would be warming if global warming were to increase by 1.5°C , 2°C and 3°C, compared to the pre-industrial baseline of 1850–1900.

South Asia would observe a mean temperature rise of 1.5°C and 3°C during 2035–2038 and 2062–2068, respectively. The Intergovernmental Panel on Climate Change (IPCC) models CMIP6 (global climate model) and CORDEX-SA (regional climate model) were used in the study.

The study said Meghalaya and Himachal Pradesh are experiencing ice melt in the Himalayas as a result of rising mean temperatures. Punjab is also seeing rising mean temperatures as a result of climate change in adjacent Pakistan. Rising sea levels as a result of mean temperature increases in eastern West Bengal are causing land to sever and submerge, the study stated.

The temperature rise in West Bengal was projected to be the highest. A global warming of 3°C could lead to a mean temperature rise of 4.432°C in the state, the study said. The neighbouring Bangladesh was to be one of the least affected countries due to the rising temperature.

2024 was the warmest year on record, first calendar year to breach 1.5° C

Last year was the hottest year ever on record, and the first calendar year to breach the 1.5°C above the pre-industrial level, according to the Copernicus Climate Change Service (C3S), CarbonCopy reported. C3S found that the global average temperature of 15.10°C was 0.72°C above the 1991-2020 average, and 0.12°C above 2023, the previous warmest year on record. This is equivalent to 1.60°C above an estimate of the 1850-1900 temperature designated to be the pre-industrial level.

In fact, the monthly global average temperature exceeded 1.5°C above pre-industrial levels for 11 months of the year, while the past ten years has also been the warmest decade on record, according to the report. Region wise, all continents faced their warmest days last year, barring Antarctica and Australasia.

Ocean temperatures highest ever in 2024: Study

The year 2024 was not only the warmest on record, but it also broke the record of highest global ocean temperatures, according to a new international study published in Advances in Atmospheric Sciences on January 8, 2025, HT reported.

The research, led by Lijing Cheng from the Institute of Atmospheric Physics at the Chinese Academy of Sciences along with 54 scientists from seven countries, observed new temperature records in six of eight investigated ocean regions: the Indian Ocean, tropical Atlantic, Mediterranean Sea, North Atlantic, North Pacific, and Southern Ocean.

The global sea surface temperature (SST) continued its record-high trajectory from 2023 into the first half of 2024, showing a slight decline in the second half of the year in response to increased greenhouse gas concentrations in the atmosphere. The 2024 annual mean global SST surpassed the previous year’s record by 0.05°C–0.07°C, establishing a new high for the instrumentation era.

Study finds 25% global freshwater fish species on brink of extinction, Western Ghats zone among worst hit regions

Around 25% (4,294 of the 23,496) studied species of decapod crustaceans, fishes and odonates living in freshwater may go extinct, according to the international Union for Conservation of Nature (IUCN) Red List of threatened species.

The DTE reported that the greatest number of threatened species were found in Lake Victoria, Lake Titicaca, Sri Lanka’s wet zone and the Western Ghats of India. These areas nestle some of the highest freshwater biodiversity in the world, including many species found nowhere else, the report added.

Interestingly, agriculture and invasive species were the major threats to both freshwater species and tetrapods.

The IUCN co-authored study pointed out that some threats are found to be more prevalent to freshwater species, especially pollution, dams and water extraction, and thus they required targeted actions in response. These primary threats would require changes in water management practices at a catchment scale, over and above species-specific or site-based actions.

The ministry has sought a report detailing the name and number of villages situated in tiger reserves.

Tribal ministry seeks report from states over tribal complaints of ‘unlawful’ evictions from tiger reserves

After complaints from dozens of villages situated inside tiger reserves in MP, Maharashtra and West Bengal alleging residents were being pressured to vacate their traditional lands without due recognition of their rights under the FRA and Wildlife Protection Act, the Ministry of Tribal Affairs has directed the states to create an institutional mechanism to ensure compliance with the law and set up a mechanism to address grievances, The Indian Express reported. The newspaper added that the ministry received representations from 52 gram sabhas in MP’s Durgavati Tiger Reserve in December.

