The NDA govt is looking at hydel power to balance the grid as it moves away from coal, but as past attempts have proven, this will be easier said than done

Read more

Testing the waters: The BJP-headed NDA government want to push India’s installed hydel capacity to 70,000 MW by 2030—a 50% jump from the current 45,700 MW. Photo: Pixabay

Does hydel have a role in India’s decarbonisation plans?

The NDA govt is looking at hydel power to balance the grid as it moves away from coal, but as past attempts have proven, this will be easier said than done. This is part one of a three-part series.

Once again, India is in the throes of a dam-building enthusiasm. Not only are old, stranded projects being revived, newer ones are being commissioned as well.

Just last year, the BJP-led NDA government announced fresh dams in Uttarakhand and Himachal Pradesh. In Sikkim, there is speculation that a 520 MW hydel project at Dzongu will be revived. In Kashmir, so many dams are being built that the region’s hydel power output will double from the existing 3,504 MW to 7,001 MW.

The biggest of these pushes, however, is in Arunachal Pradesh. In December, 2021, the Union power ministry sanctioned 29 hydel projects—adding up to 32,415 MW—in the state.

But hidden underneath these announcements is a state-financed gamble over hydel’s role in India’s decarbonisation.

As the pressure to cut emissions rises, India will struggle to add new thermal power plants. At the same time, alternatives to coal-based power are still imperfect. Renewables are cheap, but not available all day. Gas, as CarbonCopy has reported, is too expensive to be competitive. Nuclear is too small in scale—and, as agitations like Kudankulam showed—runs into intense opposition.

That leaves hydel power. It, however, is costlier than solar. And so, instead of having it compete with low solar tariffs, the NDA government wants to use hydel for peak power and grid-stabilisation. “Renewables come with intermittency and so we will need hydel to balance the grid,” said Vinay Shrivastava, a former executive director (western region) of India’s Power System Operation Corporation (POSOCO), a state-owned enterprise, which manages India’s electricity grid.

And so, not only does the BJP-headed NDA government want to push India’s installed hydel capacity to 70,000 MW by 2030—a 50% jump from the current 45,700 MW—it’s also readying a large push on pumped storage. As energy minister RK Singh told the Economic Times, the NDA has also identified 63 projects adding up to a generating capacity of 96,000 MW.