The ministry has sought a report detailing the name and number of villages situated in tiger reserves; the tribes and forest-dwelling communities in such villages; and all the forest rights claims received, vested, and rejected. It has also sought to know the process of seeking consent and the likely compensation. The issue came under the spotlight last June when the National Tiger Conservation Authority asked state forest departments for a timeline for the relocation of 591 villages in tiger reserves.

Centre eases afforestation process for coal blocks

The Indian government has made it easier for state-owned companies to meet their mandatory compensatory afforestation targets by removing bottlenecks for large infrastructure projects that require diversion of forests, the HT reported. The environment ministry clarified that Central government entities and captive coal blocks of state run companies implementing large projects that require diversion of forest land can take up compensatory afforestation on degraded forest land, and not necessarily non-forest land as previously stipulated. Experts have pointed out that raising plantations on degraded forest land does not compensate for loss of forests.

The report explains that India’s green cover may be increasing according to the India State of Forest Report (ISFR) 2023, but it also points to the degradation of large tracts of forests, increase in plantations and lack of clarity in status of so-called unclassed forests — all of which could have serious impacts for biodiversity, forest dependent people and ecosystem services provided by old-growth forests.

The Union environment ministry has made it easier for state-owned companies to meet their mandatory compensatory afforestation targets in a move aimed at removing bottlenecks in the implementation of large infrastructure projects that require diversion of forests.

Forest survey shows shift to plantations, natural ecosystems declining

The Forest Survey of India (FSI) released its 18th India State of Forest Report (ISFR), recording marginal increase in forest and tree cover, revealing a declining trend in forest cover across several biodiversity-rich areas, Mongabay reported. The report highlighted an increase in agroforestry and a loss of mangrove cover, particularly in Gujarat and Andaman and Nicobar Islands, the outlet stated. The report stated that India’s total forest and tree cover is 8,27,357 square kilometres (25.17% India’s geographical area). This includes 7,15,343 sq. km. (21.76%) of forest cover and 1,12,014 sq. km. (3.41%) of tree cover.

The outlet reported that survey claims an increase of 1,446 sq. km. in forest and tree cover since 2021, comprising a forest cover increase of 156 sq. km. (0.2%) and a tree cover increase of 1,289 sq. km. (1.16%). It categorises forest data into recorded forest areas (RFA) which largely consists of the reserved forests and protected forests and non-notified forests. While RFAs show a minor increase of 7.28 sq. km., 20 states and union territories report a decline in RFA category. States like Andhra Pradesh, Arunachal Pradesh, Assam, Chhattisgarh, Madhya Pradesh, Maharashtra, Tamil Nadu, Telangana, and the majority of north-east states have registered negative growth in the recorded forest area. In contrast, non-notified forests have increased by 149 sq. km.

India announces green steel taxonomy, with star-rated benchmarks

The Centre announced the green steel taxonomy providing benchmarks that categorises steel products based on their carbon emissions per tonne of finished steel. Any finished steel product emitting less than 2.2 tonnes of carbon dioxide equivalent per tonne of finished steel (tCO₂e/tfs) will qualify as green steel, reported DTE.

Green steel is classified into three tiers, namely three-star green steel with emissions intensity between 2 and 2.2 tCO₂e/tfs, four-star with emissions intensity between 1.6 and 2 tCO₂e/tfs and five-star, the cleanest category, with emissions intensity below 1.6 tCO₂e/tfs.

The star ratings will be reviewed every three years. The taxonomy covers scope 1, scope 2 and limited scope 3 emissions. The National Institute of Secondary Steel Technology (NISST) has been designated as the nodal agency for measurement, reporting, verification (MRV) and issuing certificates and star ratings for green steel.

China to build world’s largest hydropower dam in Tibet, India conveys concerns

India “conveyed its concerns to Beijing” about China’s plan to build the world’s largest hydropower dam in Tibet on the Yarlung Zangbo river, which flows into India, Reuters reported.

DTE also covered the news pointing out strong lobby groups behind the big dams, adding that the Brahmaputra is the lifeline of the Northeast. A huge dam on the mighty river could make it dry, while also raising the risk of floods during the wet season. The construction of the dam in a highly seismically active zone raises even more fears, the outlet continued.

The dam on Tibet’s longest river could generate three times more energy than the Three Gorges Dam, state news agency Xinhua reported. Total investment in the dam could exceed 1 trillion yuan (US$137 billion).

The Yarlung Tsangpo flows across the Tibetan Plateau, carving out the deepest canyon on Earth and falling a staggering 7,667 metres (25,154 feet), before reaching India, where it is known as the Brahmaputra River. The dam will be built in one of the rainiest parts of mainland China, Hong Kong’s South China Morning Post reported.

Energy, agriculture lead GHG emissions in India latest greenhouse gas inventory

India submitted the fourth Biennial Update Report (BUR) to the United Nations Framework Convention on Climate Change, containing the greenhouse gas (GHG) inventory for 2020.

The report stated that India’s overall emissions decreased by 7.93% in 2020 compared to 2019 (CO2 emissions dropped 5.4% due to pandemic which stalled most economic activity worldwide).

The outlet pointed out that in 2020, the energy sector was the largest contributor to GHG emissions, accounting for 2,238 MtCO₂e — a 6% decrease from 2019. Between 2016 and 2019, emissions from this sector grew by an average 3.72% annually.

The energy sector alone was responsible for nearly 92% of CO₂ emissions. Energy industries accounted for 56% of total emissions, followed by manufacturing (17%) and transport (13.28%).

Despite the drop in 2020, historical analysis shows that total emissions have steadily increased over the decades. Between 1994 and 2020, emissions (including LULUCF: land use, land use change and forestry) rose by 98.3%. Compared to India’s first BUR in 2010, the percentage increase is 29.4%. Excluding LULUCF, emissions increased by 13.5% compared to the second BUR in 2014 and 4.2% compared to the third BUR in 2016, DTE continued.

China to further restrict export of battery, critical minerals tech

China’s proposed export restrictions on technologies for batteries and the processing of lithium and gallium, Reuters reported. China said: “If implemented, they would be the latest in a series of export restrictions and bans targeting critical minerals and the technology used to process them, areas in which Beijing is globally dominant.” Reuters added that the proposals would help China to “retain its 70% grip on the global processing of lithium into the material needed to make electric vehicle (EV) batteries”. Bloomberg reported that Beijing sought to protect “innovations that China has developed during its rise to dominate global battery and electric-vehicle production” amid “rising global trade tensions”.

New York to fine fossil fuel companies $75bn under new climate law

New York state will fine fossil fuel companies to pay for the damage caused by climate change, Reuters reported. State governor Kathy Hochul has signed into law a new bill that will see $75bn raised over the next 25 years, the newswire reported. The legislation, known as the Climate Change Superfund Act, will require companies “responsible for the bulk of carbon emissions buildup between 2000 and 2024 to pay about $3bn each year”,

Morgan Stanley, Citigroup and Bank of America quit “a major climate-banking group”

Following months of pressure from Republican politicians US banks have been rushing to leave one of the world’s top banking sector climate coalitions, Reuters reported. Climate campaigners are worried that the industry is losing resolve to take action on fossil fuels. Goldman Sachs broke ranks saying it was leaving the Net-Zero Banking Alliance (NZBA) and was soon followed by Wells Fargo, Citi and Bank of America and Morgan Stanle.The exit of some of the world’s biggest lenders means the NZBA, whose members aim to align their financing with the global climate fight, now includes just JPMorgan among the Big Six U.S. banks.