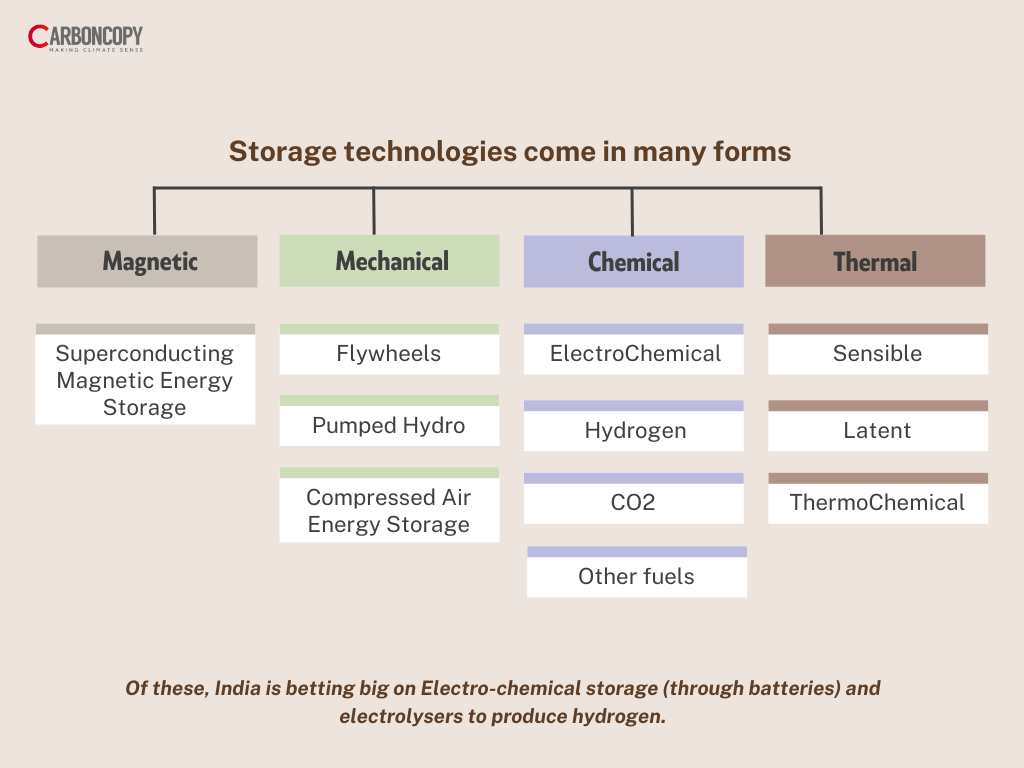

Hard-wired into this push, however, is a bet that hydel can hold its own against emerging storage technologies like battery energy storage systems (BESS) and electrolysers.

India pushes hydel again

This is not the first time India is trying to amp up its hydel power capacity. In 2003, too, the country had announced an ambitious plan—to treble its hydel power capacity.

At a time when India’s dams produced a little over 26,000 MW, the then-ruling NDA government, headed by Atal Behari Vajpayee, said it would set up 162 new hydel projects, adding up to 50,000 MW by 2012.

That number climbed higher still. A clutch of states signed more MoUs than they needed to. Uttaranchal, meant to add 5,282 MW of fresh capacity, signed MoUs for 27,450 MW. Arunachal Pradesh, set a target of 27,000 MW, signed MoUs for 43,118 MW. Sikkim, given 1,469 MW, signed MoUs for 5,284 MW.

Himachal Pradesh, which was expected to add 15 projects adding up to 3,328 MW, signed MoUs for 53 projects in one part of the state alone—Kinnaur. By 2014, it had plans for as much as 13,813 MW of fresh capacity.

A speculative bubble had formed. Attracted by the prospect of owning a hydel project—with its promises of low running costs and government-mandated fat margins—construction companies and other newcomers to the energy sector were clamouring to get in. Knowing most of these projects wouldn’t come up, but seeing an opportunity for rent-extraction, political parties in power states such as Arunachal Pradesh and Uttaranchal began charging for MoUs—even with untested companies—and commissioned as many dams as they could.

By 2013, Arunachal Pradesh had signed MoUs for 153 dams. To put that number in perspective, the state has just four major river basins—Subansiri, Lohit, Siang and Kameng.

What happened next is well known. Pushed without considering their social, environmental or even economic feasibility, most of these dams never got made. Work began on some, but halted due to local opposition. Others never started construction due to the absence of necessary infrastructure such as roads and transmission lines. Others, signed by speculators hoping to offload MoUs to serious players, found themselves scuppered as buyers wisened up.

In all, each state failed to add the capacity than its MoUs promised, and India missed Vajpayee’s target as well.

Vajpayee had wanted the country to add 50,000 MW by “the 12th Five Year Plan”–2012. In reality, the country added just 12,223 MW. Little changed in the eight years that followed. As a 2020 report in Hindu BusinessLine says: “Only about 10,000 MW of hydropower could be added over the last 10 years,” taking India’s installed hydel power capacity to 45,700 MW.

A battle over storage

Today, as the country tries again, it has jettisoned parts of the old approach.

For a start, projects are being given not to the private sector, but to public sector undertakings (PSUs).

The 29 projects coming up in Arunachal Pradesh, for instance, have been shared between India’s four hydro PSUs—National Hydel Power Corporation (NHPC), North East Electric Power Corporation (NEEPCO), THDC (formerly, Tehri Hydro Development Corporation) and SYVN (Satluj Jal Vidyut Nigam)—with each getting a river basin.

In Kashmir, too, all MoUs have been signed with NHPC. “We are back to PSU-driven development in the hydel sector,” said Jayant Kawale, a former head of Jindal Steel and Power’s hydel unit.

In addition, large hydel projects have given renewable energy status enabling new projects, as joint secretary AK Verma wrote in Hindu BusinessLine, to “receive concessions and green financing available to RE projects”.

To ensure hydel still has buyers—despite solar’s lower tariffs—the NDA has introduced Hydel Purchase Obligations. Like the Renewable Power Obligations, which compelled DISCOMs to buy solar and wind, these push hydel. “Everyone wants to schedule the cheapest power,” said Shrivastava. “With so much infra cost, if the cost of hydel is Rs4, the cost of solar is Rs2. No state will buy hydro. If some state has put up 2,000 MW of hydel, it will become a NPA [non-performing asset].”