Bloomberg reported that “the defections are playing out against a tense political backdrop in the US, as the country’s biggest financial firms find themselves the targets of Republican campaigns that have characterized net-zero groups as climate cartels”

The first plea to clean the site was filed in the Madhya Pradesh High Court in August 2004 but the sluggish process extended the timeline to 40 years

40 years after deadly Bhopal gas leak disaster, factory site cleaning begins, toxic waste to be incinerated

The 377 metric tonnes of toxic waste finally left the factory for its incineration, 40 years after the deadly 1984 Bhopal gas tragedy that killed over 5000 people after toxic ‘methyl isocyanate’ (MIC) gas leaked from the Union Carbide unit.

Scientific reports, including those from pollution control boards, confirmed the waste’s role in water contamination, necessitating incineration in a foolproof process elsewhere, DTE reported.

The first plea to clean the site was filed in the Madhya Pradesh High Court in August 2004 but the sluggish process extended the timeline to 40 years, the DTE report stated, adding this marked the beginning of the historic relocation process. The waste, packed in 12 sealed containers, was shifted from Bhopal to the disposal site at Pithampur in Dhar district on January 2.

Two men tried to immolate themselves during a protest against the planned disposal of the Union Carbide waste at Pithampur, about 30 km from Indore. Furthermore, the state sought three days to unload the waste shifted from Bhopal to Pithampur in 12 sealed containers.

Methyl isocyanate (MIC) gas leaked from the Union Carbide pesticide factory in Bhopal, killing at least 5,479 persons and leaving thousands with serious injuries and long-lasting health issues.

Keep the Ganga water of drinking and bathing quality during Maha Kumbh: NGT

Authorities have to ensure that river water quality of Ganaga river at the Maha Kumbh Mela is of “drinking water/bathing water quality” at all times, the National Green Tribunal’s (NGT’s) has ordered the Uttar Pradesh government and Central Pollution Control Board (CPCB). The Indian Express reported that the green court has asked to ensure no untreated sewage is discharged into the Ganga and Yamuna rivers. The order further went on to state that CPCB and UPPCB have to collect water samples from Ganga and Yamuna rivers at least twice a week from the monitoring points and they would have to display analysis reports on their website. Sewage generation is estimated to increase by 10% during the 2025 Maha Kumbh Mela in Prayagraj, which will continue for 45 days till February end. The Maha Kumbh Mela, held every 12 years, will begin in Prayagraj on January 13 and end on February 26.

Again, Centre denies direct correlation between air pollution and deaths

The Union Environment Ministry denied that there is conclusive data to establish a direct correlation of deaths due to air pollution, in a written submission in the House. Earlier Anupriya Patel, Minister of State for Health, made a similar statement in Rajya Sabha on July 30. Both the Union Environment Ministry and Health Ministry have maintained that there is no direct correlation between mortality and air pollution., reported the Indian Express.

However, the newspaper added that Centre’s advisory on air pollution in November 2024 quoted the 2021 ICMR study, which said that 1.7 million deaths in India in 2019 were attributable to air pollution. Of this, the largest proportions were due to chronic obstructive pulmonary disease (32.5 per cent), ischemic heart disease (29.2 per cent), stroke (16.2 per cent) and lower respiratory infections (11.2 per cent).

In July 2024, a first-of-its-kind multi-city study in India published in Lancet revealed that about 11.5 percent of deaths in Delhi every year, roughly 12,000 deaths, can be attributed to air pollution. It said that 33,000 deaths could be attributed to air pollution every year on average. The researchers – from India and abroad – had obtained daily death data from civil registries in the 10 cities between 2008 and 2019. The National Green Tribunal had sent notices to authorities following the report.

Noise pollution: Bombay high court seeks compliance report on its ban on illegal loudspeakers from govt

The Bombay high court directed Maharashtra’s home department and police to file an affidavit detailing the steps taken to comply with the high court’s directions regarding illegal loudspeakers. The court was hearing a contempt petition alleging non-compliance with its directives against loudspeakers issued in August 2016, the HT reported.

The court was informed that the government was aware of at least 2,940 illegal loudspeakers based on the government’s response to an RTI application. Nearly 37 directions were earlier issued by the court in a 2016 judgement dealing with noise pollution, report added.