In tandem, the debt repayment period for dams has been hiked from 12 years to 18 years and their project life has been extended to 40 years—both give promoters more time to retire loans, and ergo, make lower tariffs possible.

That said, even if some old challenges have been addressed, others persist. These include social, environmental, geological, geopolitical (China) and infrastructural challenges that dam-building runs into.

And then, there are newer challenges. India’s pushing hydel storage at a time when the world is making a big push on rival storage technologies like batteries and electrolysers.

India, too, has sanctioned a 50 GW PLI scheme for batteries. Central government agencies are projecting BESS installations for the grid at 27 GW by 2030.

Firms like Reliance are trying to produce cheap electrolysers. In addition, India has provisionally settled on a 5 GW target for electrolyser manufacturing by 2030 – with caveats that this might rise.

Think about it. India’s installed capacity of solar and wind is about 175 GW right now. The country wants to push renewables to 500 GW by 2030. At that level, said Shrivastava, India will “need as much as 85 GW of storage to balance the grid”.

India’s planned 96 GW of pumped hydro—and its projected 70 GW capacity comprising multipurpose dams and run of the river projects—will have to compete with newer forms of storage for this 85 GW space.

The resulting interplays are still evolving. On one hand, batteries and electrolysers are yet to be deployed at scale. On the other hand, hydel is a mature technology with little scope for dramatic cost reduction. Within hydel itself, pumped storage, run-of-the-river and multi-purpose projects come with different competitive advantages.

These two interplays—with storage, and within hydel—will determine hydel’s role in India’s emerging energy architecture.

(Next week: Can hydel take on batteries and electrolysers?)

In deep water: Storage levels in 140 major reservoirs have fallen to 39% of their cumulative capacity as of April 21, 2022 | Photo: Down To Earth

140 major reservoirs in India record dip amidst intense heatwave, deficient pre-monsoon rain

The intense heatwave that has gripped India coupled with deficient pre-monsoon rainfall has led to a significant dip in the country’s major reservoirs. According to data released by the Central Water Commission (CWC), storage levels in 140 major reservoirs as of April 21, 2022 have fallen to 39% of their cumulative capacity compared to 50% on March 17, 2022. This translates into a dip of about 2-3% per week.

According to data released by the India Meteorological Department (IMD), pre-monsoon rainfall as of April 19 fell in the ‘large deficient’ category. The data revealed the subdivisions of East Uttar Pradesh and Saurashtra and Kutch have had no rainfall since March 1, Madhya Maharashtra and Arunachal Pradesh had normal rainfall, and only eight subdivisions recorded ‘large excess’ rainfall.

Torrential rain, flooding kills 450 in South Africa

Relentless rain and floods in South Africa killed around 450 people and rendered thousands homeless this month. The president of South Africa, Cyril Ramaphosa, linked the storm, which delivered an entire year’s worth of rainfall in 48 hours, to climate change. The region has already been hit by multiple tropical storms and cyclones since the beginning of the year.

According to experts, the enormous death toll of 450 people was a result of the lack of infrastructure, a communication breakdown and an abundance of informal settlements. Even though the South African Weather Service forecast the flooding a day in advance, no red alert was issued. The event highlighted the issue of climate justice as well. According to Debra Roberts, co-chair of the Intergovernmental Panel on Climate Change (IPCC) report on climate impacts, the poor had been hit the hardest by the weather event.

Study links rising heat to longer, more intense seasonal allergies

Warmer temperatures have increased the duration of the spring season causing flowers to bloom earlier, according to a study published in the journal Nature. The pollen season, therefore, now begins 10-40 days earlier and ends 5-15 days later, the study stated. This has resulted in a longer and more intense allergy season for those affected, according to the researchers. The increase in atmospheric CO2 is pushing up pollen production. This means seasonal allergies are only likely to increase in the coming years.

Greening the grays: RBI suggests carbon capture technology to curb growing cement production emissions | Photo: Hindustan Times

RBI pushes for ‘green’ tech such as CCS to reduce emissions in cement industry

A recent Reserve Bank of India (RBI) report recommended technological interventions such as carbon capture to tackle rising emissions in the cement industry. The report highlighted the “exciting opportunities” for the cement sector with regards to green technology. India is the second-largest cement producer and consumer, second to China. It accounts for over eight percent of the global installed capacity which is only expected to grow. According to the report, government schemes such as the National Infrastructure Pipeline, Pradhan Mantri Awas Yojana, and the SMART cities mission are likely to push up the demand for cement.