The Supreme Court had observed that noise can disturb sleep, communication, damage hearing and evoke other gynaecological and pathological reactions.

The court had earlier said that if the noise level exceeded the ambient noise standard by 10 decibels, a person could make a complaint to the authority and the latter was bound to take action against the violator.

The central government’s role under the Electricity Act is establishing policy frameworks and issuing directions for the regulator, serving as guidance rather than binding mandates.

Karnataka HC says Centre’s directions on green energy open access not mandatory, strikes down rules

The Karnataka High Court ruled that Centre cannot exceed powers granted under Electricity Act by making its regulations on green energy open access binding on state regulatory authorities. The court struck down the Electricity (Promoting Renewable Energy Through Green Energy Open Access) Rules, 2022, along with the Karnataka Electricity Regulatory Commission (KERC) (Terms and Conditions for Green Energy Open Access) Regulations, 2022, Mercom reported.

The report said that the court directed the KERC to consider the interests of all stakeholders and, if necessary, frame appropriate regulations for granting open access to green energy generators and consumers as per the National Electricity Policy and the Tariff Policy formulated by the Union government but retain autonomy in its decision-making.

The central government’s role under the Electricity Act is establishing policy frameworks and issuing directions for the regulator, serving as guidance rather than binding mandates.

India installed ‘record’ 24.5 GW of solar power capacity in CY2024: Study

India added about 24.5 GW of new solar (18.5 GW from utility-scale PV, 4.59 GW rooftop and about 1.48 GW off-grid installations) and 3.4 GW of new wind capacity in 2024, marking over twofold rise in solar installations and a nearly 1.21 times increase in wind installations compared to 2023, according to study by JMK research that attributes this rise partly to Centre’s Surya Ghar Muft Bijli Yojana. The total solar capacity addition in 2024 is the highest recorded capacity in any previous year, The PV Magazine reported. With these additions, India’s total installed renewable energy (RE) capacity reached 209.44 GW as of Dec. 2024. Solar energy is the biggest contributor with around 47% share of the total RE segment (comprising solar, wind. hydro (large and small) and bio power). Utility-scale solar installations (18.5 GW) were up 2.8 times compared to the installations in 2023. Rooftop solar installations (4.59 GW) were up 53% year-on-year.

Clean energy investments will beat fossil fuels in 2025: S&P report

Clean energy technology investments will exceed those in oil and gas for the first time in 2025, according to a report by S&P Global, ET reported adding that cleantech energy supply spending is projected to reach $670 billion in 2025, with solar PV accounting for half of the investments.

The report stated that globally at least 620 GW of new solar and wind capacity will be added globally, equivalent to the combined power systems of India, Pakistan, and Bangladesh. Battery energy storage may surpass pumped hydro storage in installed capacity by 2025, the report said. The report also highlighted that ammonia is emerging as a significant component in low-carbon hydrogen production, and carbon capture, utilization, and storage (CCUS) projects are projected to witness substantial growth.

UAE announces renewable energy facility for round-the-clock power

The UAE launched the world’s first renewable energy facility capable of providing uninterrupted clean power, reported ET. The UAE Minister of Industry and Advanced Technology and Masdar Chairman Dr. Sultan Al Jaber opened the Abu Dhabi Sustainability Week (ADSW) 2025 and said the project integrates 5.2 GW of solar capacity with 19 GW hours of storage to deliver 1 GW of baseload renewable energy.

The facility is a partnership with the Emirates Water and Electricity Company and addresses the challenge of renewable energy intermittency. Dr. Al Jaber highlighted that global energy demand is projected to rise from 9,000 GW to over 15,000 GW by 2035, driven by the rapid growth of Artificial Intelligence (AI). He noted that AI applications, such as ChatGPT, are accelerating energy consumption, which could push demand to 35,000 GW by 2050.

China plans to build ‘Three Gorges dam in space’ to harness solar power

China plans to “use super heavy rockets to build solar power stations in space”, a senior member of the Chinese Academy of Engineering told the Hong Kong-based South China Morning Post, as the blueprints of the project are released.