Exxon estimates carbon capture will become $4 trillion market by 2050

Exxon Mobil Corp, meanwhile, estimated the carbon capture will become a $4 trillion market by 2050. This comes up to about 60% of the company’s 2050 estimate for oil and gas. Oil companies have been looking to make carbon capture technology (CCS) a lucrative business, and it has also received an endorsement from the IPCC, which stated the technology is key to mitigating climate change.

India plans to launch own uniform carbon trading market in a year

India is planning to launch its own uniform carbon market in a year. The country is the largest exporter of carbon credits. According to a report in The Economic Times, the government is mulling changes in legislation to facilitate a carbon trading scheme. The Economic Times quoted sources as saying that this scheme will subsume all present tradeable certificates. These clean certificates cannot be exported to international carbon markets.

Parliamentary panel suggests changes to Wildlife Protection (Amendment) Bill

The Parliamentary standing committee headed by Congress leader Jairam Ramesh suggested changes to the Wildlife Protection (Amendment) Bill, 2021, to prevent elephant trade. The panel also suggested including non-official members in state/national wildlife boards. Experts previously pointed out that the proposed bill removes the protection given to elephants against being traded commercially. The panel recommended there should be a balance between religious traditions and conservation.

It suggested introducing terms and conditions that would strengthen the protection accorded to seized and surrendered wild animals. The panel suggested at least one-third non-official members from at least three wildlife institutions and the director of the Wildlife Institute of India or his/her nominee should be included on the proposed standing committees of state wildlife boards formed to assess infrastructure projects in and around protected areas.

Blazing the trail: UP is aiming to reduce PM2.5 level in the air to 45 micrograms per cubic meter in five years | Photo: DNA

UP becomes first to adopt airshed management to cut pollution

Uttar Pradesh became the first Indian state to adopt ‘airshed management’ to reduce pollution with a target of reducing PM2.5 level in the air to 45 micrograms per cubic metre by 2027. UP’s airshed area includes the Indo-Gangetic plain, which gets impacted by stubble burning sites as far as Punjab and Haryana. Under the airshed management approach, sources of pollution within the city (micro airshed) as well as the macro airshed that covers the larger area are addressed.

UP conducted the airshed management workshop recently with the help of the World Bank. The measures will be taken up in coordination with the departments such as rural development, panchayati raj, agriculture, urban development, industrial development, reported TOI.

Delhi braces for dust storms amid heat waves, air quality expected to worsen to ‘very poor’

Delhi is under the grip of a severe heatwave with at least one area touching 46°C. Following the extreme heat, the India Meteorological Department predicted dust storms in the coming week, which is likely to worsen air quality of the city. Noida already touched very poor air quality of 377 on Thursday.

The System of Air Quality and Weather Forecasting and Research also predicted air quality to worsen from Monday to Wednesday. Experts said dust becomes a major source of pollution during summer because high temperatures dry up the soil. According to a source apportionment study conducted in 2018 in Delhi, soil, road and construction contributed 25% PM10 and 17% PM2.5, during winter and 42% PM10 and 38% PM2.5 in summers.

Green court orders govt to set standards for indoor air quality

The government should regulate indoor air quality at public places, India’s green court National Green Tribunal (NGT) said while hearing a petition which contended that indoor air pollution is as serious as outdoor air pollution. A joint committee to be formed by the environment ministry, the Central Pollution Control Board (CPCB) in coordination with other concerned ministries has been directed to hold its first meeting within one month. The court ordered the joint committee to work out appropriate standards for indoor air quality within three months. Applicants will get the chance to make representations for the standards and protocols.

Pumping up: India has a target of producing 5 million tonnes of green hydrogen by 2030 | Photo: BW Businessworld

India sets up first green hydrogen plant in Assam

Government-owned Oil India Limited commissioned India’s first pure green hydrogen plant that can produce 10 kg per day in Jorhat, Assam. The green hydrogen will be generated from a 500 KW solar power plant running a 100 KW Anion Exchange Membrane Electrolyser array, reported web portal Mercom.

The company expects to increase production of green hydrogen from 10 kg per day to 30 kg a day in future. India has a target of producing 5 millions tonnes of green hydrogen by 2030.