Space-based solar stations can collect energy without being affected by seasons or day-night cycles, the article stated, adding that the energy density is much higher in space – about 10 times the average on the Earth’s surface.

China to work with African countries to set up Africa solar belt programme

The Chinese Ministry of Foreign Affairs said it will “work with African countries to build the ‘Africa Solar Belt’ programme and help Africa truly embark on the path of green and low-carbon development”, reported the state-owned China Daily. State news agency Xinhua added that “green development will be another highlight of China-Africa cooperation” and that a total of 1.5 gigawatts (GW) of solar plants have been jointly built by China and Africa. Xinhua also reported about “Chinese companies help drive UAE’s transition to clean energy.”

The most number of EVs were sold in Uttar Pradesh at 368,718 units.

1.9 million EVs were sold in 2024, showing 27% annual growth

In 2024, 1.9 million electric vehicle sales were sold in India, which means there was a 27% year-on-year growth from 2023’s sales, according to a report by Mercom. While EVs made up only 3.6% of total automobile sales in India last year, there are over 5.39 million registered EVs in the country now. The most number of EVs were sold in Uttar Pradesh at 368,718 units while the two-wheeler segment accounted for 59% of total EV sales in 2024.

Govt approves PLI incentives of ₹246 crore cumulatively to auto majors M&M, Tata Motors

Pleased with the progress that two of India’s biggest automobile manufacturers – Mahindra & Mahindra and Tata Motors – have made in localising manufacturing of electric, the government has further cleared incentive claims of ₹246 crore submitted by the two auto majors under the ₹25,938 crore PLI scheme for the automobile and auto components industry, according to a report. Tata sought the incentive after totalling eligible sales spread across three EVs – Tiago, Starbus and Ace – at ₹1,380.24 crore. Meanwhile, M&M eligible sales from their e3W models – Treo, Treo Zor, and Zor Grand – totalled ₹836.02 crore.

Prodded by Chinese competition, US EV giant Tesla suffers first ever annual sales drop

US-based electric vehicle company Tesla has recorded its first ever drop in annual sales, as Chinese EV makers are giving it stiff competition, amidst a global slowdown in the demand for electric vehicles, according to the Daily Telegraph. In 2024, Tesla sold 1.79 million cars, just slightly less than the 1.8 million units sold in 2023.

Norway likely to achieve its target of 100% new car sales to be electric in 2025

Norway is likely to become the first country to achieve 100% new car sales to be electric in 2025, which has been a longstanding target for the Nordic country, according to a report by the National. 88% of new cars sold in 2024 were zero-emission. It attributes this growth, in part, to tax incentives funded by Norway’s oil-and-gas revenue. Unlike its EU neighbours, Norway has not imposed tariffs on Chinese electric vehicles, and these have “surged to account for almost 10% of new car sales in Norway in only five years”.

ONGC claims that during the 10-year contract period, BP has projected an increase in oil and oil equivalent gas production of up to 60% over the field's baseline levels.

BP wins ONGC contract to ramp up oil and gas production in India

UK-based global energy major BP won the contract to operate and enhance production from Oil and Natural Gas Corporation’s (ONGC) flagship Mumbai High field—India’s largest oil and gas field. This oil and gas field has been witnessing a gradual fall in output for over three decades. To boost output from the field, the state-owned ONGC requested proposals from foreign oil and gas companies in June. The tender, which gave the foreign partner a fixed fee and a portion of the revenue from the increased hydrocarbon production, but no stake in the field, was only attended by BP and Royal Dutch Shell. Although Shell had expressed interest in the tender, it did not submit the final bid, leaving BP as the sole bidder. ONGC claims that during the 10-year contract period, BP has projected an increase in oil and oil equivalent gas production of up to 60% over the field’s baseline levels.