Solar imports jumped 210% before BCD kicked in

Solar module imports jumped 210% from 3.13 GW in Q1 2021 to 9.7 GW in Q1 2022 ahead of the imposition of Basic Customs duty on April 1. Mercom reported that developers say it will take time for local manufacturing capacity to ramp up and attain efficiency and quality compared to imported equipment.

Cost of modules from China jumped 40% after the BCD was imposed. Jinks solar was the top supplier during the quarter, while TRINA, LONGI and Canadian solar were other top suppliers, Mercom reported.

Green hydrogen cost drops lower than hydrogen from natural gas for the first time

The record rise in natural gas prices has made green hydrogen cost cheaper than hydrogen produced using natural gas for the first time. Hydrogen experts at BloombergNEF calculated that “one kilogram of grey hydrogen [made with natural gas] currently costs $6.71 in parts of Europe, the Middle East and Africa, compared to $4.84-$6.68 per kilogram for green hydrogen”.

27 states and UTs behind schedule to meet 2022 renewable energy target: Ember

Global think-tank Ember published a study that says four Indian states have already surpassed 2022 renewable energy targets. India planned to touch 125 GW by 2022. The report also said that other 27 states are not even half through their RE targets and require big steps to achieve their target.

According to the Ember report, India has installed 110 GW of renewable energy by March 2022. Rajasthan and Gujarat deployed the highest number of RE power in the past 6 months.

Power play: India's first national battery swapping policy will aim to promote the Battery-as-a-Service (BaaS) industry across India for the faster uptake of EVs | Photo: Livemint

India: NITI Aayog releases draft battery swapping policy to promote BaaS

India’s top planning body released the first draft of the national battery swapping policy on April 22, which will aim to promote the Battery-as-a-Service (BaaS) industry across India for the faster uptake of EVs. The policy will address important regulatory, financial and technical issues surrounding India’s battery swapping ecosystem to “de-risk” it, but it will only support advanced chemistries that are used in batteries that are equivalent to, or are better than, EV batteries currently supported under FAME-II. To ensure operational safety, the manufacturers will be required to equip the units with battery management systems (BMSs) to prevent thermal runaway (catching on fire), as well as internet-of-things (IoT) and remote monitoring and immobilisation features.

Furthermore, the batteries’ life cycle operation will be monitored by the manufacturers through a unique identification number (UIN), and the units will have to comply with the AIS 156 (2020) and AIS 038 Rev 2 (2020) standards. The draft policy will be open to comments and suggestions till June 5, 2022.

Australian scientists to traverse country on Tesla powered by printed solar panels

A team of scientists in Australia will gear up to traverse the nation on a Tesla solely powered by printed solar panels, and the 84-day trip in September 2022 will be used to raise awareness about the possibilities with EVs and about climate change. The solar panels will be printed by a standard commercial printer — one that prints wine labels at the moment — on PET plastic and will only cost about $10/sq. m, but each of the 18 panels will be 18 metres long to soak up as much solar energy as possible. The trip will take the scientists to nearly 70 schools across Australia and they hope that their efforts will make Australians re-think their range anxiety about EVs. The journey may also be similar to a previous long-distance record set for the vehicle, when a Tesla was hypermiled to 1,078km on a single charge in 2017 by the Tesla Owners Club Italia.

India: Tesla to provide $1billion worth of BESS, must not import cars from China

Tesla Power USA announced that it would lease out USD 1 billion worth of battery energy storage systems (BESS) to its Indian customers over the next two to three years, as part of its plan to cater to India’s expanding energy market. The service will enable customers to only pay for OPEX (operational expenses), instead of having to set up and maintain their own battery storage systems under the vastly more expensive CAPEX (capital expenditure) model.

Tesla’s electric cars division, on the other hand, is being discouraged from manufacturing its cars in China and selling them in India by Nitin Gadkari, India’s transport minister, possibly as a step to encourage it to set up shop within India’s borders. Tesla founder Elon Musk has repeatedly pointed out India’s very high import tariffs on vehicles manufactured outside the country, which has been a deterrent for the carmaker to sell its EVs in the country.