India to sign deal to import coking coal and copper from Mongolia

India and Mongolia are anticipated to soon sign a preliminary agreement in the fields of geology and exploration, according to a senior Indian government official with firsthand knowledge of the situation, the Mint reported. India is mostly reliant on imports to supply the growing demand for coking coal for steelmaking and copper, which is used in electrical vehicles, building, and power. Mongolia has abundant quantities of these minerals. The report said that while the discussions are still confidential, India’s cabinet has approved the MoU (memorandum of understanding) and both countries are expected to sign it soon.

Rescue efforts underway at Assam coal mine as eight miners get stuck in flooded hole, 4 bodies recovered so far

Since the morning of January 6, at least eight miners have been stranded within a rat-hole coal mine in the Dima Hasao region of Assam, the Hindu reported. The body of a Nepali miner, one of nine trapped in a flooded coal mine, was recovered by army divers on January 8. The remaining eight miners have not yet been located, despite the efforts of numerous rescue agencies, divers, and a remotely operated search vehicle. The constant level of murky water has made the operation more difficult. The rescue effort involved the participation of deep divers from the Indian Navy, as well as officials from the Army, National Disaster Response Force, State Disaster Response Force, ONGC, Coal India Limited (CIL), and the district administration.

As of January 16, the dewatering process continues and the navy divers who have been involved in the rescue efforts have been moved from the site. Officials said that four bodies have been found so far since an unexpected rush of water inundated the quarry, trapping nine workers within the Umrangsu mine.

Delhi slashes gas supply for LPG production, diverts to gas retailers

According to an official order, the Delhi government reduced the amount of natural gas used to produce LPG and transferred the cheap fuel to city gas retailers like Indraprastha Gas Ltd and Adani-Total Gas Ltd in order to partially satisfy their demand for CNG/piped cooking gas supplies, the Economic Times reported. Due to limited production, the government reduced the amount of cheap natural gas supplied to city gas retailers by up to 40% in October and November of last year. As they replaced lost volumes with more expensive input fuel, gas retailers in the city raised the price of CNG by ₹2-3 per kilogramme. When compared to alternative fuels like diesel, the price increase made CNG less appealing. In order to address this, the Ministry of Petroleum and Natural Gas revised several subsurface and underwater gas allocations in an order dated December 31.

Biden bans new offshore oil and gas projects shortly before Trump takes office, latter promises to revoke

Before President-elect Donald Trump takes office, U.S. President Joe Biden has prohibited new offshore oil and gas extraction along the majority of the country’s coastlines, according to the Associated Press. As the measure will not affect regions where oil and gas exploration is already underway and mostly covers places where drillers have no significant possibilities, such as in the Atlantic and Pacific oceans, the measure is primarily seen as symbolic. Biden will utilise his power under the 70-year-old Outer Continental Shelf Lands Act to safeguard all federal waters off the East and West coasts, the eastern Gulf of Mexico, and parts of the northern Bering Sea in Alaska, the White House announced. About 625 million acres (253 million hectares) of ocean will be impacted by the prohibition. Biden claimed that the action was in line with his plans to preserve 30% of American lands and waters by 2030 as well as his efforts to fight climate change. Thanks to significant gains in output from states like Texas and New Mexico, as well as increased demand following Russia’s invasion of Ukraine, the United States is currently the world’s largest producer of gas and oil.

Trump is scheduled to take office on January 20. He has said that he’ll revoke the ban.

Oil ports at risk due to rising sea levels: Study

A new study found that several of the largest oil ports in the world will be overwhelmed by rising sea levels brought on by the climate catastrophe, the Guardian reported. Given that burning fossil fuels contributes to global warming, scientists argued the threat was ironic. The study estimated that just 1 metre of sea level rise will cause significant harm to 13 of the ports with the most supertanker traffic. According to the researchers, Yanbu and Ras Tanura, two low-lying ports in Saudi Arabia, were especially at risk. The Saudi state oil company, Aramco, runs both, and these ports handle 98% of the nation’s oil exports. The list also includes ports in the United Arab Emirates, China, Singapore, and the Netherlands, as well as Houston and Galveston in the United States—the world’s biggest oil producer.