Tata Motors discovers record low prices for e-buses under new CESL tender

Tata Motors discovered record low prices for the per kilometre operation of its electric buses — at Rs. 43.49 for 12m buses and Rs. 39.21 for 9m buses — and emerged as the lowest bidder in CESL’s new tender to aggregate demand for the vehicles. Called the Grand Challenge, the Rs. 5,000crore-tender will help deploy 5,450 e-buses across Delhi, Bangalore, Hyderabad, Surat and Kolkata and the buses are assured a service life of at least 12 years. During this period, they are expected to cover 4.71 billion kilometres and prevent 3.31 million tonnes of CO2 from being released into the atmosphere. The tender was developed under the remodelled FAME-II scheme and is also expected to create 25,000 jobs.

Delhi govt to raise taxes on ICE cars to promote EVs, Centre halts e2W launches

The Delhi government is reportedly planning to raise the road taxes on new petrol, diesel and CNG cars registered in the state to make electric cars the more attractive option for new car buyers. The most expensive cars will be targeted first and the new tax structure may come into effect within the next few months. The move is also being seen as a part of the state government’s target to have EVs account for 25% of new vehicle sales by 2024, whereas the share stands at 12.6% at the moment.

Also, the national government issued an order to all electric two-wheeler manufacturers to halt the deliveries of their vehicles until the recent spate of the vehicles catching on fire is investigated. The manufacturers will have to recall their vehicles from any faulty batch, and Okinawa, Ola and Pure EV have already recalled 7,000 units.

Honda to sell 750,000-800,000 EVs in North America by 2030

Leading carmaker Honda Motor Co. announced that it would aim to sell 750,000-800,000 electric vehicles in North America by 2030, and the vehicles will be developed on its three new platforms that it will work on, along with General Motors (GM). The announcement comes just two weeks after the carmaker pledged to invest nearly $40billion in developing 30 new EV models by the end of the decade, and it is likely to prefer the use of solid-state batteries over conventional lithium-ion units for a greater operational range.

Still keeps growing: Despite all calls to the contrary, China's coal plant fleet has expanded even through the pandemic and continues to add to the global capacity | Photo: The Independent

GEM: Near 1% rise in global coal power capacity as economies recover from COVID-19

A new report by the energy markets tracker GEM (Global Energy Monitor) found that there was a 0.87% increase (18.2GW) in the global coal power capacity last year, evidently because of the economies recovering from the COVID-19 pandemic. Over half of the new capacity came from China, and a total of 176GW of new coal plant capacity was brought under construction in 2021. The report also found that China was the only country that was actively approving new coal plants, while almost all other countries had significantly scaled back their plans for coal power.

Dutch oil and gas firm okayed to drill in North Sea as Germany pulls away from Russian gas

The German government okayed, for the first time, drilling for natural gas in the North Sea (20km north of the Wadden Sea Islands) as it ramps up its pullback from Russian gas supplies. The pullback is the EU’s response to sanctioning Russia for its military offensive against Ukraine and the German government’s decision could unlock around 60 billion cubic metres of the fuel, which would be enough to supply half of The Netherlands’ and Germany’s annual gas consumption. One-Dyas, the firm okayed for the extraction, will commence operations “as soon as possible” in the controversial territory, but the Dutch ministry of economic affairs has indicated that there would not be any significant damage to the region’s ecosystem.

China’s imports of Russian coal grow amidst latter’s tightening international isolation

China is reported to have more than doubled its imports of Russian steel-making coal—from 550,000 tonnes last March to 1.4 million tonnes last month—as the latter supplies heavily discounted quantities of the fuel to its neighbour amidst growing international isolation. China imports coking coal as its domestic coal grades do not carry enough calorific value to be used for steel manufacture, and the country’s vice foreign minister justified the purchase amidst growing calls to further isolate Russia by referring to the “great resilience and internal dynamism of bilateral cooperation” between the two nations. Its own production of thermal coal, too, is on the rise, and its purchase of Russian coking coal is still at prices that are well below what it pays competitors Indonesia and Mongolia.

US: Biden govt to re-open drilling leases on public lands despite campaign promise

The Biden government announced that it would re-open 145,000 acres of public lands to oil and gas drilling, despite the president specifically having campaigned not to do so in February 2020 by saying “And by the way, no more drilling on federal lands, period. Period, period, period” . The leases will be issued in what is a possibly a step for the US to boost its domestic supply of oil and gas as the global prices of the fuels rise amidst the Russian military offensive on Ukraine. However, this time the new leases will increase the royalties payable to the government to 18.75% of the revenues, which is up from the figure of 12.5% that has been frozen in place for a century.